Money Worksheets for Ages 6-9

18 filtered results

Difficulty Level

Grade

Age

-

From - To

Subject

Activity

Standards

Favorites

With answer key

Interactive

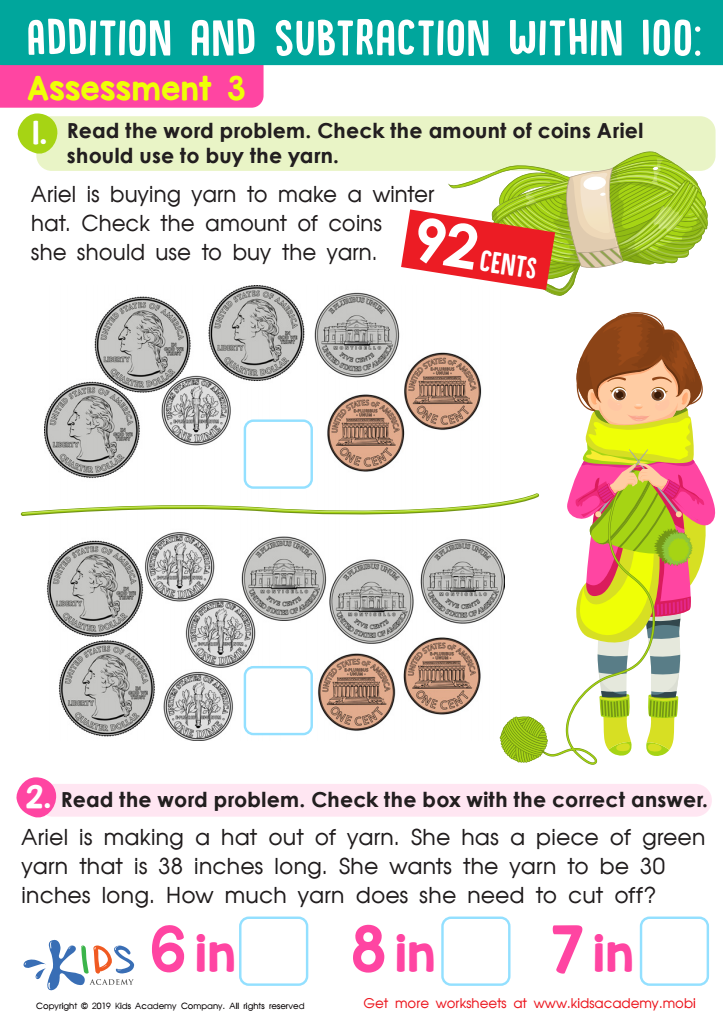

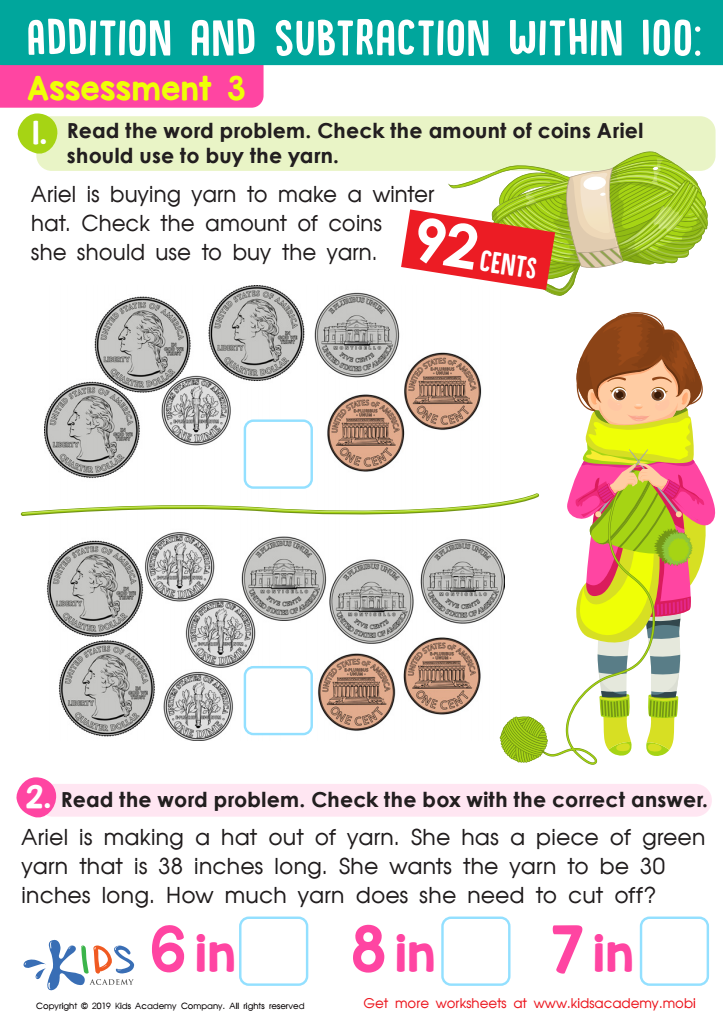

Assessment 3 Math Worksheet

Ariel needs to buy yarn. Do your kids know what yarn is? If they've seen you knit, they will. Help them solve the two word problems to figure out how many coins Ariel needs to buy it.

