Money management Worksheets for Ages 6-9

4 filtered results

-

From - To

Introduce your child to the basics of financial literacy with our engaging Money Management Worksheets for Ages 6-9. Perfectly designed to make learning about money fun, these worksheets cover a variety of topics such as identifying coins and bills, basic addition and subtraction with money, and understanding the value of saving and spending wisely. Our printable resources are tailored to capture young minds and introduce valuable life skills, ensuring that children gain confidence in handling money through interactive exercises. Start the journey to financial literacy early with Kid’s Academy and pave the way for a secure financial future.

Grocery Store Worksheet

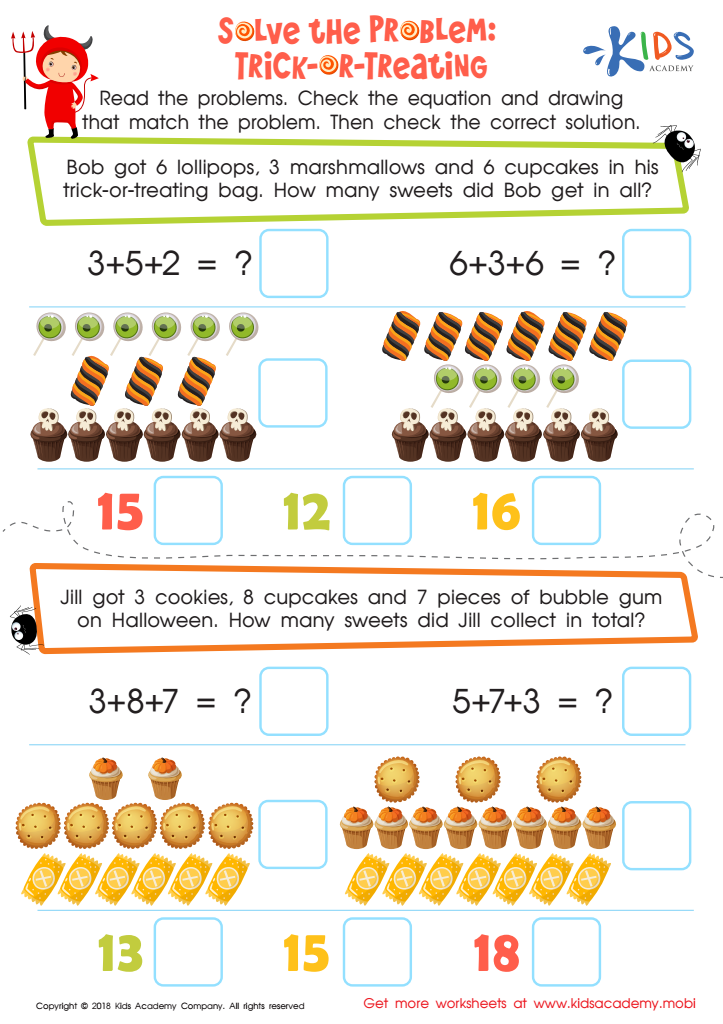

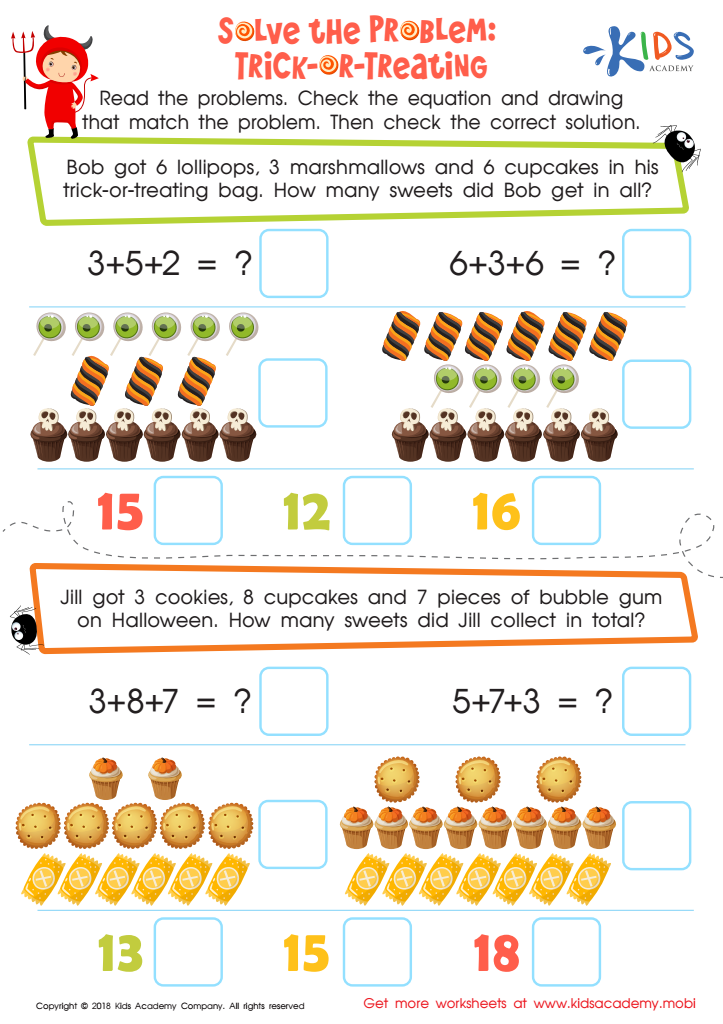

Solve the Problem: Trick–or–treating Worksheet

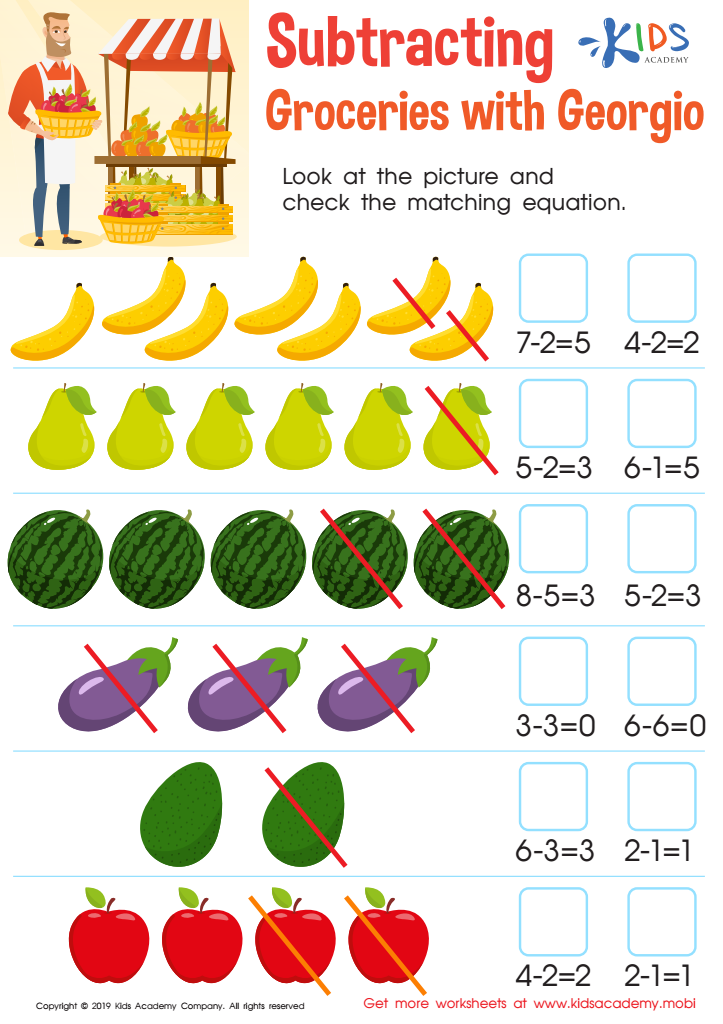

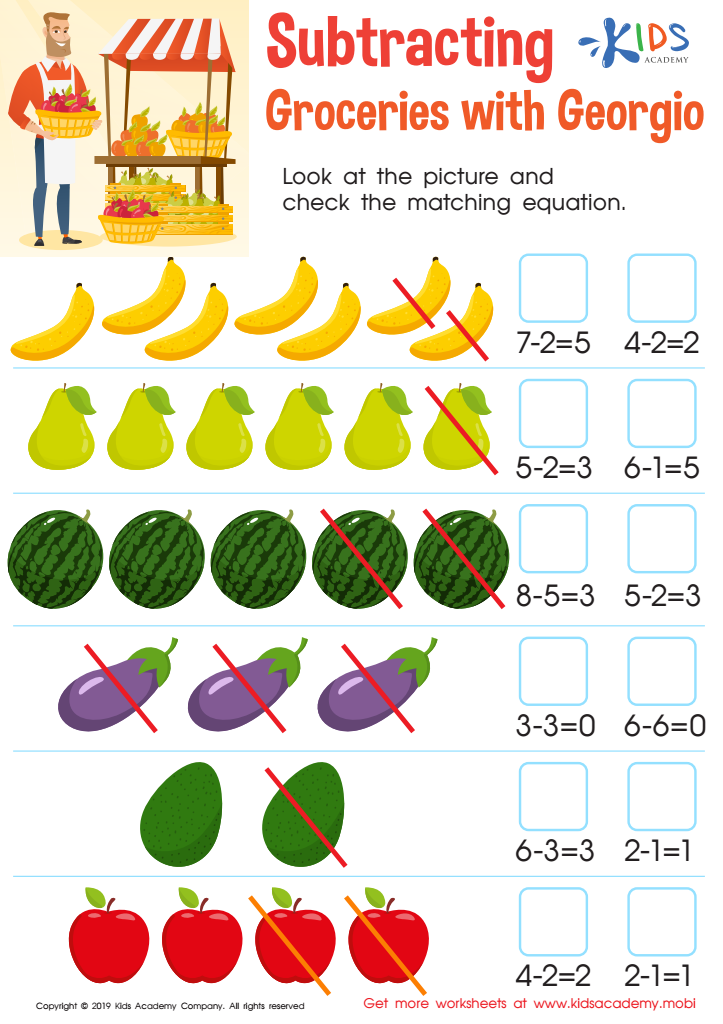

Subtracting: Groceries with Georgio Worksheet

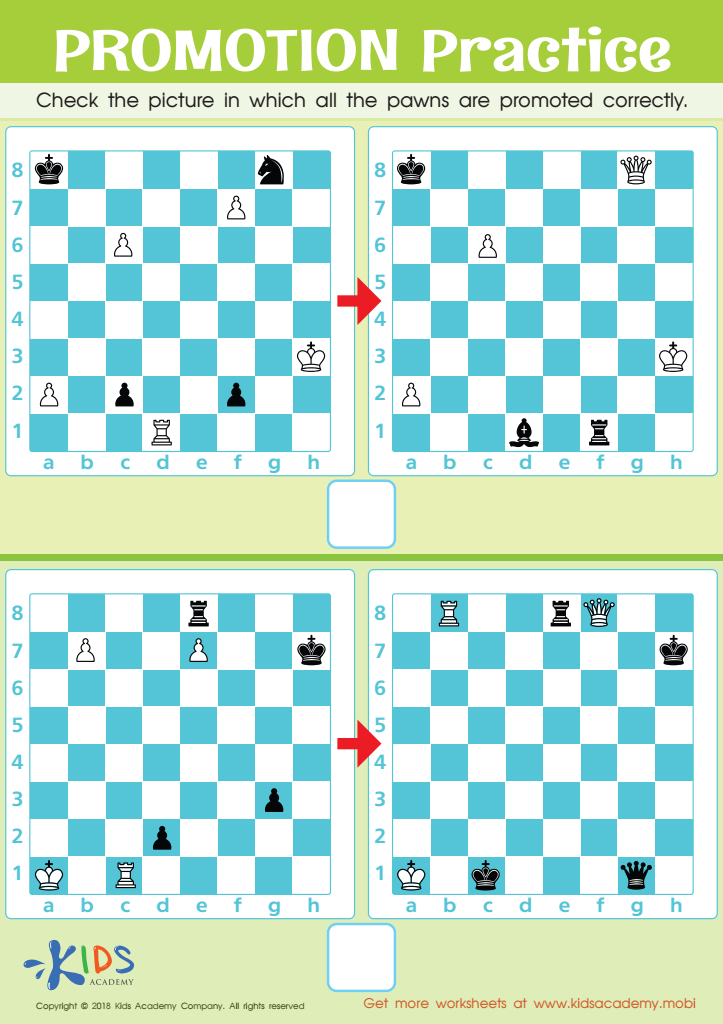

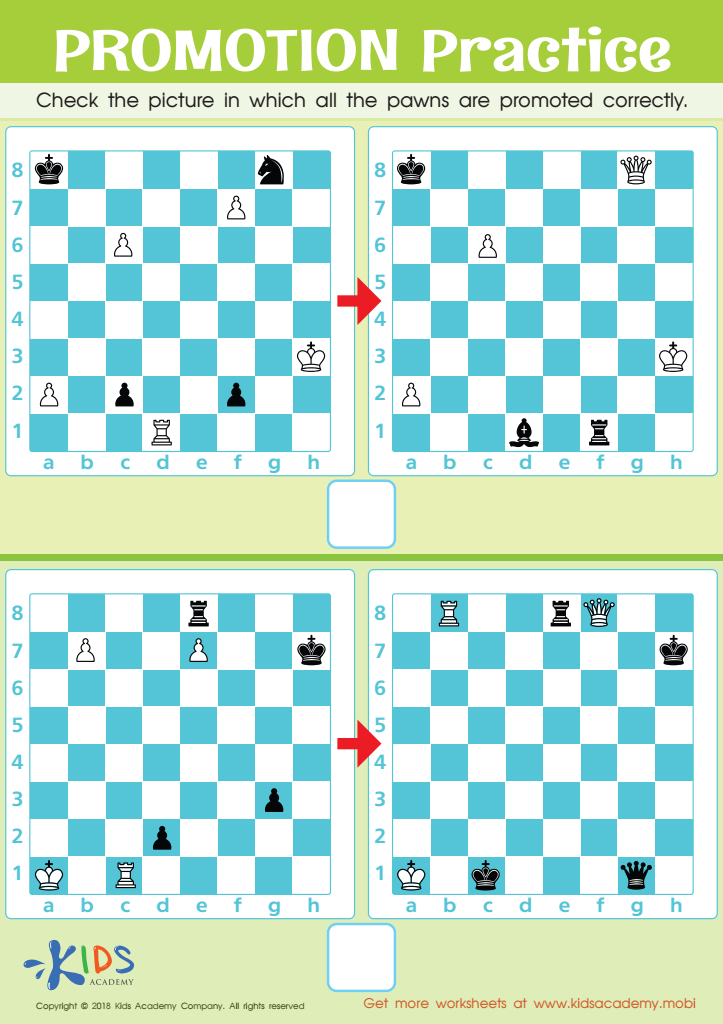

Promotion Practice Worksheet

Parents and teachers should care about money management for children aged 6-9 because it lays the foundation for their future financial well-being. At this developmental stage, kids are highly impressionable and can grasp basic concepts that can influence their attitudes towards money in later years. By teaching them about money now, we instill essential skills like saving, responsible spending, and understanding the value of money.

Engaging children in simple activities, such as saving a portion of their allowance or understanding the difference between needs and wants, equips them with critical thinking skills that they will carry into adulthood. It also helps them develop discipline and patience, as they learn to delay gratification for future rewards—a key principle in successful financial planning.

Moreover, kids who understand the basics of money are less likely to develop poor habits that can lead to debt or financial stress in their adult years. Narrating concepts through fun, interactive activities also makes learning enjoyable and memorable. By integrating money management into their routine education, we empower children to become knowledgeable, confident, and ultimately successful in handling finances. Thus, investing time in teaching money skills early doesn't just benefit the individual child, but also contributes to building a financially responsible society.

Assign to My Students

Assign to My Students