Money Worksheets for Ages 6-9

16 filtered results

-

From - To

Enhance your child's financial literacy with our engaging money worksheets designed for kids aged 6-9. These worksheets are perfect for building essential money-counting skills in a fun, interactive way. Featuring relatable, everyday scenarios, your child will learn to identify coins and bills, add up different amounts, and make change—all through visually appealing and age-appropriate activities. Whether at home or in the classroom, these printable worksheets provide invaluable practice to help young learners confidently manage money while reinforcing their math knowledge. Unlock your child's potential with our expertly crafted money worksheets and watch their skills flourish!

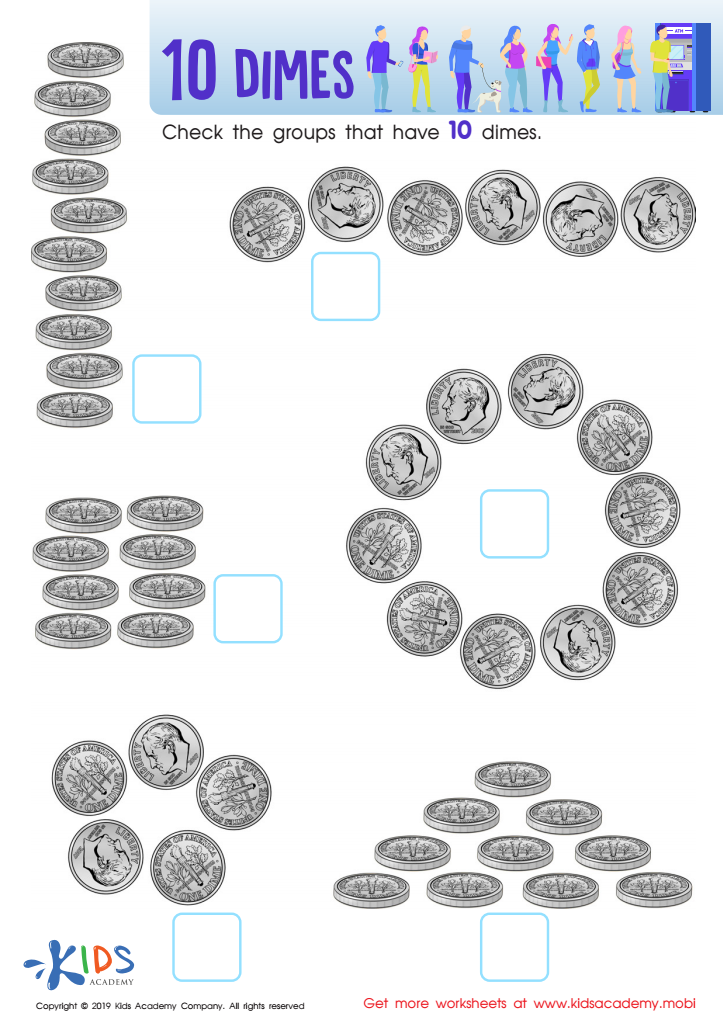

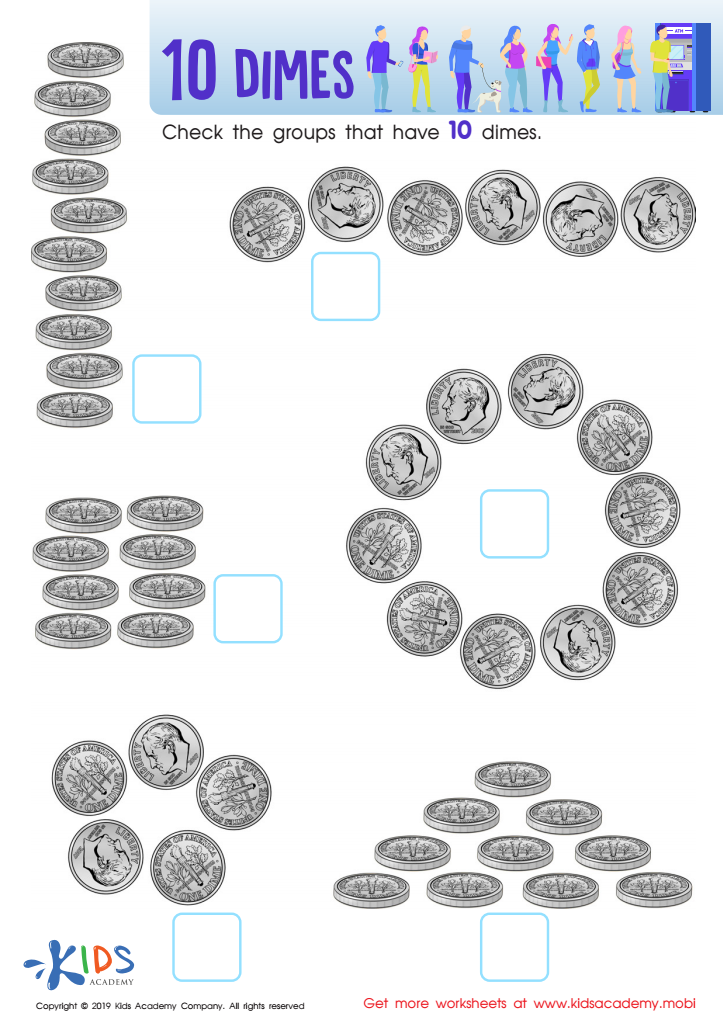