Assessment 3 Math Worksheet

Worksheet

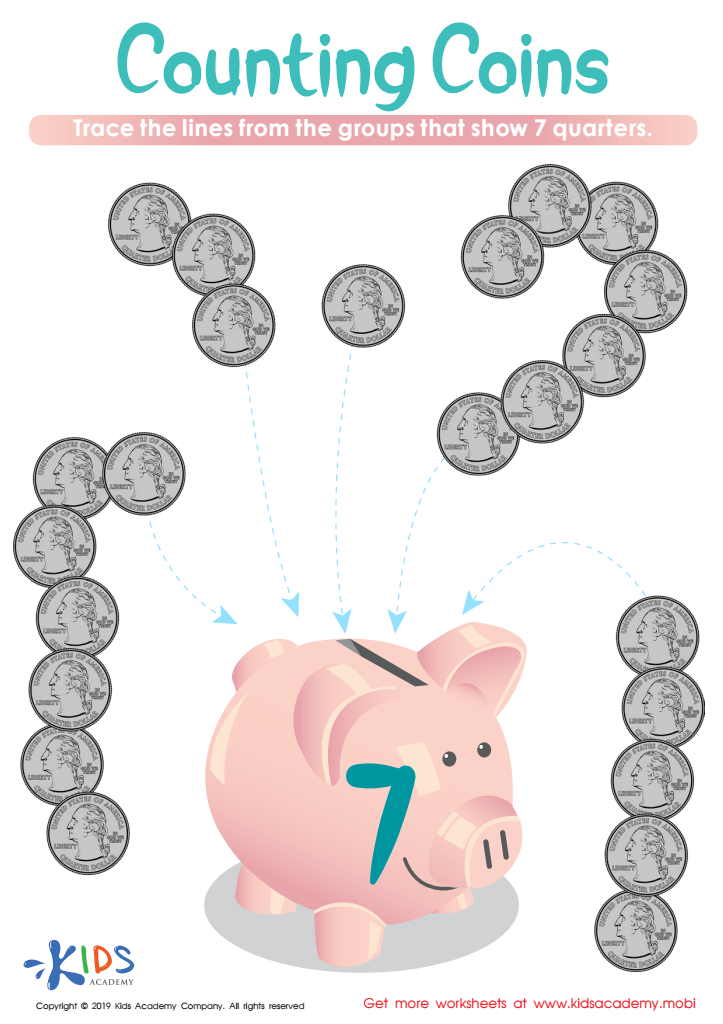

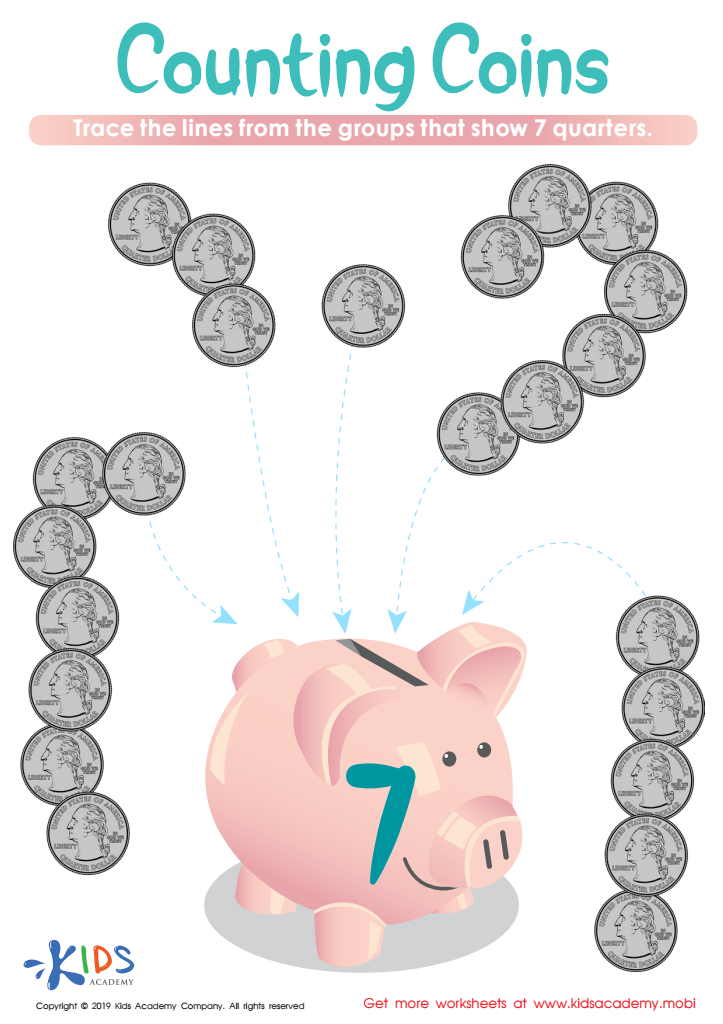

Counting Coins Worksheet

Help your students overcome their fear or aversion of counting and learning numbers with this fun worksheet! It features colorful pictures with four groups of coins. Ask the students to count each group, then trace the lines to the piggy bank. Show them it's easy to count and learn numbers!

