Money Worksheets for Ages 3-8

18 filtered results

-

From - To

Discover engaging money worksheets designed for children ages 3-8! Our collection helps young learners grasp essential money concepts, from recognizing coins to simple counting exercises. With colorful illustrations and interactive activities, these worksheets make learning about money fun and effective. Perfect for classrooms or home practice, our resources cater to various skill levels. Whether your child is just starting to learn about money or needs to reinforce their counting skills, you'll find the right worksheets here. Help your child build confidence and foundational math skills with our thoughtfully designed money worksheets, ensuring they understand the value of coins and bills while having a blast!

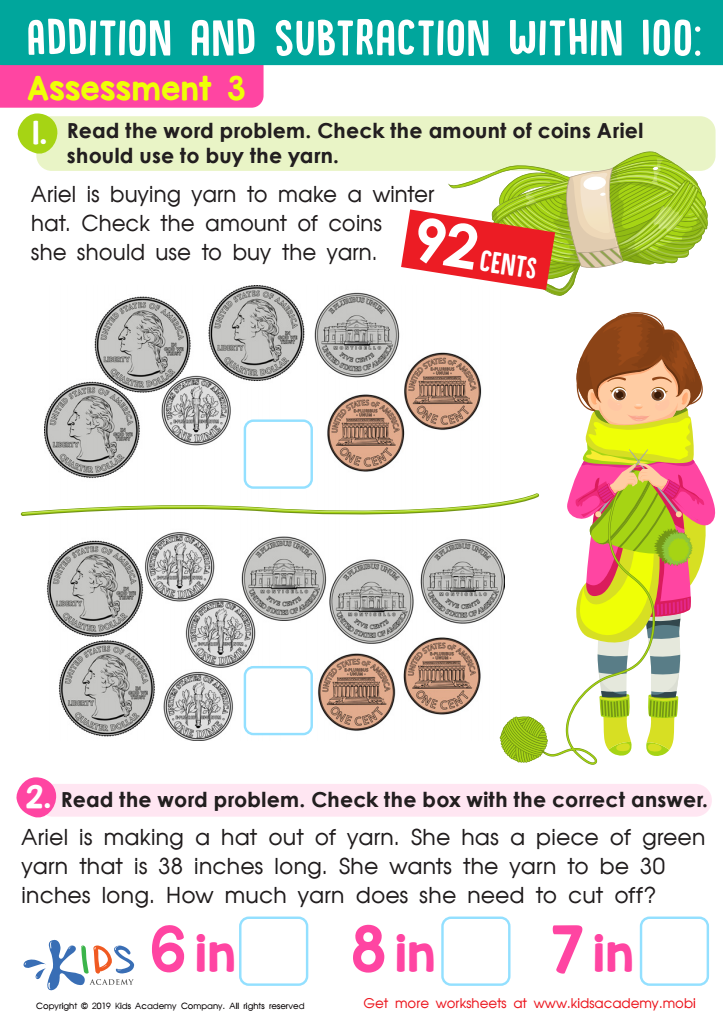

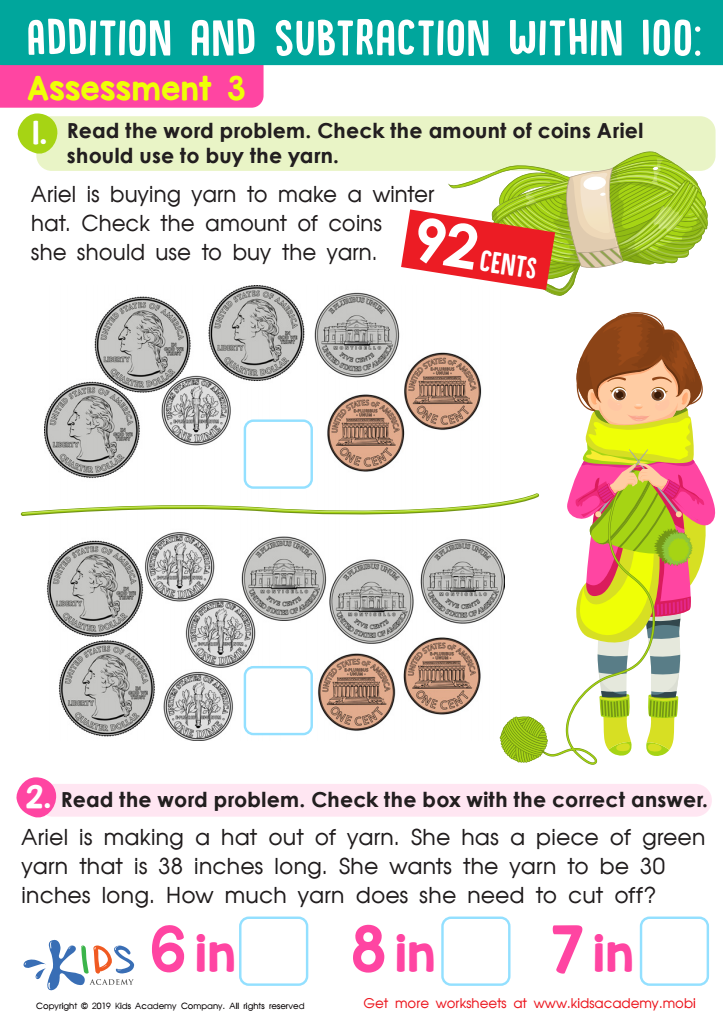

