Coins Worksheets for Ages 6-9

13 filtered results

-

From - To

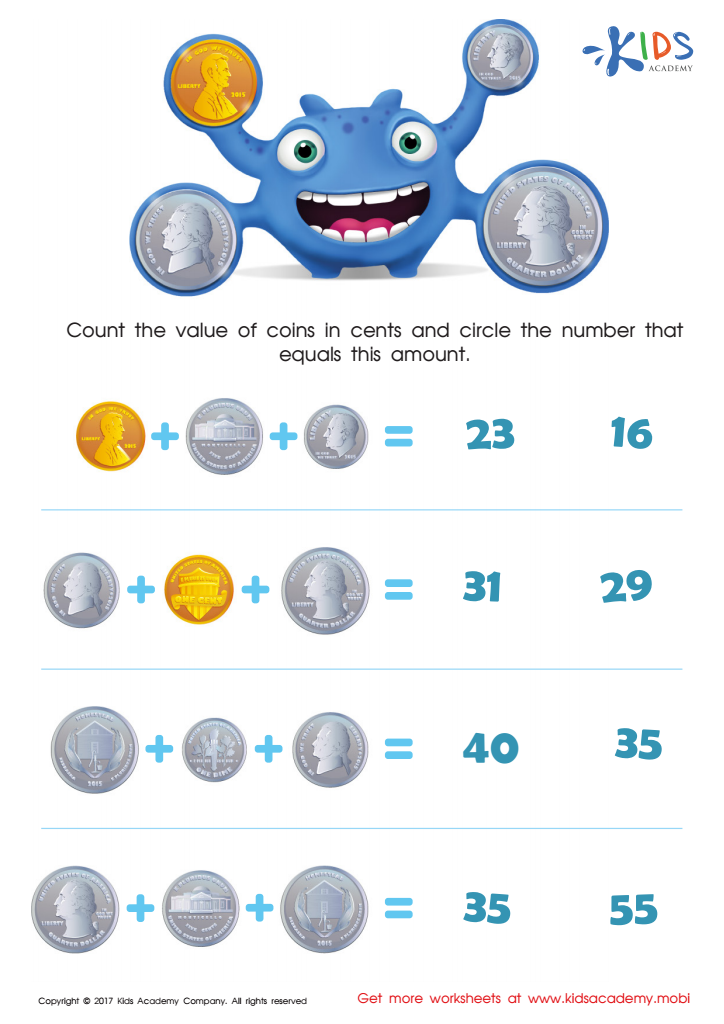

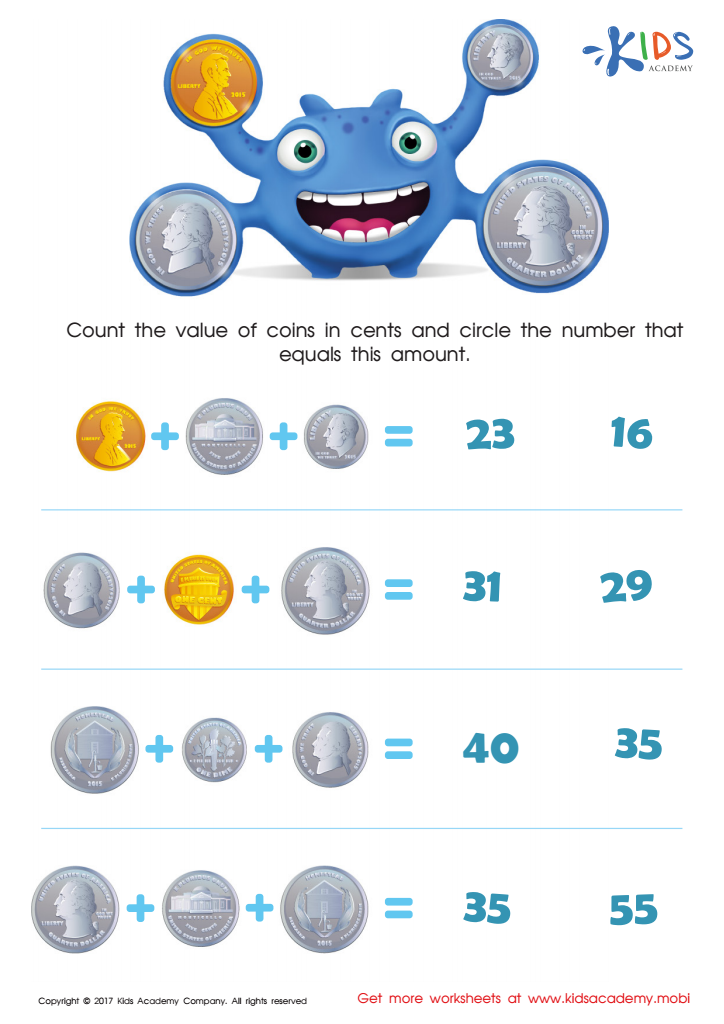

Welcome to our Coins Worksheets for Ages 6-9! This engaging resource is designed to help young learners master coin recognition, counting, and basic money skills. Our fun, interactive worksheets cover various topics, including identifying different coins, practicing addition with money, and solving real-life money problems. Perfect for at-home learning or classroom activities, these worksheets encourage students to develop essential math skills while enjoying hands-on practice. With colorful visuals and age-appropriate exercises, your child will boost their confidence in handling money. Download our coins worksheets today and give your young mathematicians the tools they need to shine!