Counting Coins Worksheet

Worksheet

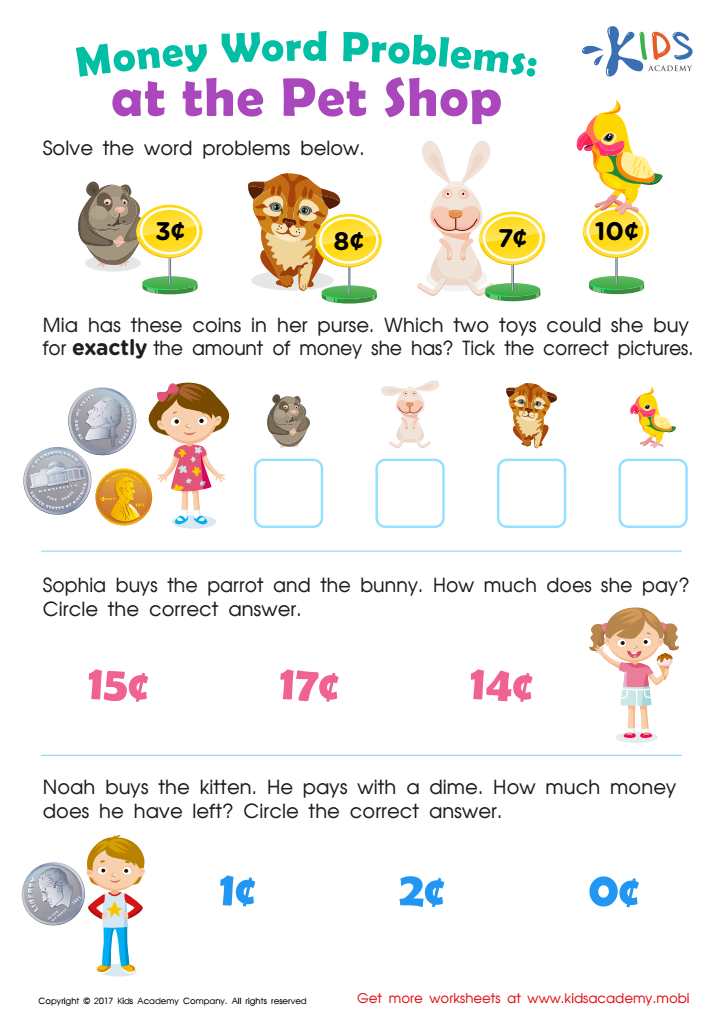

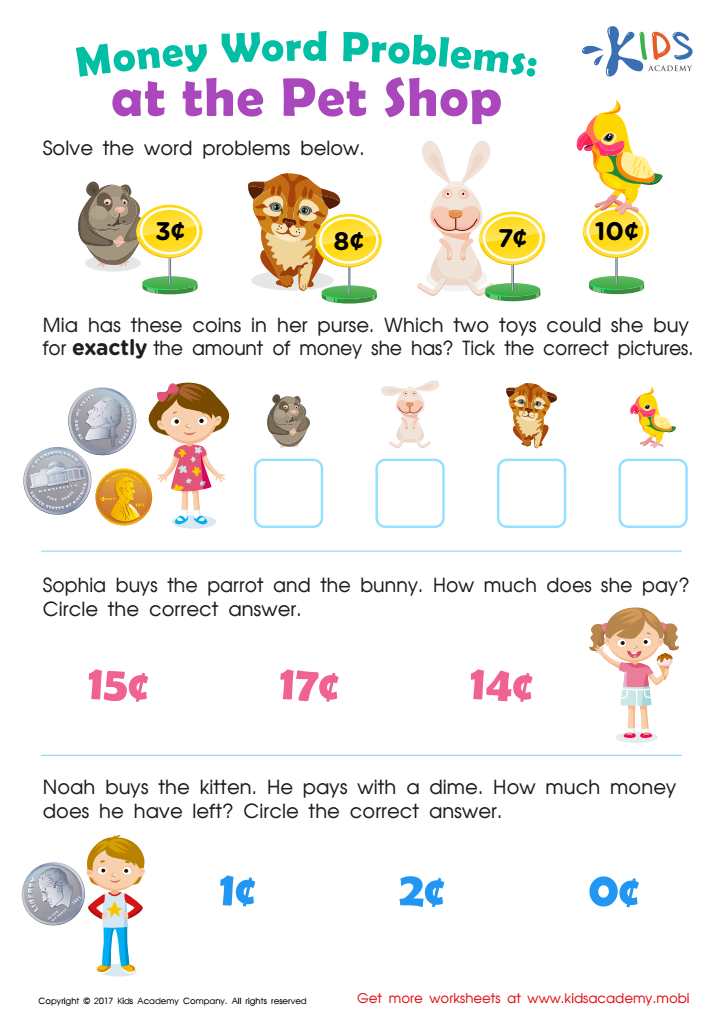

Pet Shop Worksheet

Teach your child a key life skill: counting and managing money. With this worksheet, they'll learn to count coins and calculate purchases at the pet shop. Give them colorful, fun math practice!

Pet Shop Worksheet

Worksheet

Counting Coins Worksheet

It will challenge them to spend a given amount using the least coins possible. Perfect for 2nd grade.

