Money management Worksheets for Ages 5-9

4 filtered results

-

From - To

Discover our engaging Money Management Worksheets designed specifically for children ages 5-9! These worksheets aim to instill fundamental financial skills in young learners through fun and interactive activities. By exploring concepts such as identifying coins, understanding the value of money, and basic saving tips, kids can develop essential life skills early on. Our worksheets are thoughtfully crafted to keep children motivated while they learn critical money management. Ideal for both home and classroom environments, these resources encourage financial literacy and responsible spending habits. Let’s set the foundation for your child's bright financial future with our educational money management tools!

Grocery Store Worksheet

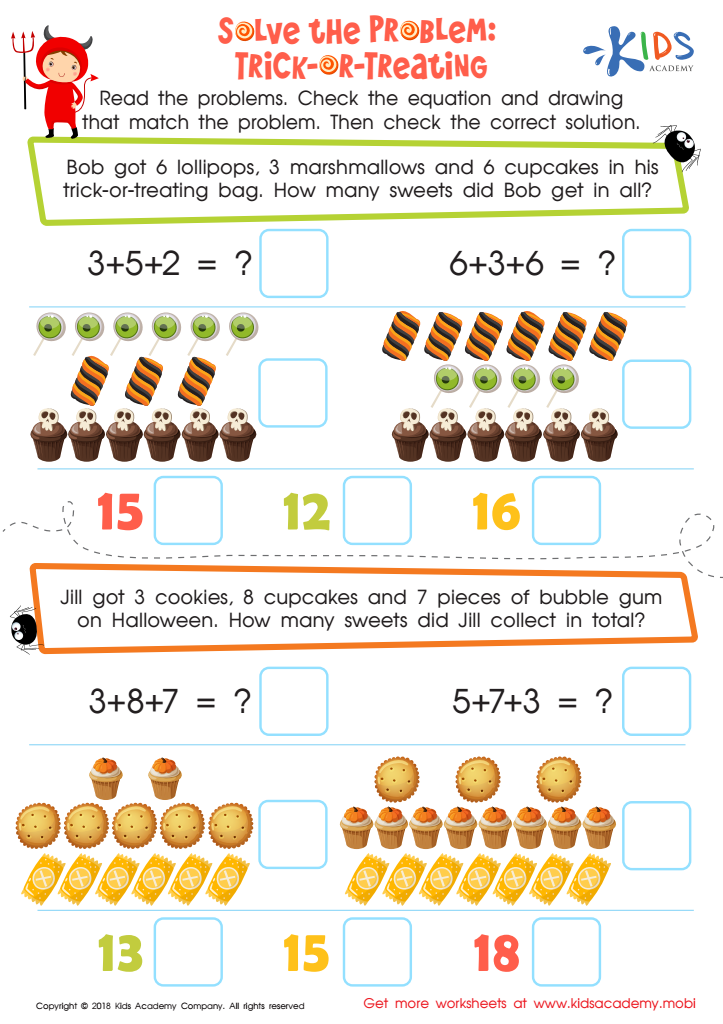

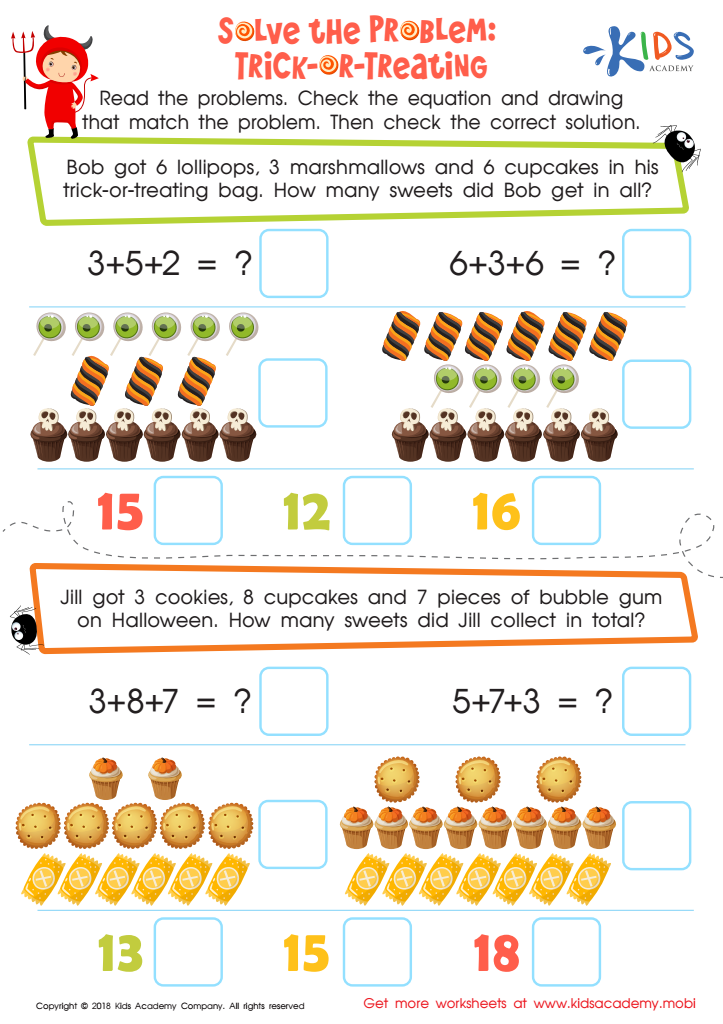

Solve the Problem: Trick–or–treating Worksheet

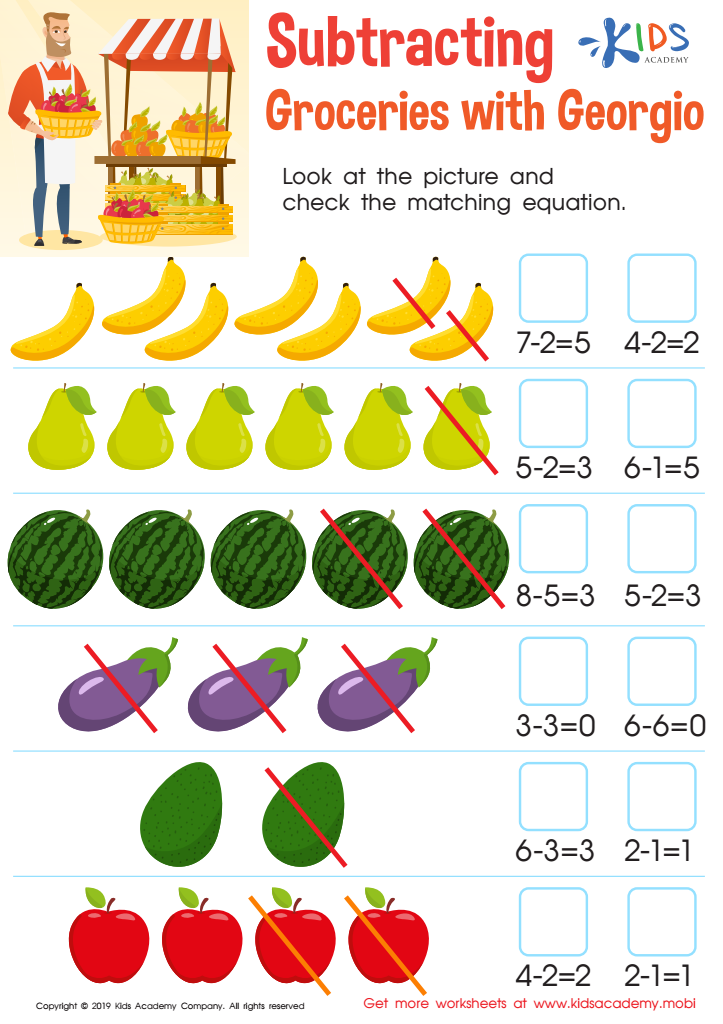

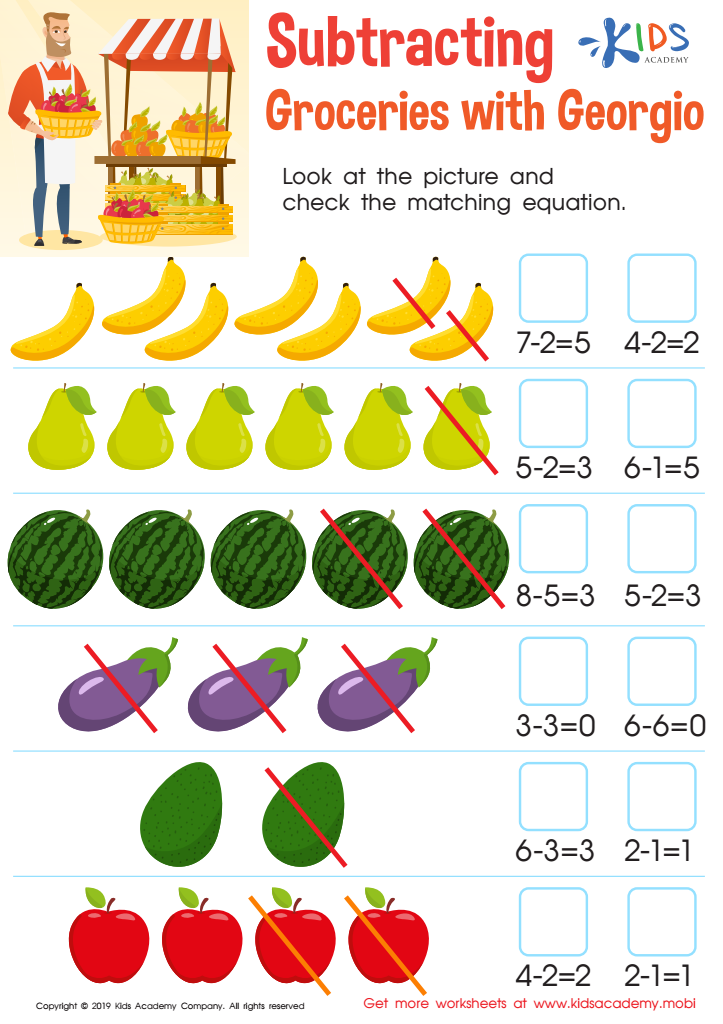

Subtracting: Groceries with Georgio Worksheet

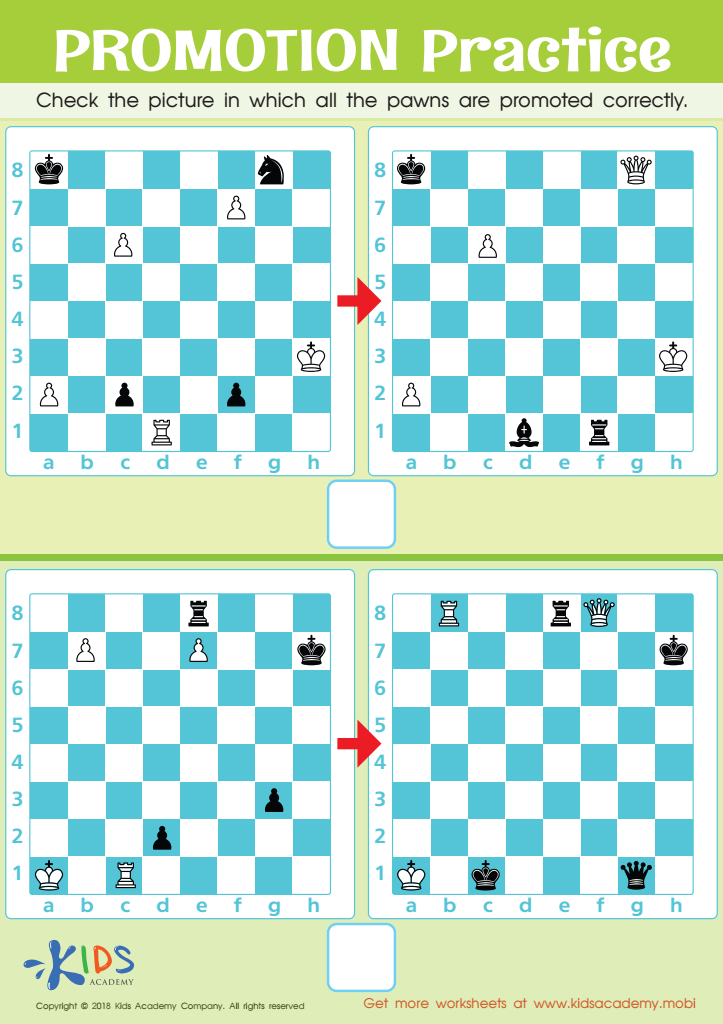

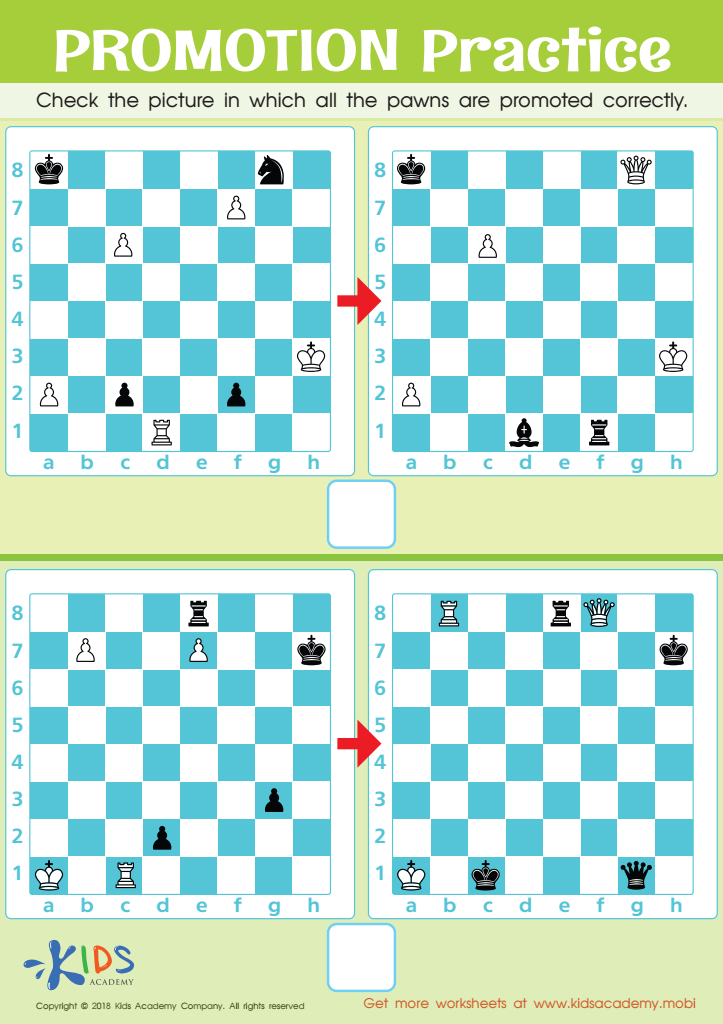

Promotion Practice Worksheet

Teaching money management to children aged 5-9 is crucial for their future financial literacy and independence. At this formative age, kids are naturally curious and begin to form foundational life skills. Introducing basic money concepts, such as earning, saving, and spending, helps them understand the value of money and responsible financial behavior.

Learning money management early lays the groundwork for healthy fiscal habits later in life. Children who grasp these concepts become more confident in making financial decisions and are less likely to fall into debt or unhealthy spending patterns as adults. For example, engaging children in simple activities like setting up a savings jar can instill the importance of saving.

Moreover, teaching financial literacy fosters critical thinking skills as children learn to weigh choices, understand needs versus wants, and set priorities. Parents and teachers play a pivotal role not just in imparting knowledge, but also in modeling healthy financial behaviors. By discussing money openly, they can reduce the stigma around financial topics and create a culture of awareness and responsibility. Ultimately, empowering children with money management skills equips them for a future of financial stability and growth.

Assign to My Students

Assign to My Students