Money counting skills Worksheets for Ages 4-8

5 filtered results

-

From - To

Enhance your child’s financial literacy with our Money Counting Skills Worksheets designed for ages 4-8. These engaging worksheets help young learners grasp the fundamentals of counting, identifying coins and bills, and performing simple calculations. Incorporating fun and practical exercises, children will develop confidence and accuracy in handling money. Our expertly crafted materials align with educational standards, offering the perfect blend of learning and play. Empower your kids with essential money management skills early on, preparing them for a future of responsible financial decisions. Visit Kids Academy for printable resources that make learning about money enjoyable and interactive.

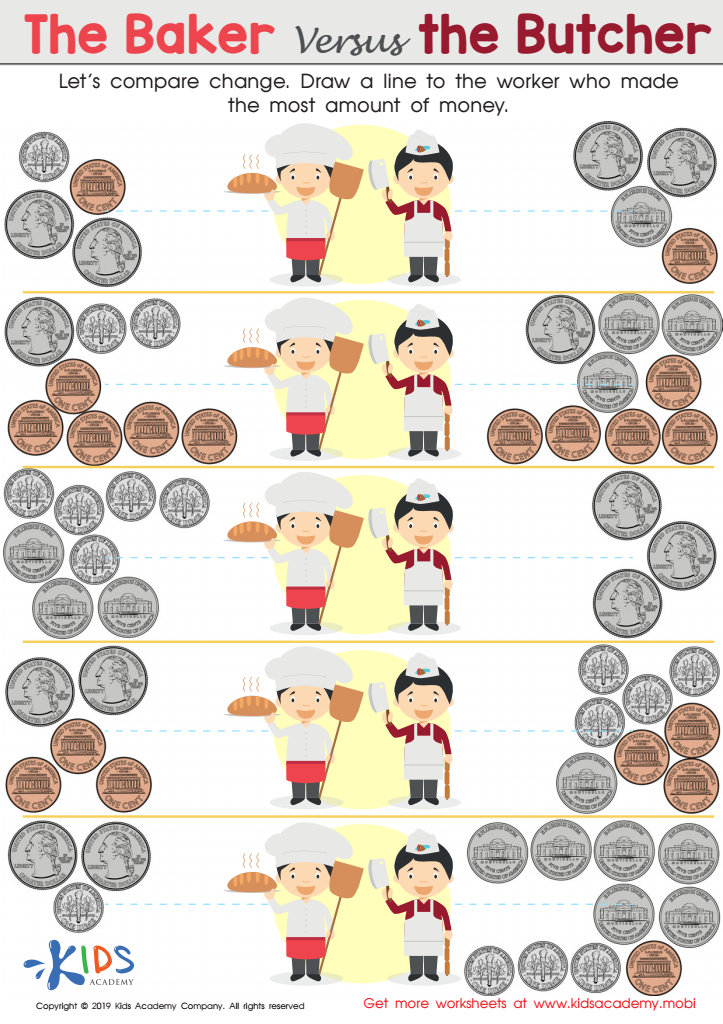

The Baker versus the Butcher Worksheet

Let's Go to the Store! Worksheet