Help your child learn to count coins with this fun bakery-themed worksheet. It's perfect for 2nd graders and will challenge them to use the least coins possible to spend a set amount. Develop a valuable life skill and have fun while doing it!

Counting Coins Worksheet

Worksheet

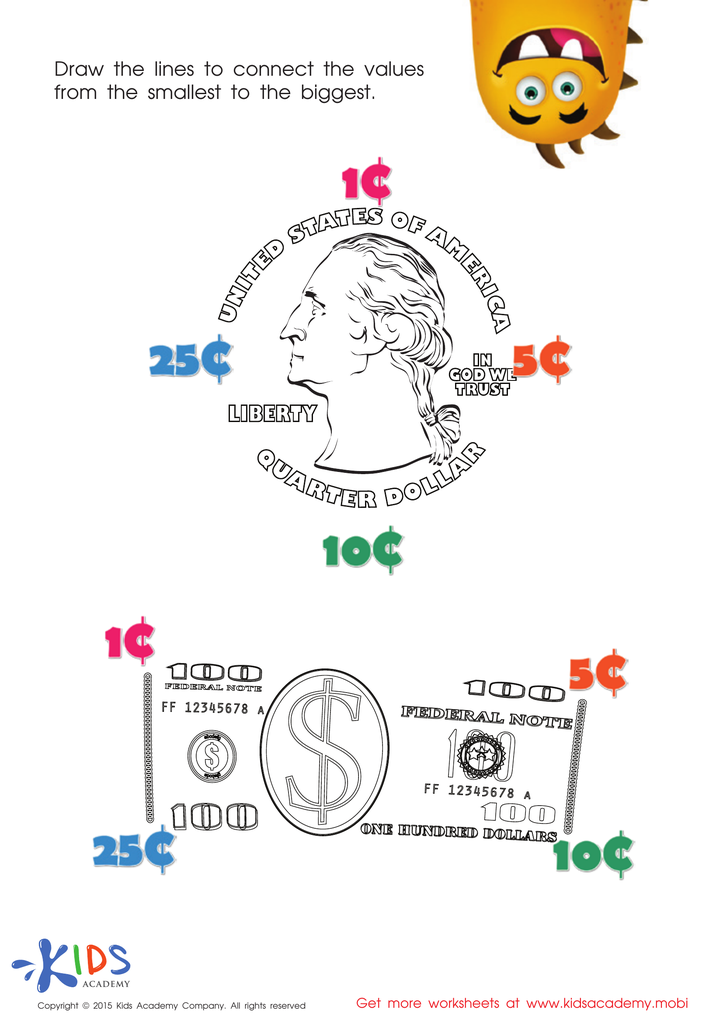

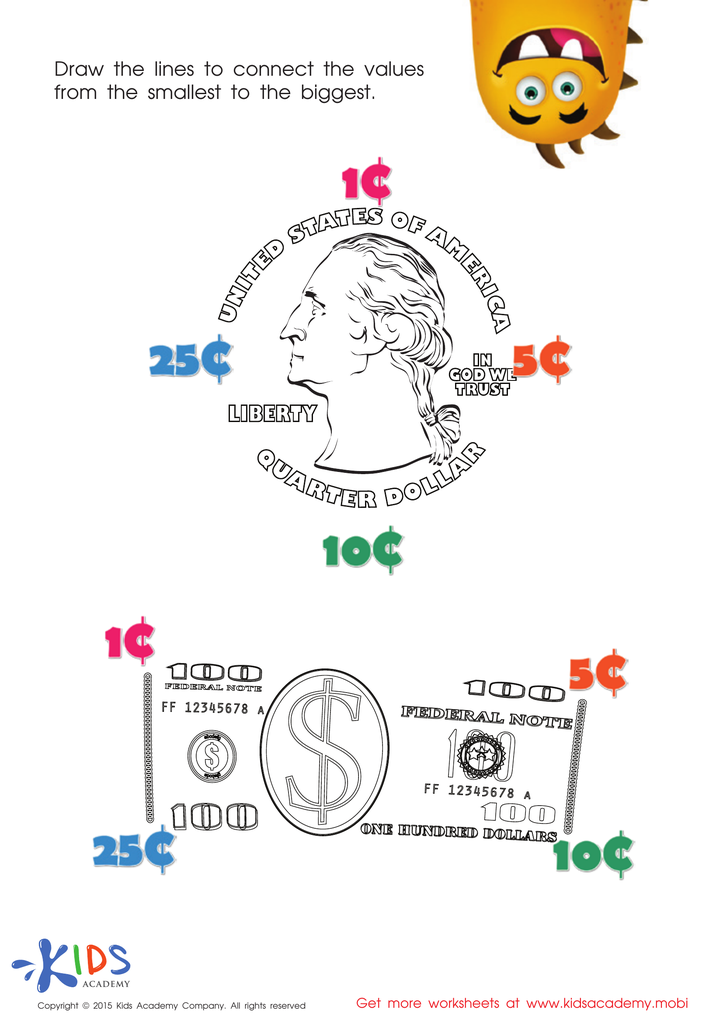

Connecting the Values Money Worksheet

Counting games are a fun way to teach kids about money and counting money. We've learnt the penny, nickel, dime and quarter - can you identify them from the pictures? Draw a line from the smallest to the biggest value and remember the order. Kids Academy has more fun and informative worksheets on counting money.

