Normal Money Worksheets for Ages 5-6

1 filtered results

-

From - To

Introducing our captivating Normal Money worksheets, expertly designed for Ages 5-6. These interactive sheets are your child's first step into the fascinating world of finance, offering a fundamental understanding of money in a fun and engaging way. Tailored specifically for young learners, our worksheets cover basic money recognition, counting coins, and simple transactions, helping children build a strong foundation in financial literacy. With vibrant illustrations and easy-to-follow instructions, our Normal Money collection makes learning about money an enjoyable experience, setting your child on the path to financial confidence and competence. Perfect for home or classroom use, these worksheets are an essential tool for early education in finance.

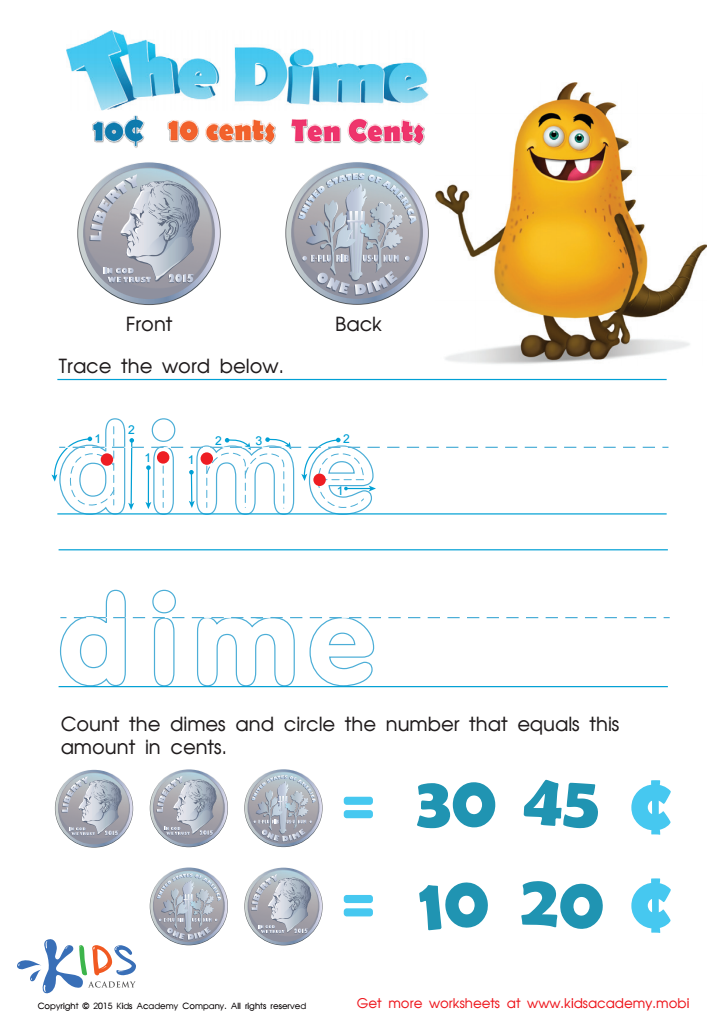

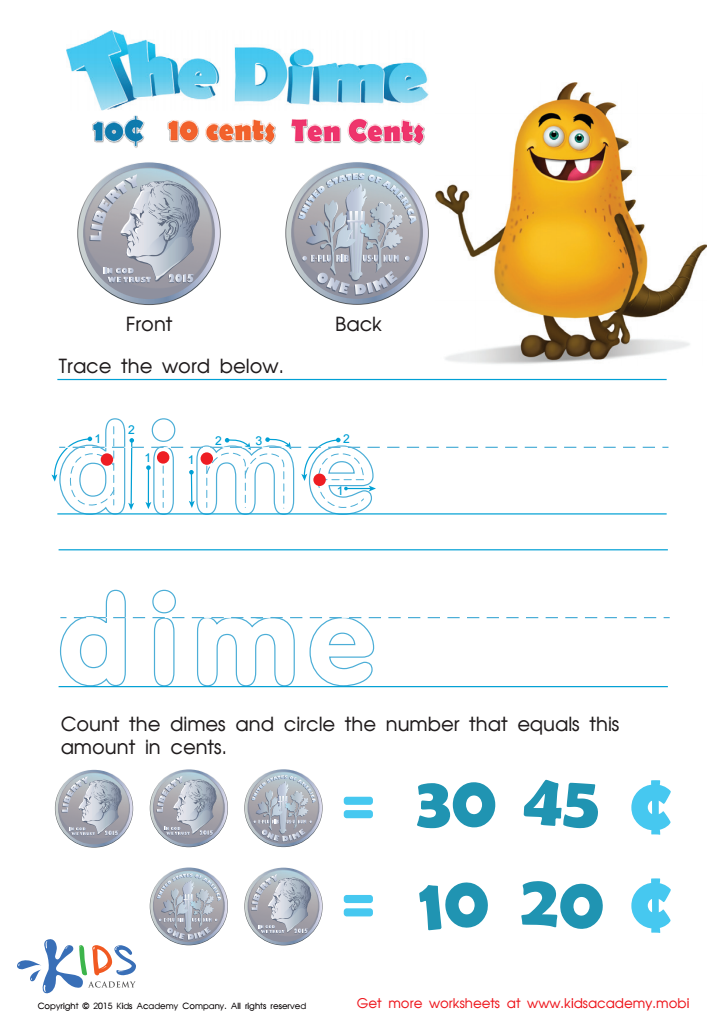

Ten Cents or the Dime Money Worksheet

Normal Money worksheets for Ages 5-6 are incredibly beneficial tools in laying the foundation for financial literacy in young children. At this pivotal age, kids are naturally curious about the world around them, including money and how it works. By integrating Normal Money worksheets into their learning curriculum, children ages 5 to 6 are introduced to the basic concepts of money management, earning, saving, and spending in a way that is both engaging and age-appropriate.

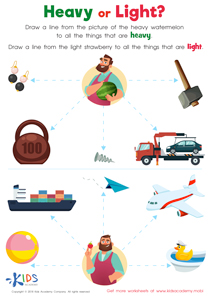

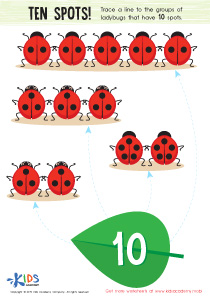

These worksheets are designed with the cognitive and developmental stages of 5 to 6-year-olds in mind, ensuring that the content is accessible and understandable. Through a variety of activities such as identifying coins and notes, simple addition and subtraction of money amounts, and understanding the value of different denominations, children develop a fundamental understanding of money. This not only prepares them for more complex financial concepts in the future but also encourages a healthy attitude towards money from an early age.

In addition to academic learning, Normal Money worksheets for Ages 5-6 also support the development of life skills such as decision making, critical thinking, and problem-solving. As children navigate through these worksheets, they learn to make choices about spending and saving, skills that are essential for their future financial wellbeing.

Assign to My Students

Assign to My Students