10 Dimes Worksheet

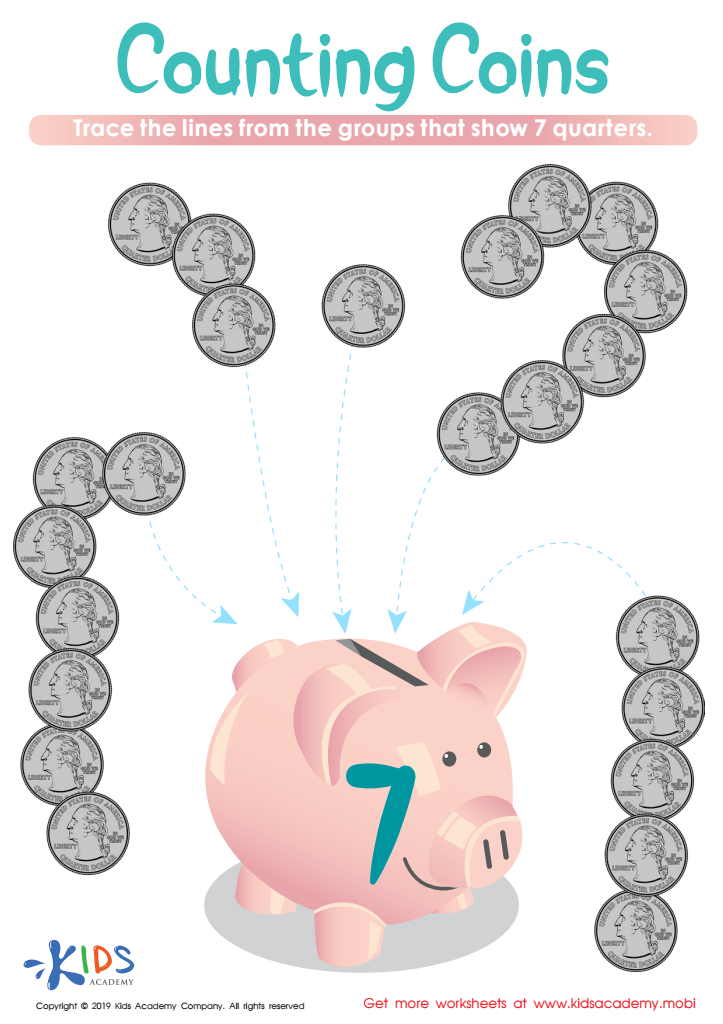

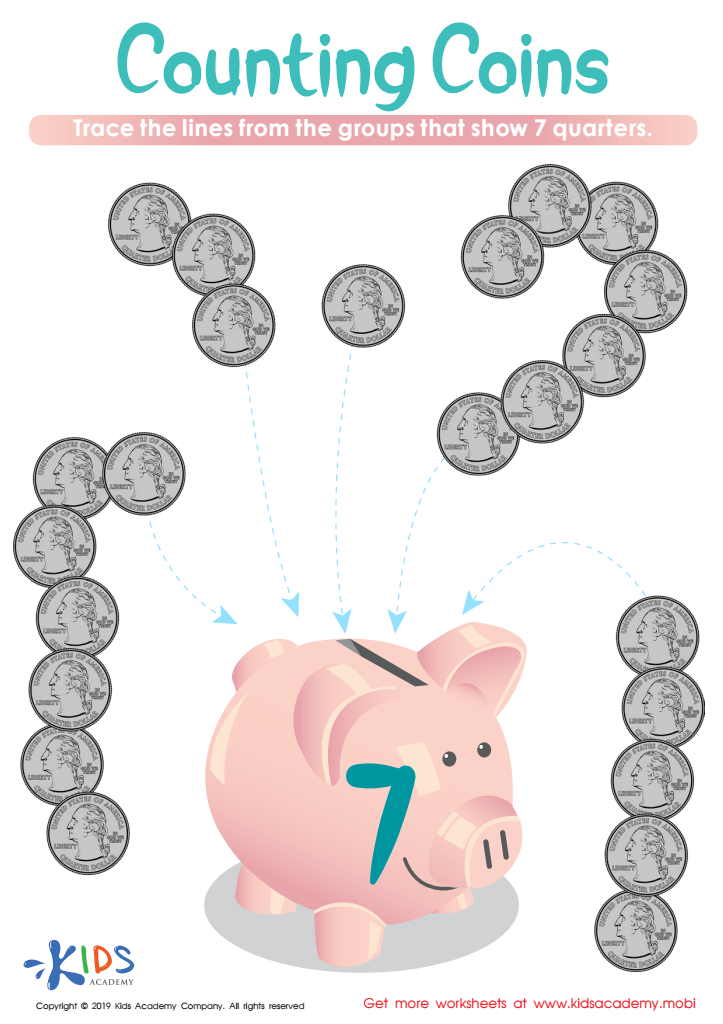

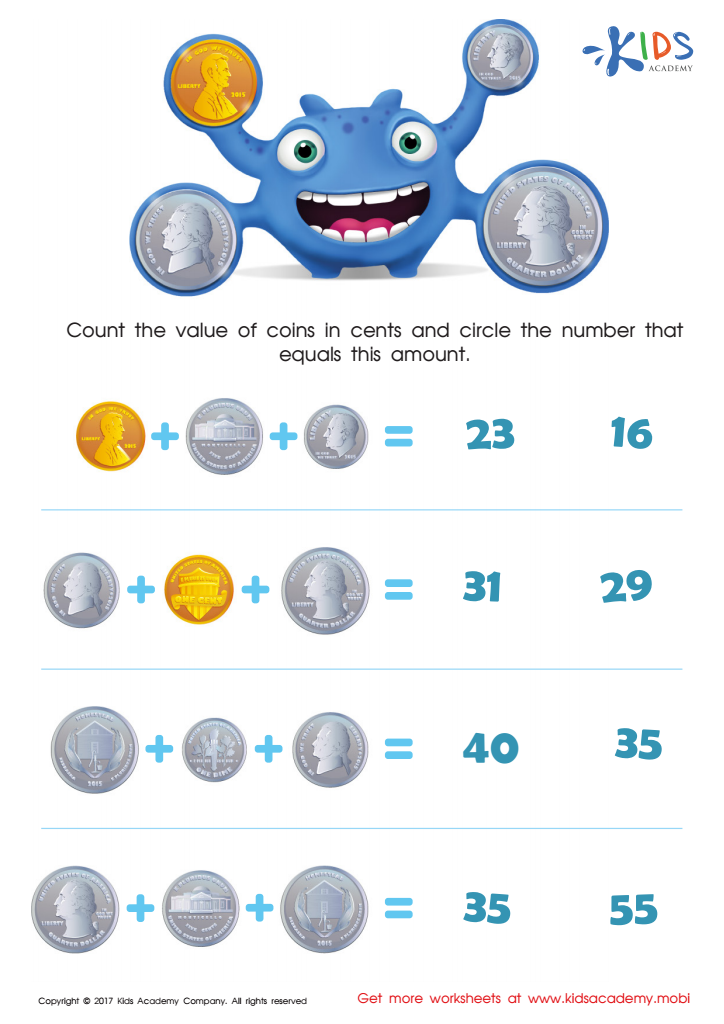

Counting Coins Worksheet

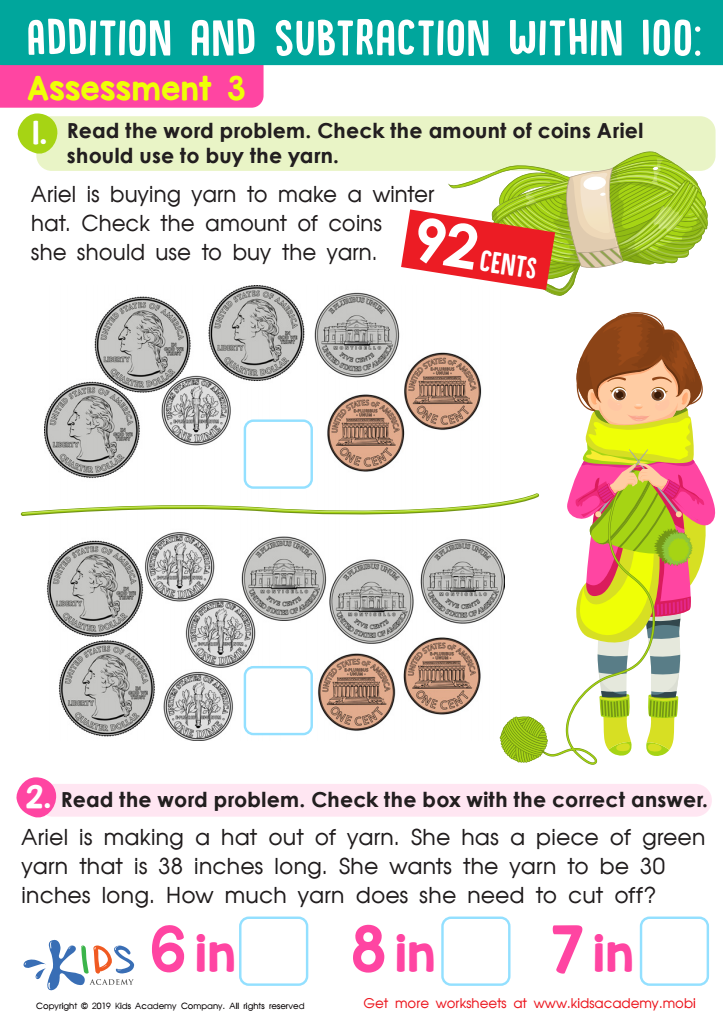

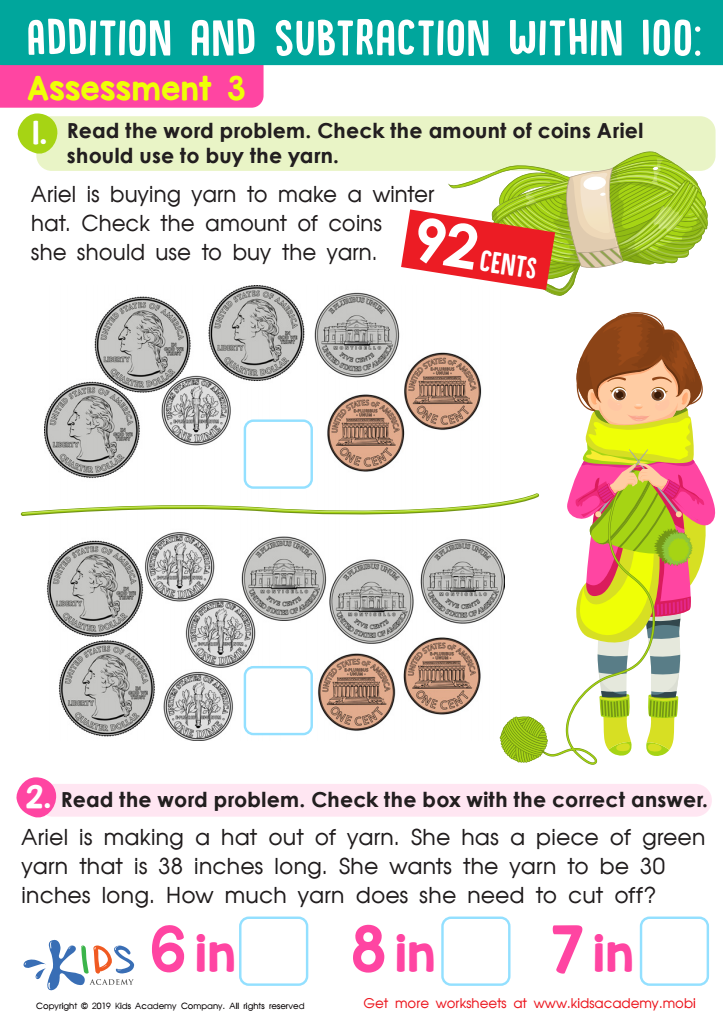

Assessment 3 Math Worksheet

Sweet Shop – Counting Coins Worksheet

Counting Coins Worksheet

Money: Coins Dollars Printable

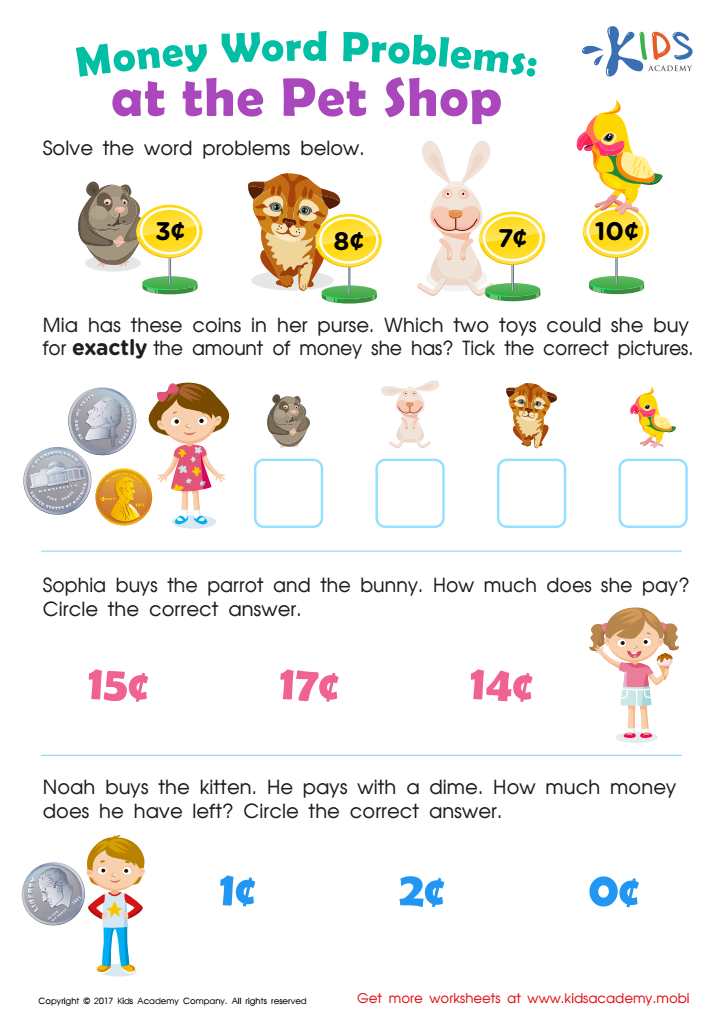