Connecting the Values Money Worksheet

Worksheet

How Many Coins Money Worksheet

Have fun while counting coins: look at the monsters and count the coins in their hands. Challenge your little learners to count and write down the number of coins each one has. Enjoy the time together!

How Many Coins Money Worksheet

Worksheet

Recognizing Money Money Worksheet

Help the piggy bank by coloring its coins with Kids Academy's free money worksheets! Learn the different coins and their values with your kids. Printable worksheets are available to continue the lesson. Let's learn and have fun!

Recognizing Money Money Worksheet

Worksheet

One Cent or the Penny Money Worksheet

Counting money made easy with Kids Academy's new collection of worksheets! Start with the one cent coin, or "Penny": trace it and count the pennies to work out the total. Visit our site for more free, printable money worksheets.

One Cent or the Penny Money Worksheet

Worksheet

Five Cents or the Nickel Money Worksheet

Counting money games help kids make learning money fun and easy. Next up: the 5 cent coin, or nickel. Look at both sides and remember them. Then, trace the word "nickel" to help you remember. Finally, count the nickels and work out amounts in cents. Let's do this! Kids Academy helps make money learning easy and fun!

Five Cents or the Nickel Money Worksheet

Worksheet

Coin Names and Values Money Worksheet

Learning about money can be easy, interesting and fun! Start by memorizing names and values of coins and then try matching pictures of coins to the right names and values. Find a great selection of counting money worksheets at our web site and keep learning.