Assessment 3 Math Worksheet

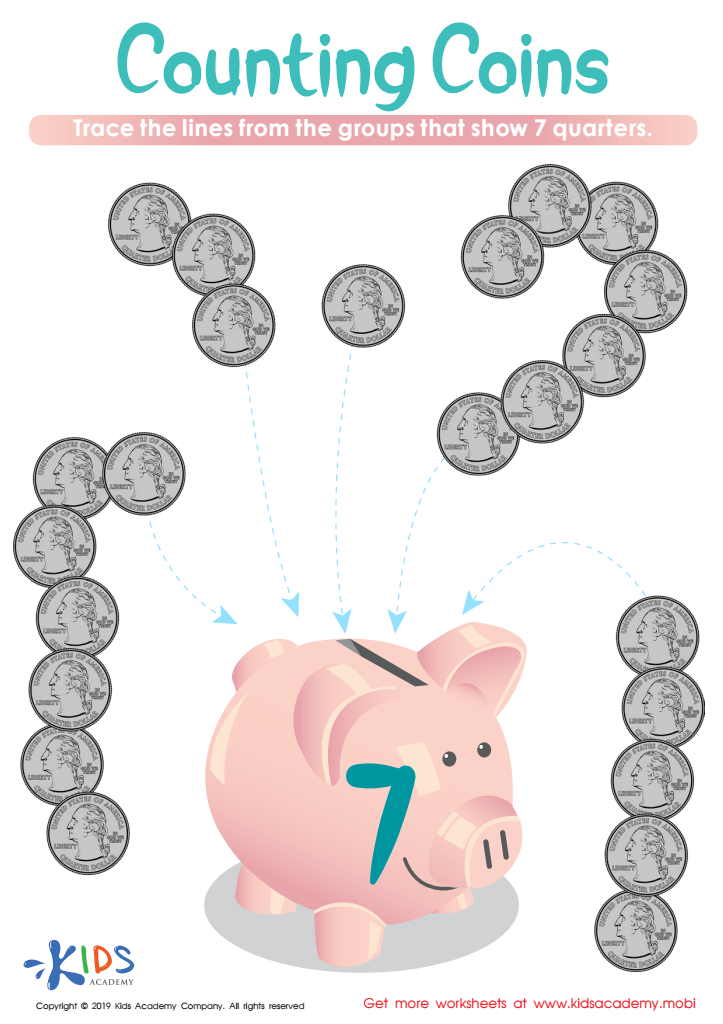

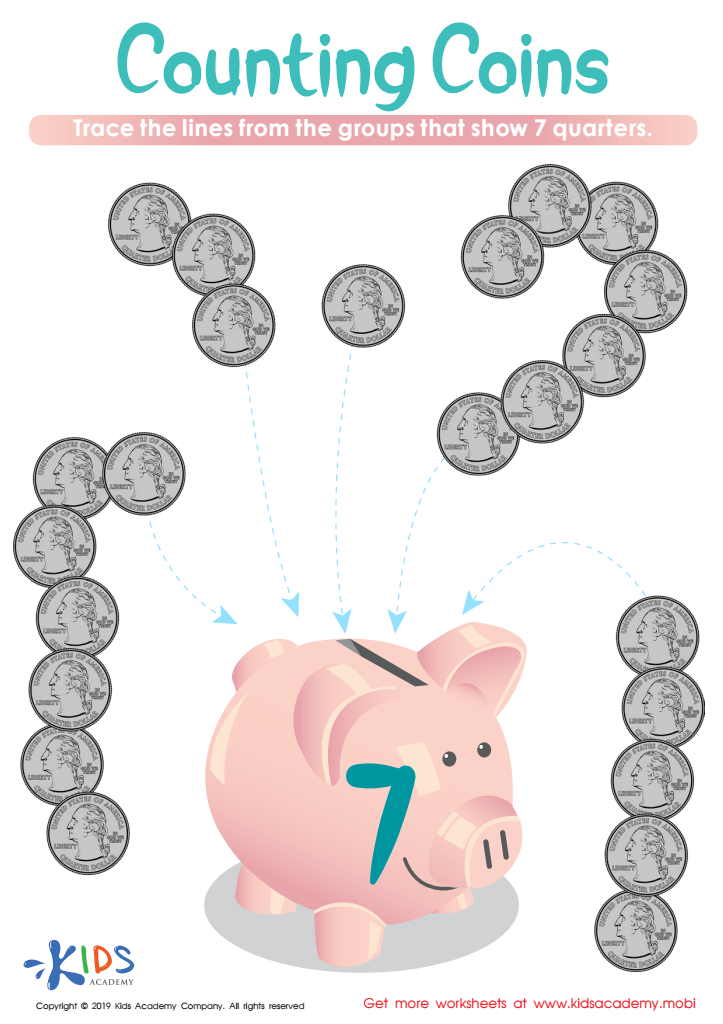

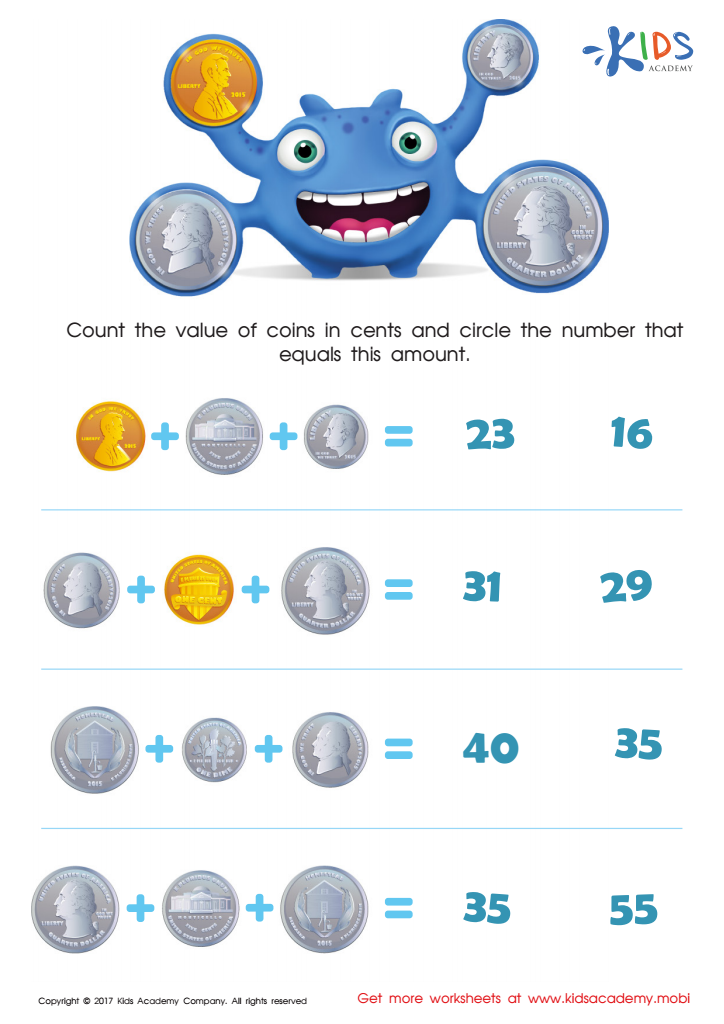

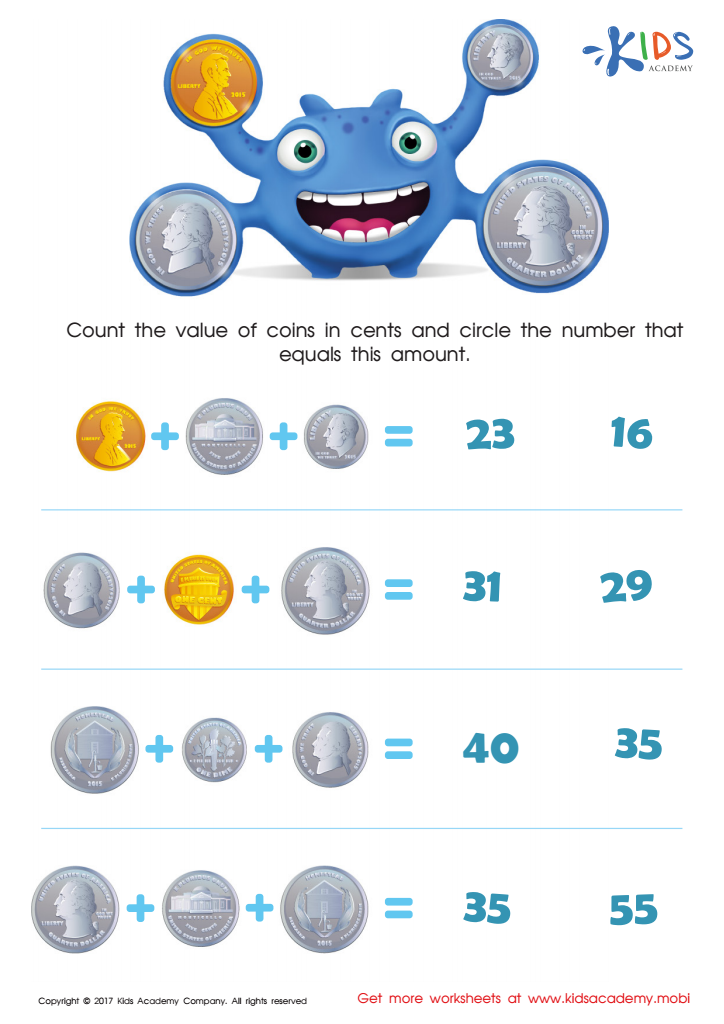

Counting Coins Worksheet

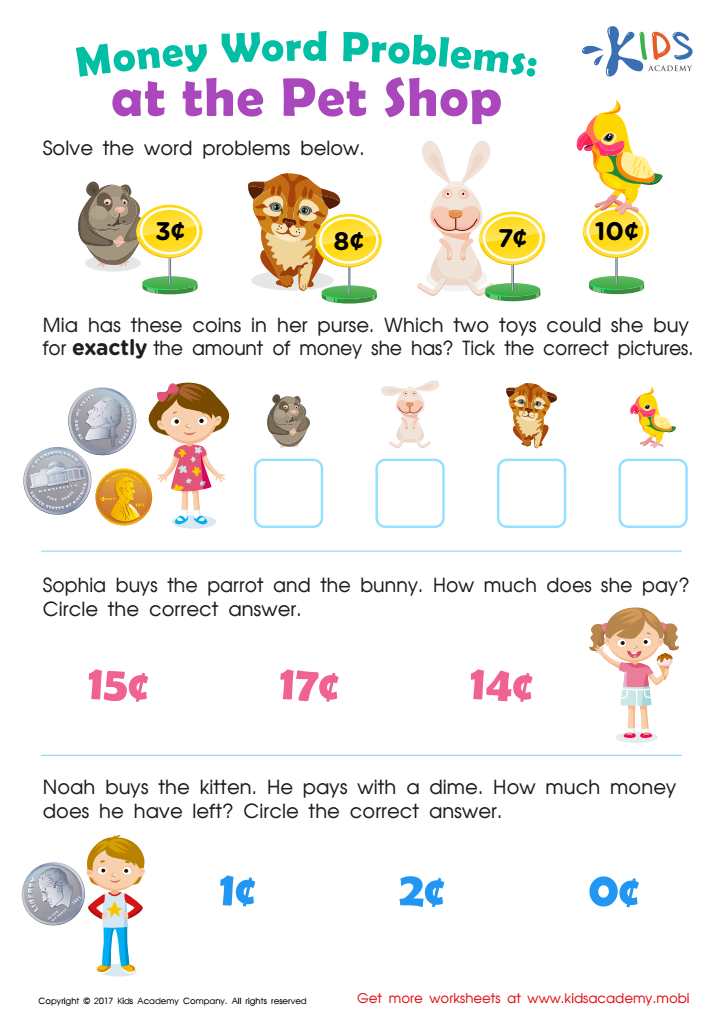

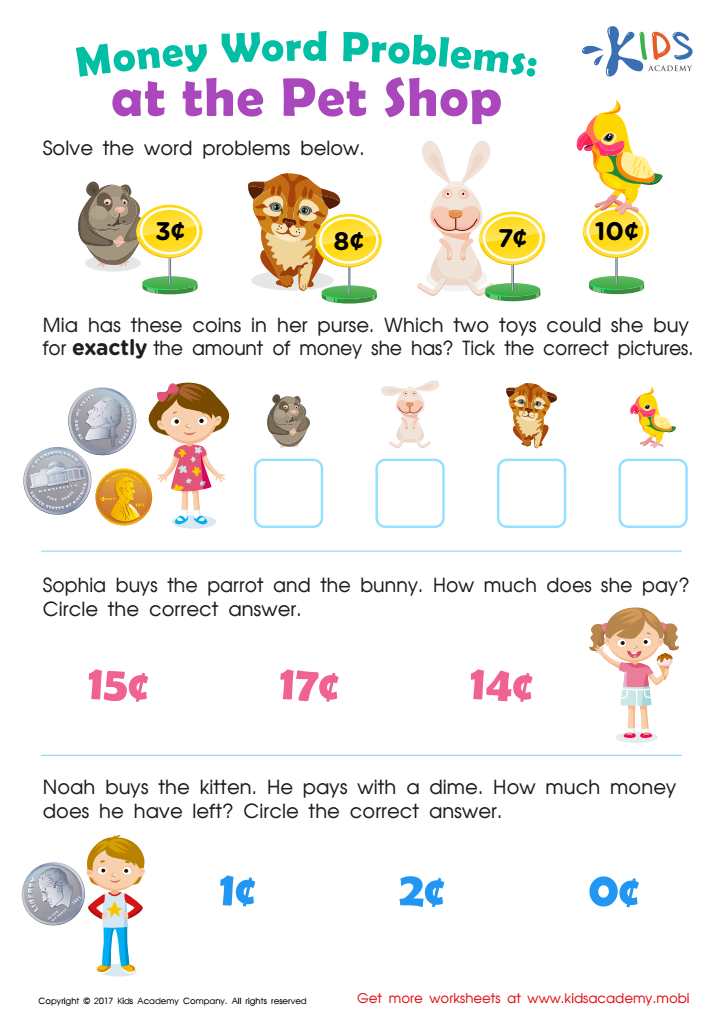

Pet Shop Worksheet

Counting Coins Worksheet

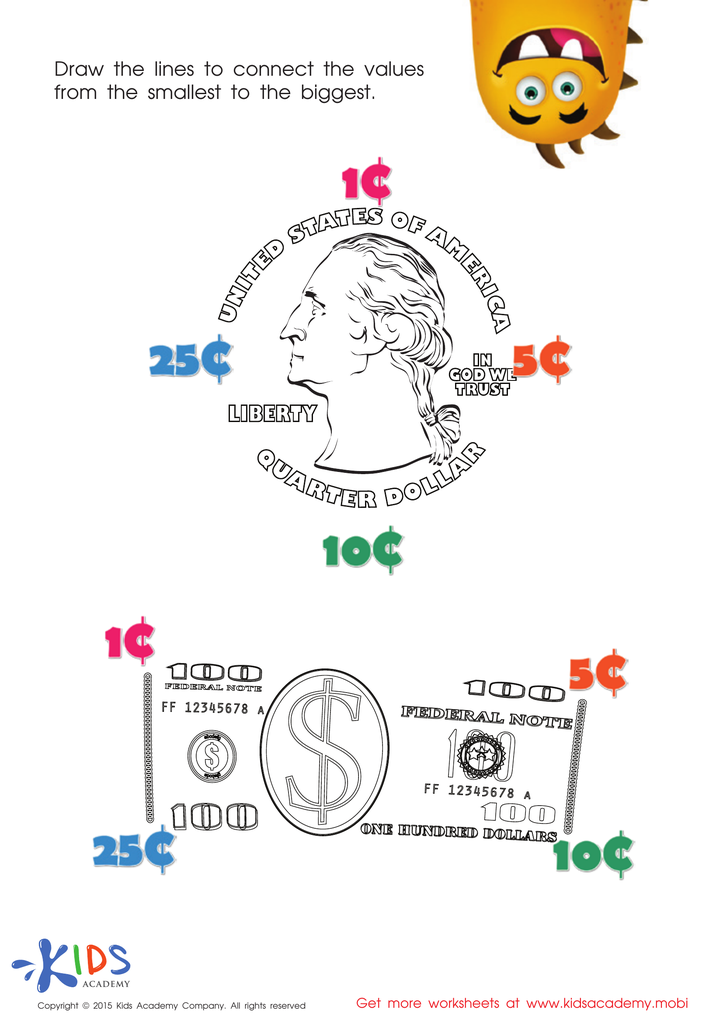

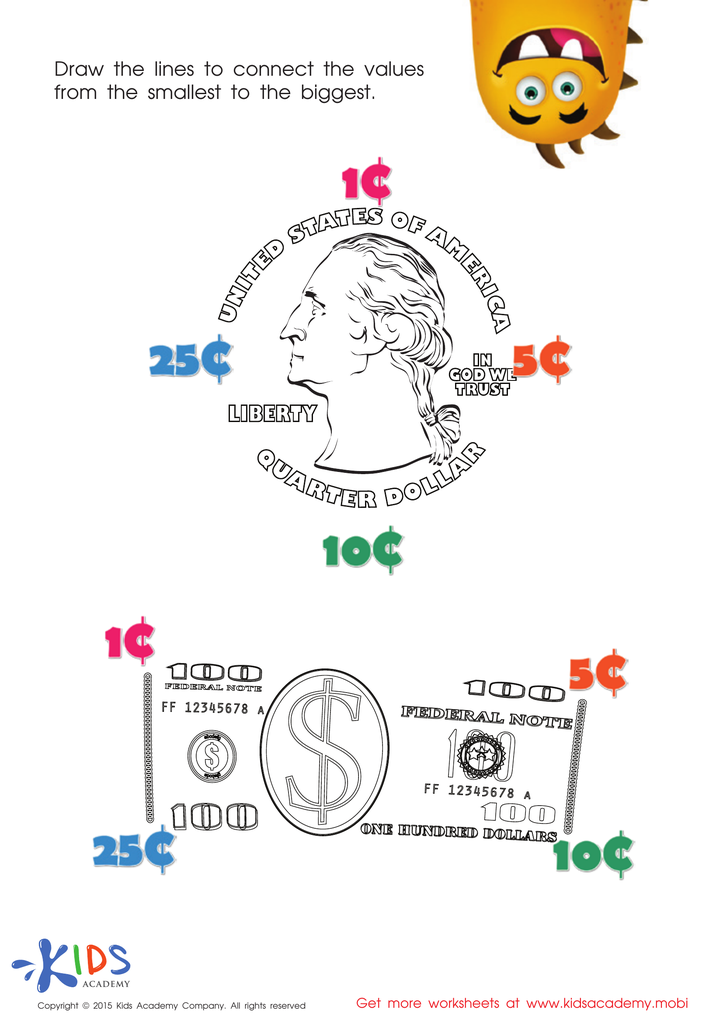