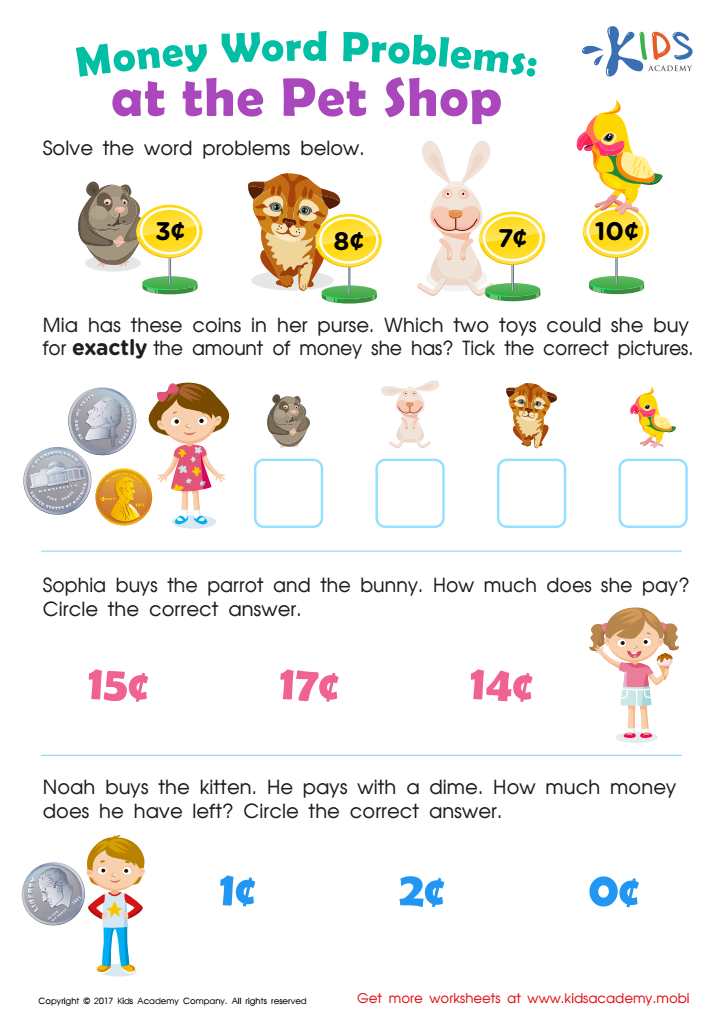

Pet Shop Worksheet

Picking the Coins You Need Money Worksheet

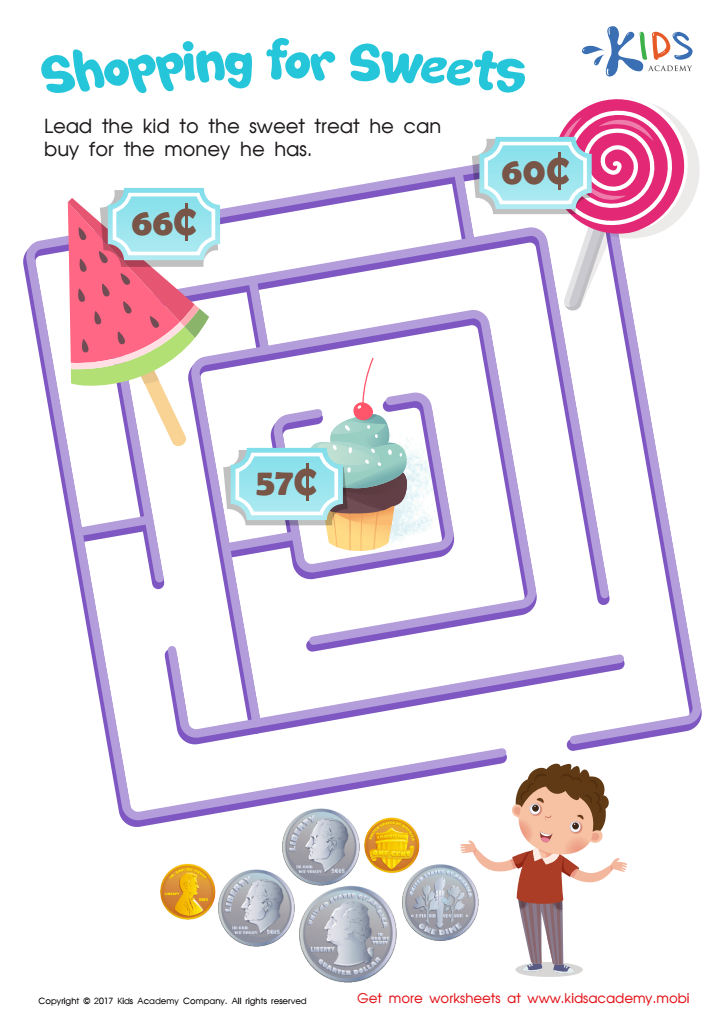

Shopping for Sweets Worksheet

Coin Names and Values Money Worksheet

Counting the Coins Money Worksheet

How Many Coins Money Worksheet

Twenty Five Cents or the Quarter Money Worksheet

Five Cents or the Nickel Money Worksheet

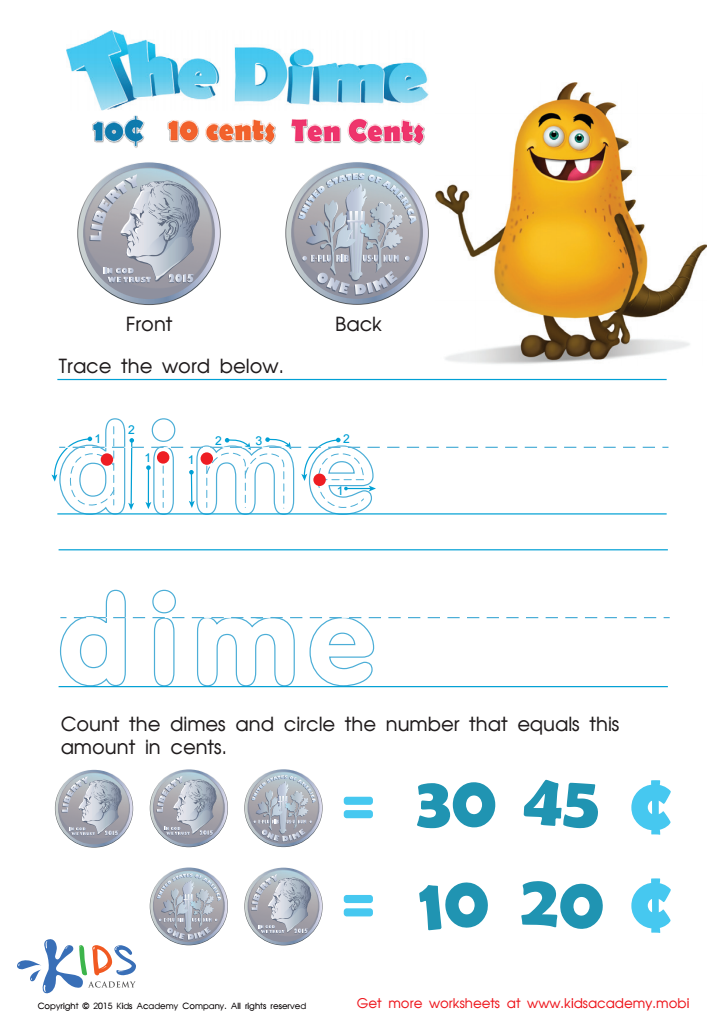