Coin Names and Values Money Worksheet

Worksheet

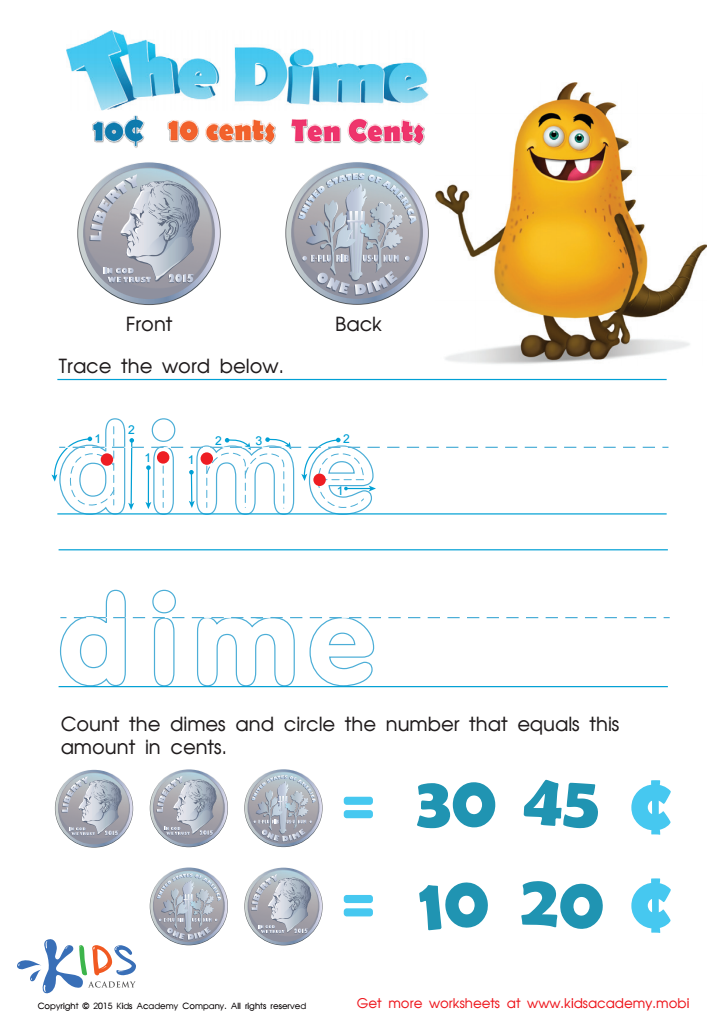

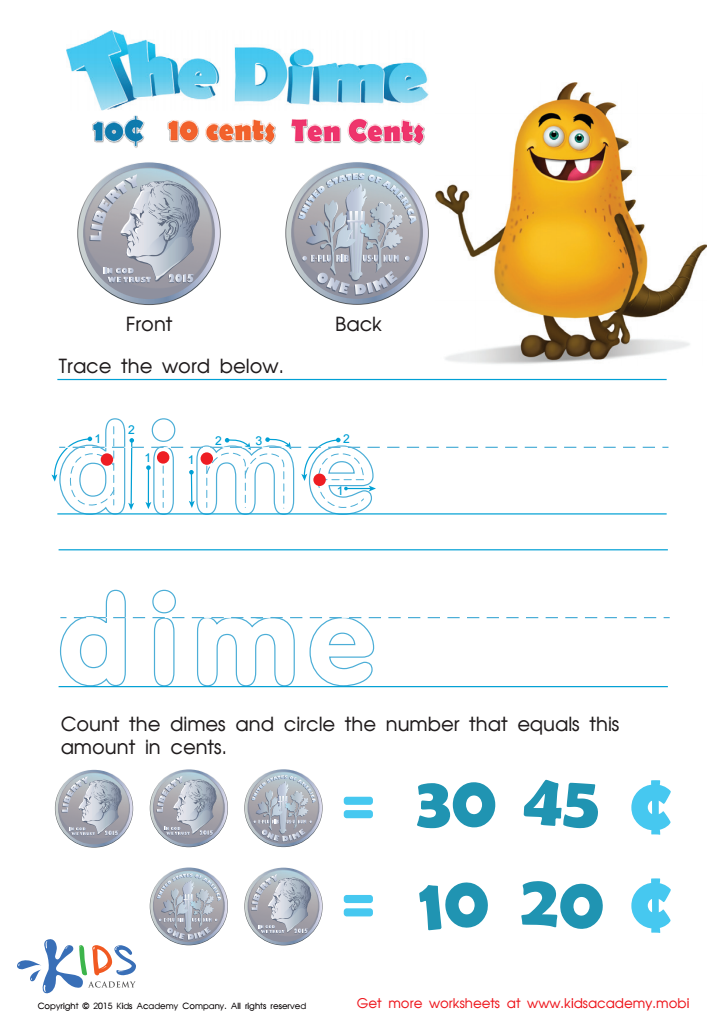

Ten Cents or the Dime Money Worksheet

Introduce your kids to coin games! Start with a dime: trace the word on both sides and count the dimes. Kids Academy has printable worksheets to help your kids learn how to count money.