Connecting the Values Money Worksheet

How Many Coins Money Worksheet

Recognizing Money Money Worksheet

One Cent or the Penny Money Worksheet

Five Cents or the Nickel Money Worksheet

Coin Names and Values Money Worksheet

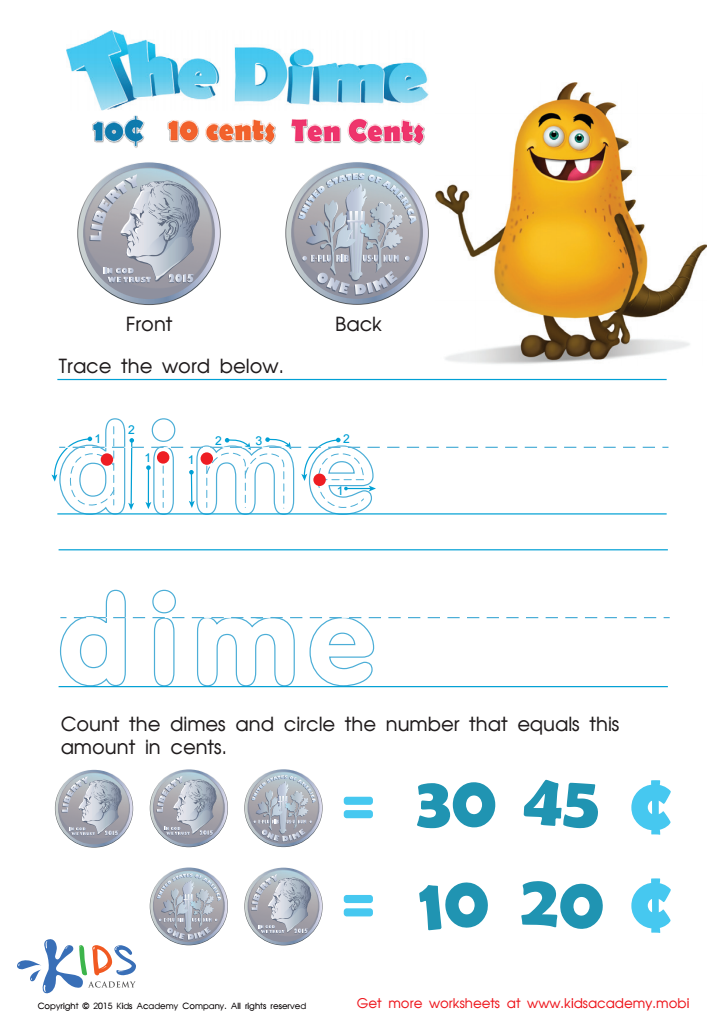

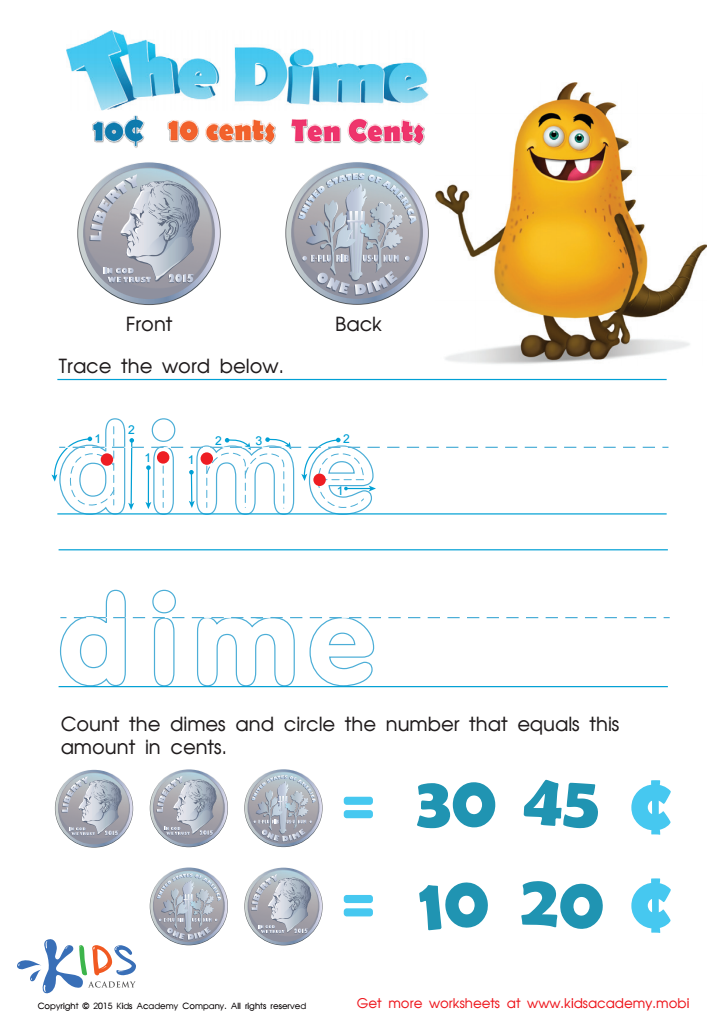

Ten Cents or the Dime Money Worksheet

Counting the Coins Money Worksheet

Money: Coins Dollars Printable