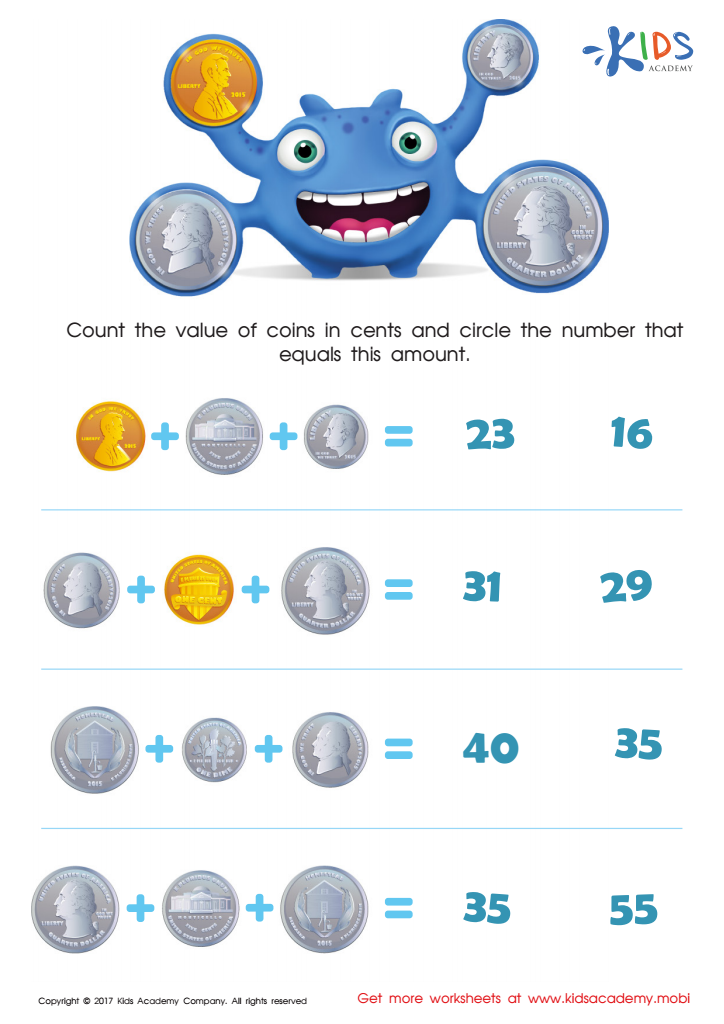

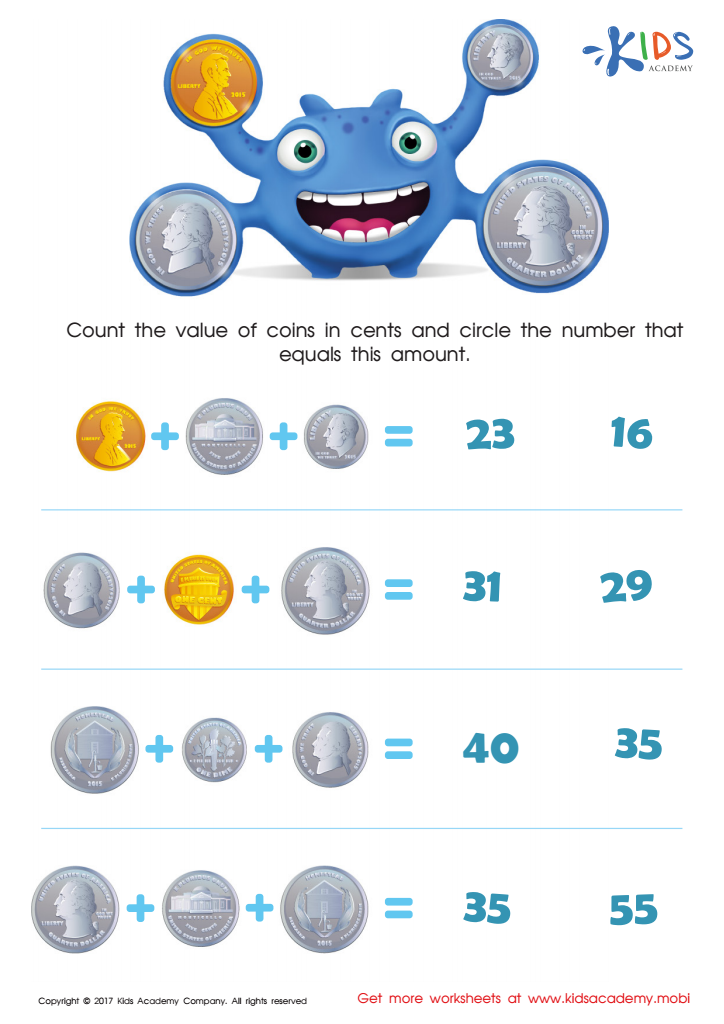

Counting Coins Worksheet

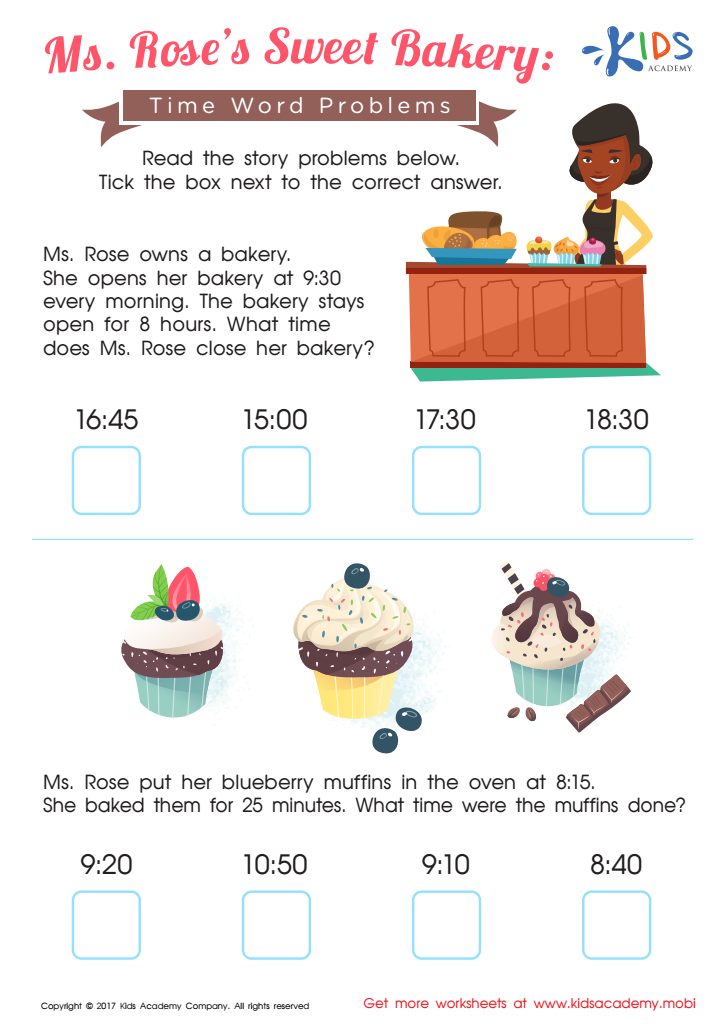

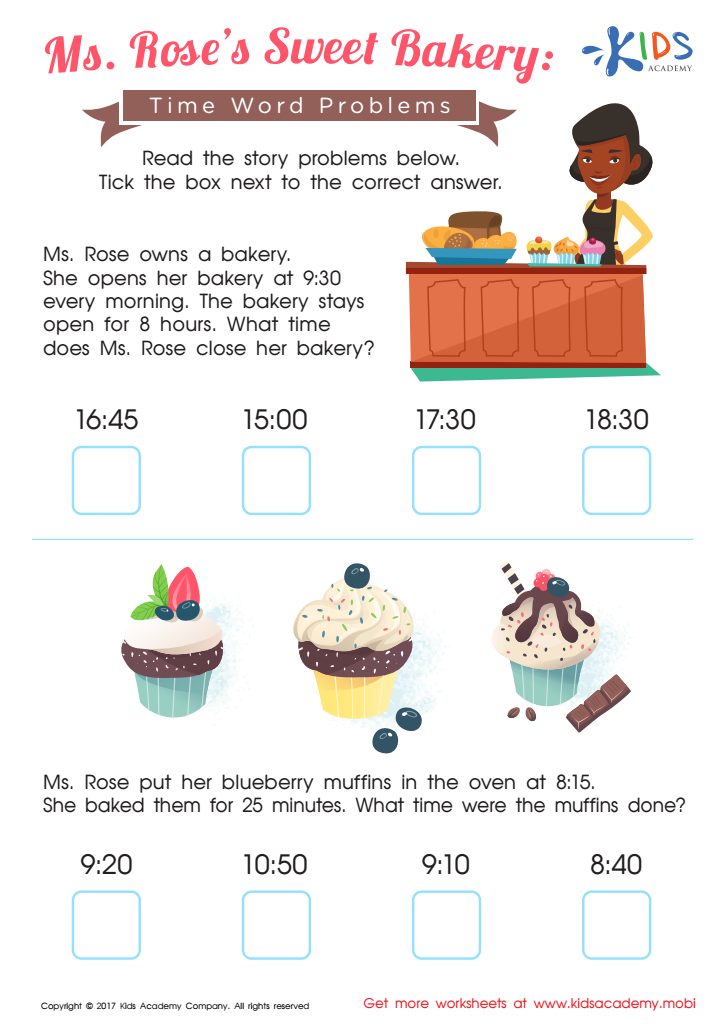

Ms. Roseв's Sweet Bakery Time Worksheet

Counting the Coins Money Worksheet

Money counting skills are fundamental for young children, providing a foundation for future financial literacy and effective decision-making. For ages 4-8, mastering these skills goes beyond the ability to buy toys. Early exposure to money concepts fosters crucial cognitive development, enhancing numeracy, critical thinking, and problem-solving abilities.

Parents and teachers play an essential role in this learning process. By engaging children in money-related activities, they can make math tangible and relevant. Recognizing different coins, understanding their values, and performing basic transactions instill a sense of responsibility and independence. This hands-on experience with money, whether counting coins or role-playing in a shop, transforms abstract concepts into practical skills.

Moreover, learning about money at an early age instills values of saving, sharing, and spending wisely. These financial habits, when nurtured early, tend to stick, building a foundation for sound financial behavior in adulthood. Teaching children to appreciate the value of money also enhances their understanding of effort, work, and reward.

Prioritizing money counting skills ensures children are not only better prepared academically but also equipped with life skills that contribute to their overall development. By integrating fun, real-world applications, parents and teachers can nurture financially savvy, confident, and competent young individuals.

Assign to My Students

Assign to My Students