Ten Cents or the Dime Money Worksheet

Worksheet

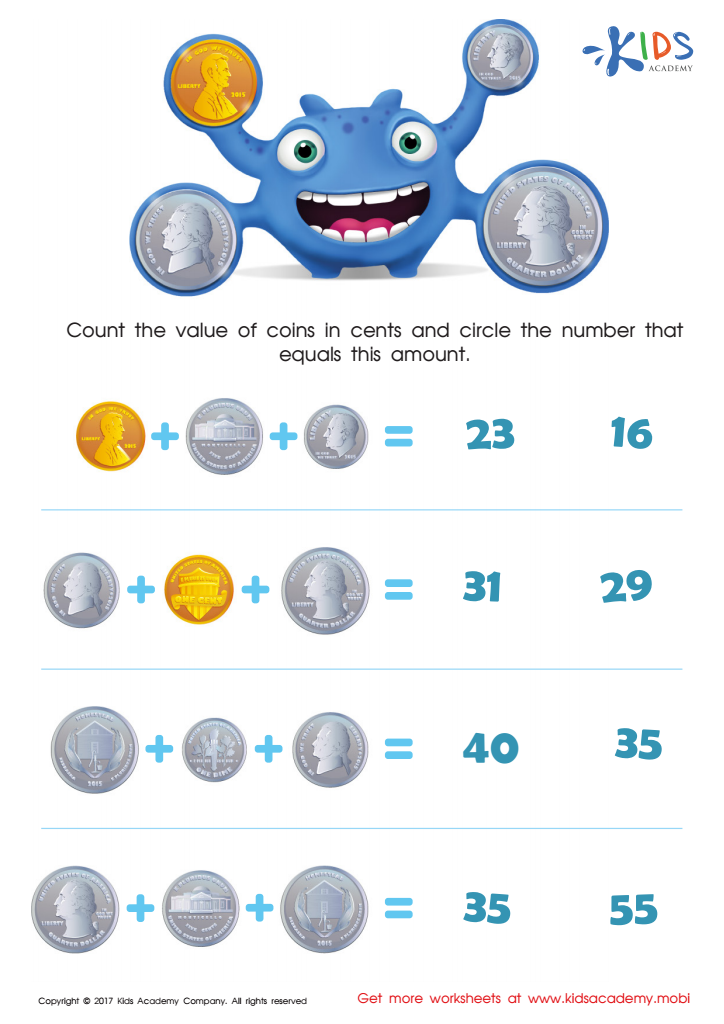

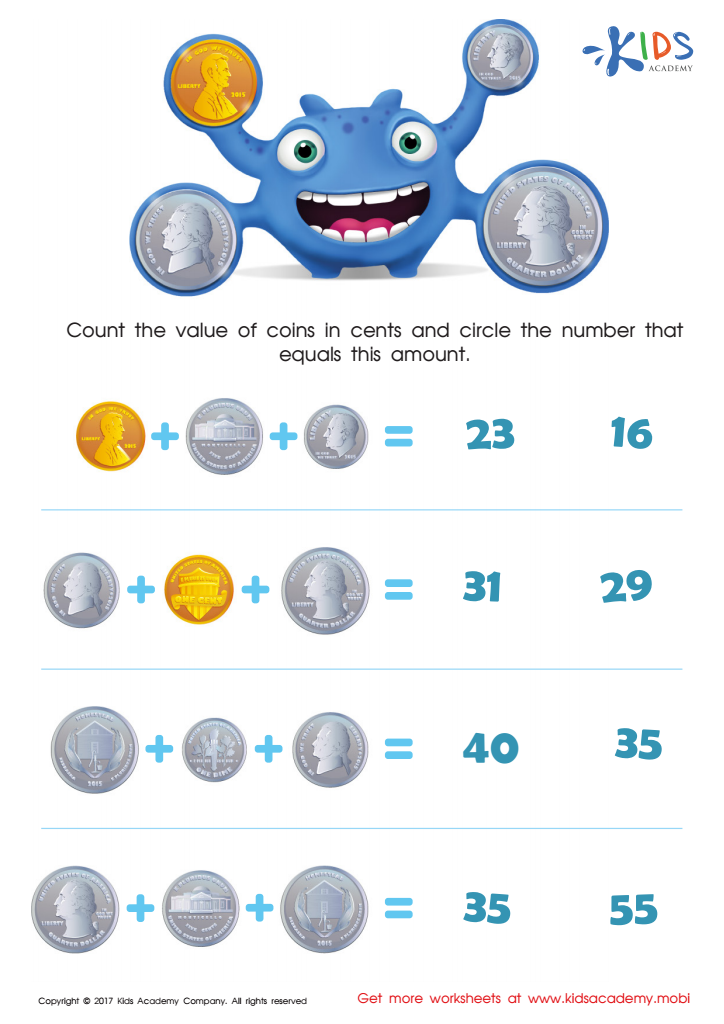

Counting the Coins Money Worksheet

Count coins quickly and work out sums in cents. Remember the value of each coin!

Counting the Coins Money Worksheet

Worksheet

Money: Coins Dollars Printable

Motivate your kid to learn and practise essential math skills, like 'greater than' and 'less than', by introducing the importance of money! The money worksheet "Coins and Dollars" will give them a hands-on experience of counting coins and dollars, making math symbols more memorable.

Money: Coins Dollars Printable

Worksheet

Picking the Coins You Need Money Worksheet

Let's learn to count money with Parents and Kids Academy! Investigate a real shop together: buy a globe, pencils, books, and a school bag using coins. Then, circle the coins you'll need. Visit our website for more free and fun money games for kids!

