Money management Normal Worksheets for Ages 6-7

3 filtered results

-

From - To

Introduce your 6 and 7-year-olds to the fundamentals of financial literacy with our Money Management Normal Worksheets. Designed to develop essential skills through fun, engaging activities, these worksheets help young learners differentiate coins and notes, understand value, and grasp basic concepts of saving and spending. The interactive exercises involve counting money, making change, and budgeting for simple purchases, fostering critical thinking and responsible financial habits early on. Perfect for home or classroom use, our worksheets align with educational standards to enhance your child’s learning experience with practical and age-appropriate money management guidance. Start building a financially savvy future today!

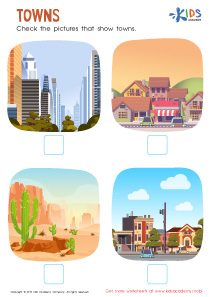

Grocery Store Worksheet

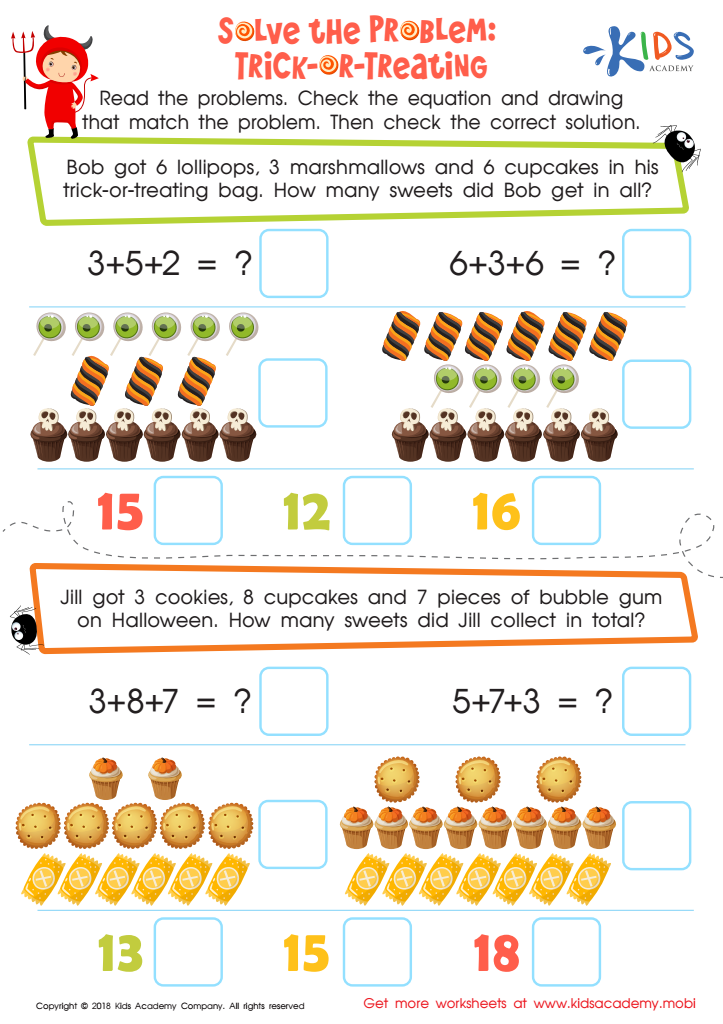

Solve the Problem: Trick–or–treating Worksheet

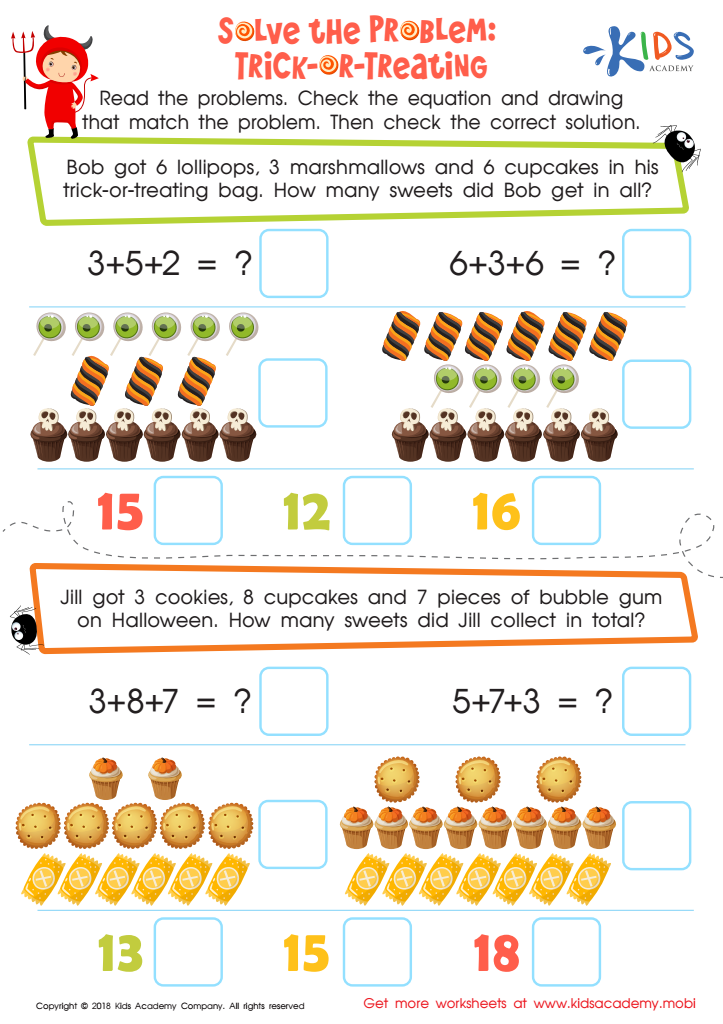

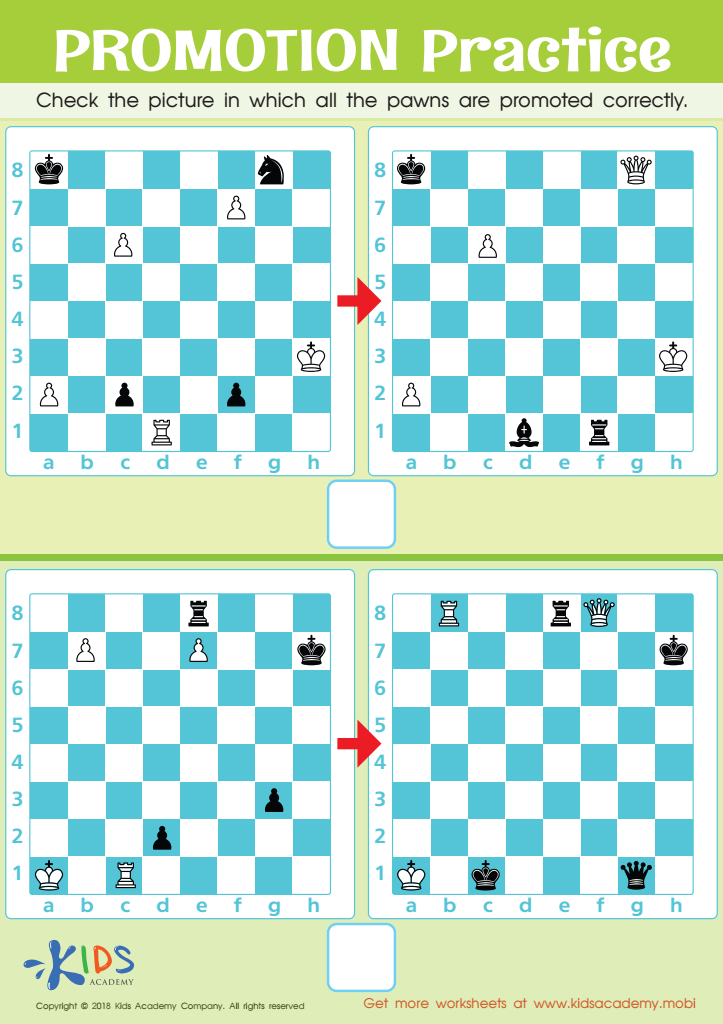

Promotion Practice Worksheet

Teaching money management skills to children aged 6-7 is crucial for several reasons. First, it lays a strong foundation for financial responsibility, which is essential for their future independence. At this age, children are highly impressionable and can quickly grasp fundamental concepts like earning, saving, spending, and sharing. Introducing these ideas early helps inculcate habits such as budgeting and saving, which are critical for avoiding financial mismanagement later in life.

Secondly, understanding money enhances math and critical-thinking skills. Engaging in activities like counting coins or making small purchases develops their ability to add, subtract, and understand monetary values in a practical context. This reinforces classroom learning and shows how math applies to everyday life.

Additionally, early money management education can build appreciation for the value of money and resources. It teaches children to set priorities, distinguish between needs and wants, and appreciate the effort required to earn money. These lessons foster a sense of gratitude and encourage thoughtful decision-making.

Lastly, financial literacy at a young age can reduce anxiety around money in the future. When children understand how to manage resources effectively, they are more likely to grow into adults who are confident in their financial decisions, contributing to their overall well-being and success.

Assign to My Students

Assign to My Students

.jpg)