Picking the Coins You Need Money Worksheet

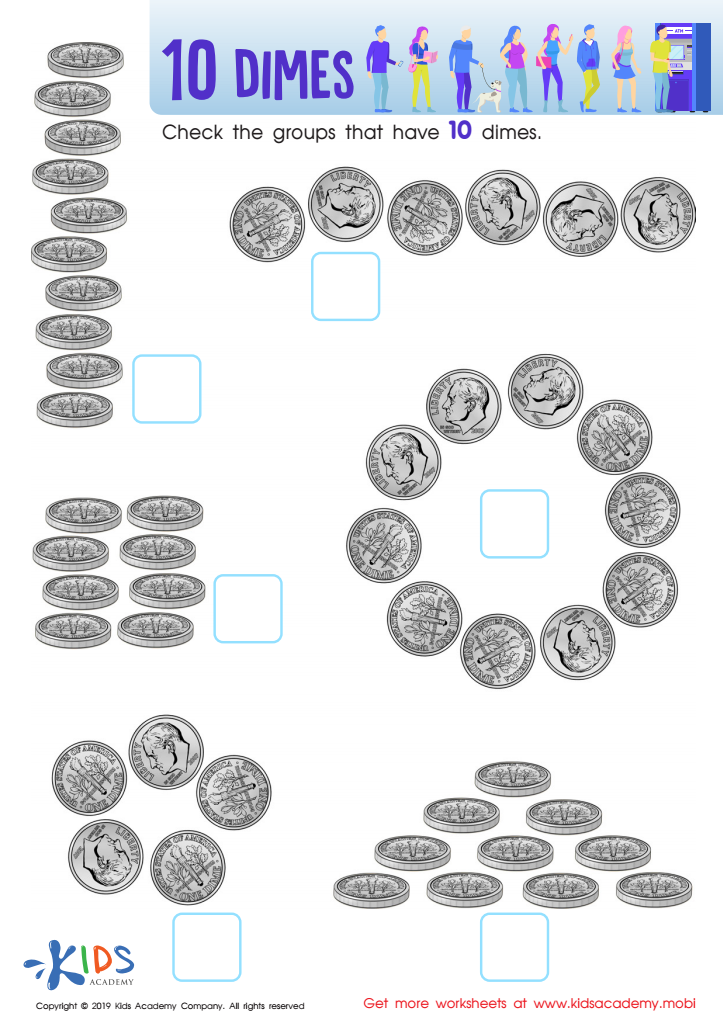

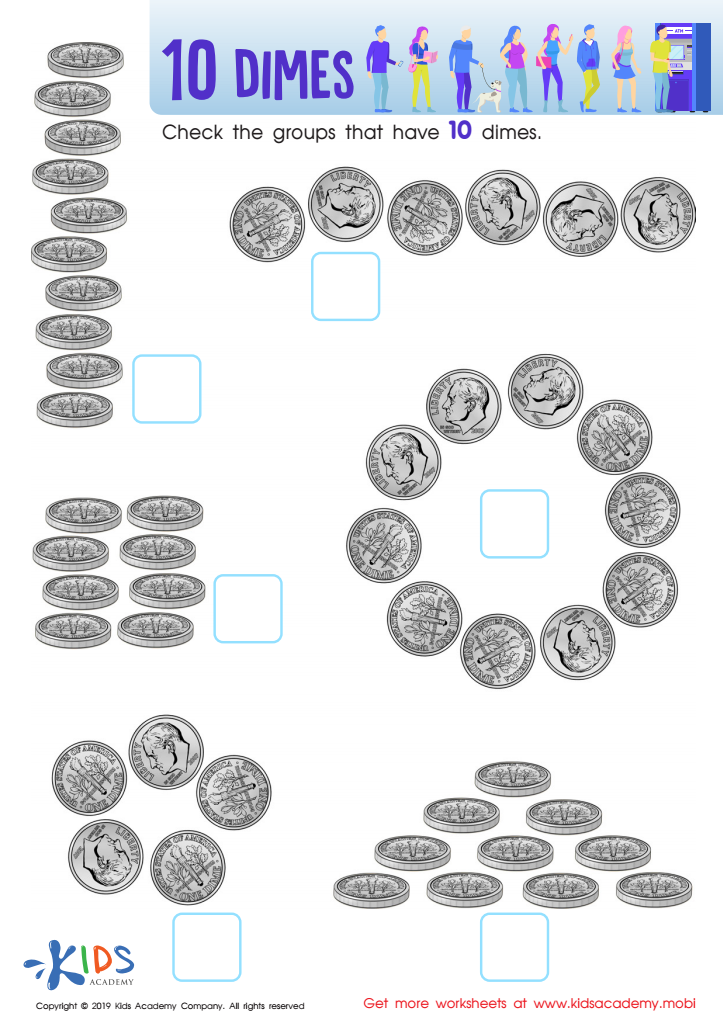

10 Dimes Worksheet

Sweet Shop – Counting Coins Worksheet

Twenty Five Cents or the Quarter Money Worksheet

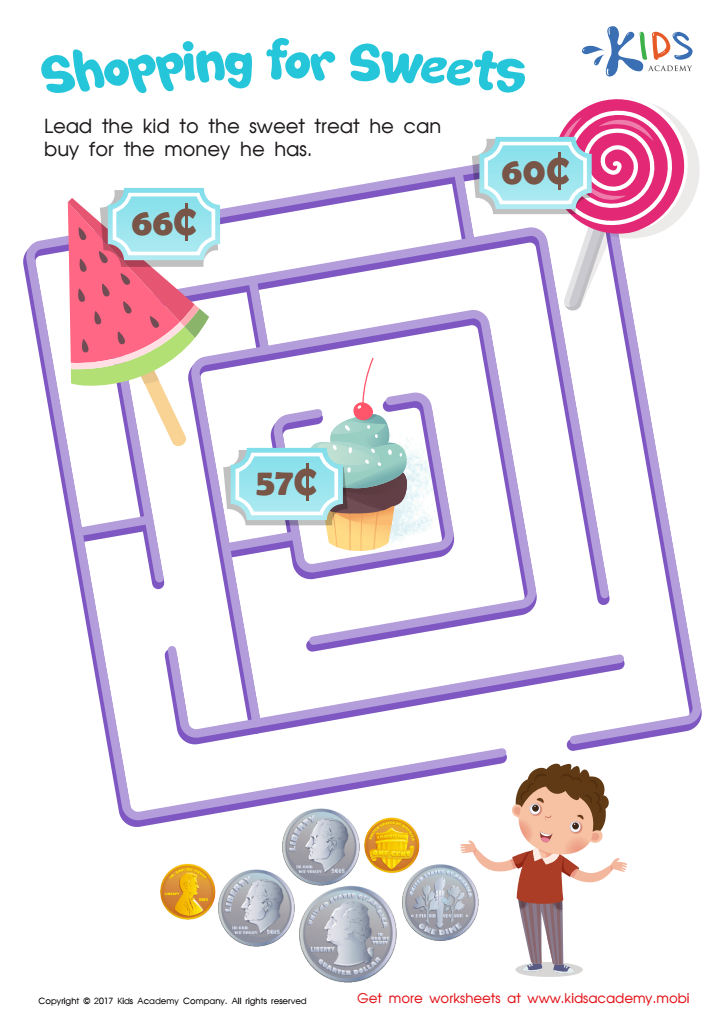

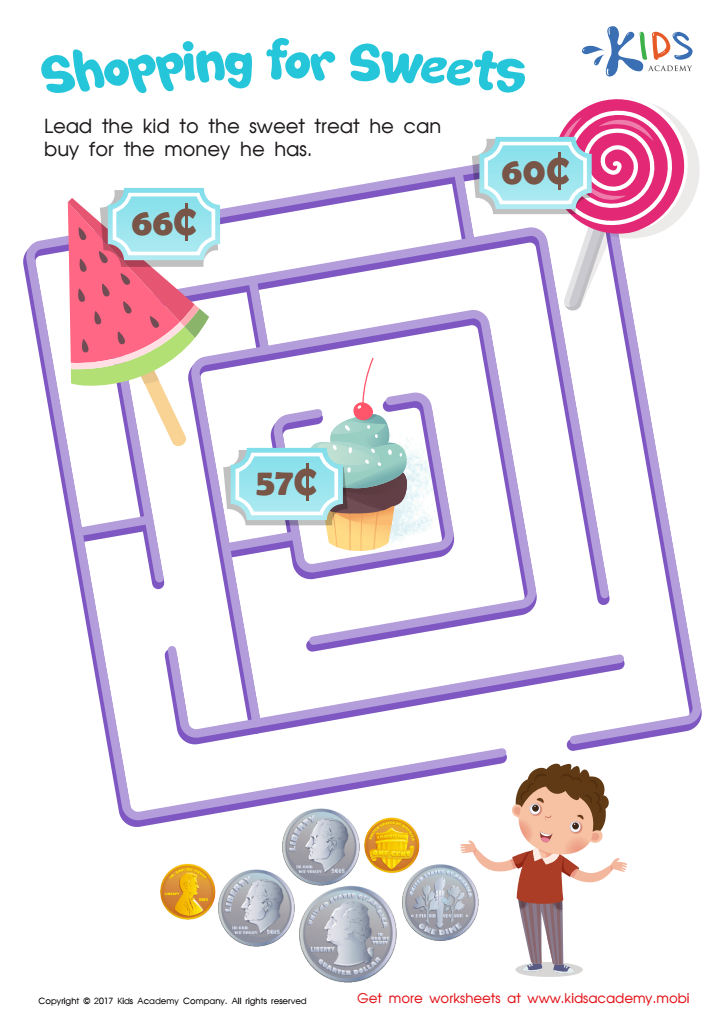

Shopping for Sweets Worksheet

Understanding money concepts from a young age is crucial for children aged 3-8, as early financial literacy lays the foundation for responsible money management in later life. Parents and teachers should care about introducing financial themes because it cultivates essential skills such as counting, budgeting, and making informed choices.

At this developmental stage, children are naturally curious and eager to explore the world around them. By integrating money concepts into their daily routines, adults can engage children in discussions about needs versus wants, saving, and sharing. This engagement fosters critical thinking and decision-making skills that extend beyond financial scenarios.

Moreover, learning about money promotes the value of delayed gratification, enabling children to understand the importance of saving towards goals rather than immediate spending. This understanding can contribute to healthier attitudes towards money and reduce anxiety about financial decisions as they grow older.

Incorporating fun activities, such as playing store or using play money, can make these lessons engaging and memorable. Equipping young minds with these principles not only enhances their cognitive development but also prepares them for future challenges in managing finances, ultimately leading to more financially savvy individuals.

Assign to My Students

Assign to My Students