Picking the Coins You Need Money Worksheet

Worksheet

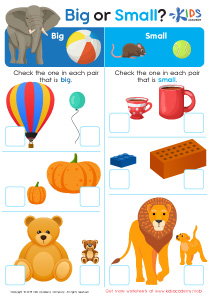

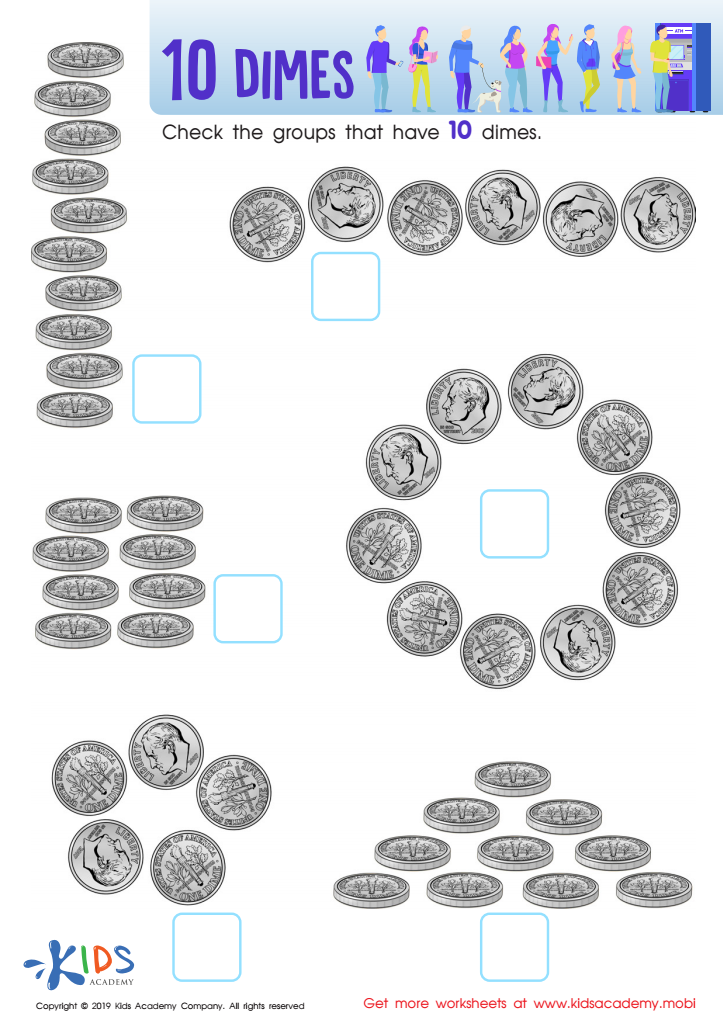

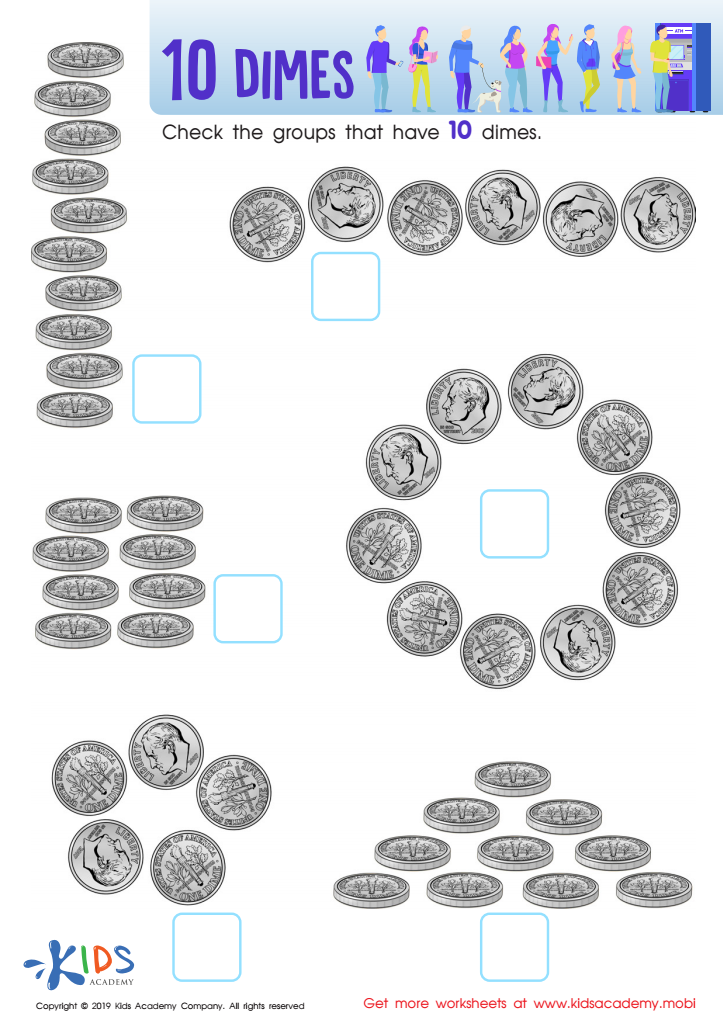

10 Dimes Worksheet

Get your students ready for the task by asking them to count as high as they can. Familiar objects are stacked in groups. Look at the picture and help them count the dimes. Circle the groups of 10. This worksheet will help kindergartners practice counting up to and recognizing 10 dimes.

10 Dimes Worksheet

Worksheet

Sweet Shop – Counting Coins Worksheet

Help your child get ready to buy sweet treats with this coin counting worksheet. It'll challenge them to use the fewest coins possible. With knowledge of coin values, they'll work out the right combination to get the sweets!

Sweet Shop – Counting Coins Worksheet

Worksheet

Twenty Five Cents or the Quarter Money Worksheet

Check out our new printable money games - learn to count money easily! With quarters, trace the word, count them and calculate the amount in cents. More worksheets at our website. Give it a try!

Twenty Five Cents or the Quarter Money Worksheet

Worksheet

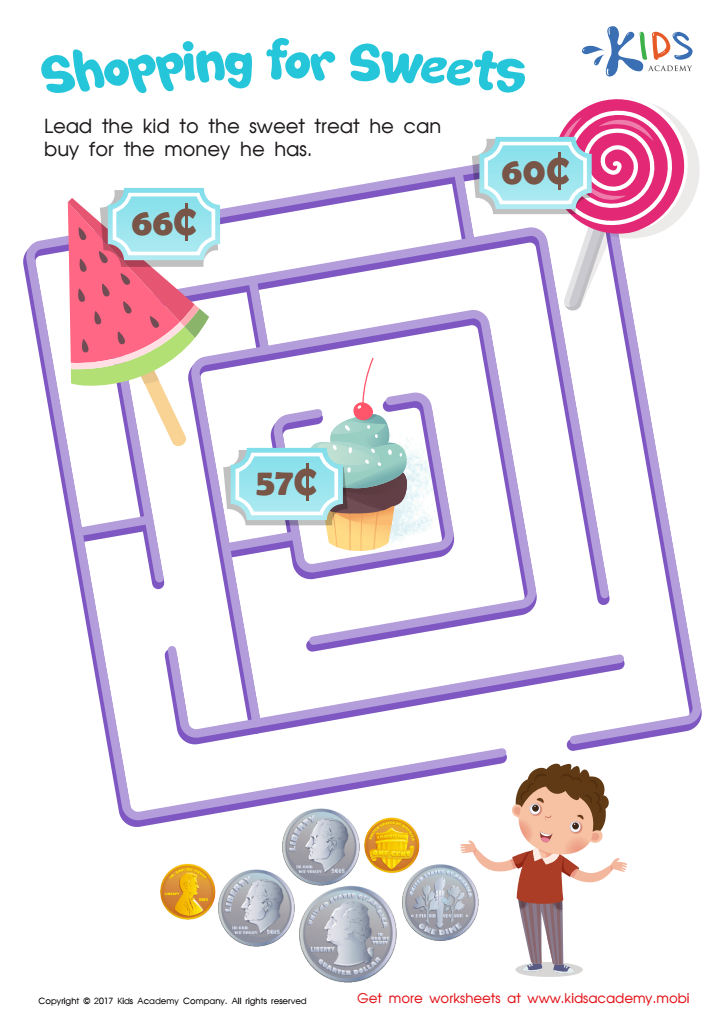

Shopping for Sweets Worksheet

Help your child hone their math and money skills with Shopping for Sweets! They'll count coins, work their way through a maze, and find the amount of money. Fun and educational - perfect for kids!

Shopping for Sweets Worksheet

Worksheet

Assign to the classroom

Assign to the classroom