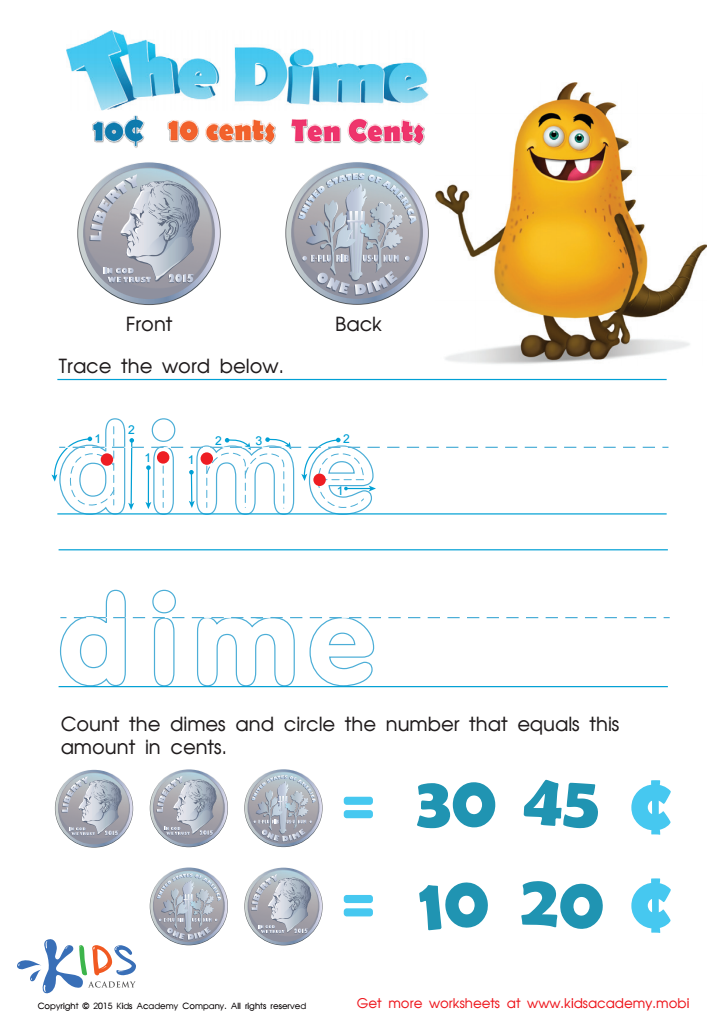

Ten Cents or the Dime Money Worksheet

One Cent or the Penny Money Worksheet

Understanding money at an early age fosters critical life skills in children aged 6-9, setting the foundation for future financial literacy. At this stage, children are developing numeracy skills, and integrating lessons about money nurtures their mathematical abilities in a practical context. Learning about money teaches the value of saving, budgeting, and spending wisely, establishing good financial habits and a sense of responsibility from an early age.

Introducing money concepts also helps children grasp the importance of work and earning, promoting a work ethic through chores and allowances, for instance. This can make them appreciate the value of goods and services more deeply, reducing tendencies towards impulsive behavior as they begin to understand the effort required to obtain money.

Moreover, discussing monetary concepts can boost children's problem-solving and decision-making skills. Basic lessons about making choices within a budget expand their thinking abilities and encourage strategic planning and prioritization.

Parents and teachers care about financial education because it empowers children, equipping them with tools to achieve future financial independence. Addressing money matters early can bridge socioeconomic education gaps and enrich children's lives through comprehensive comprehension of economics in everyday life. Early financial literacy paves the way for informed, responsible adults who can confidently navigate their financial journeys.

Assign to My Students

Assign to My Students