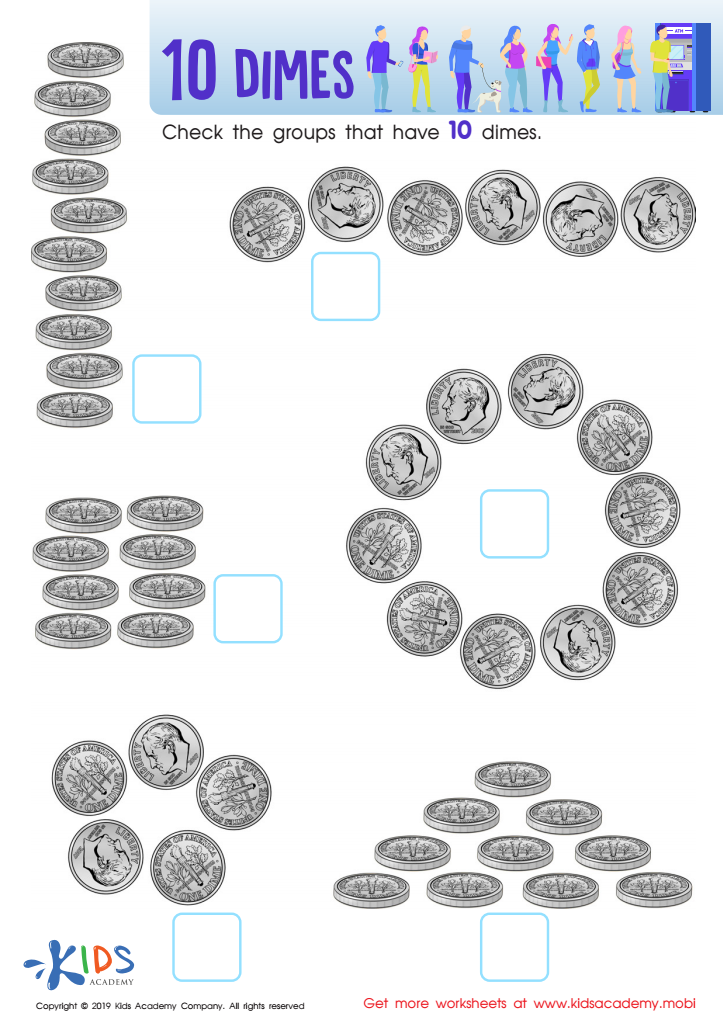

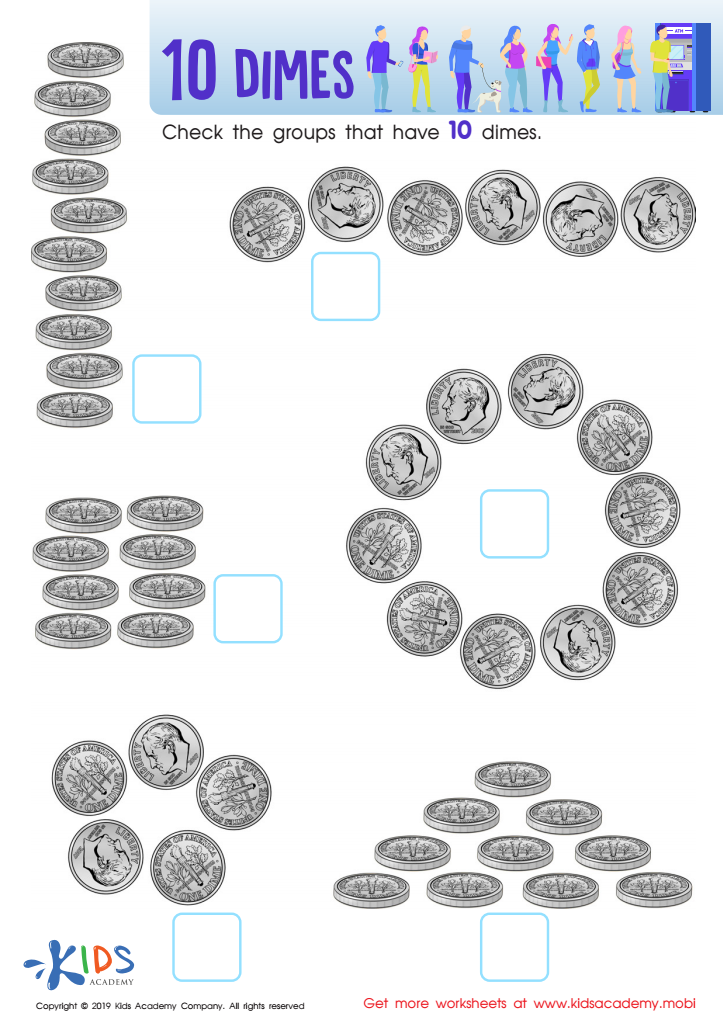

10 Dimes Worksheet

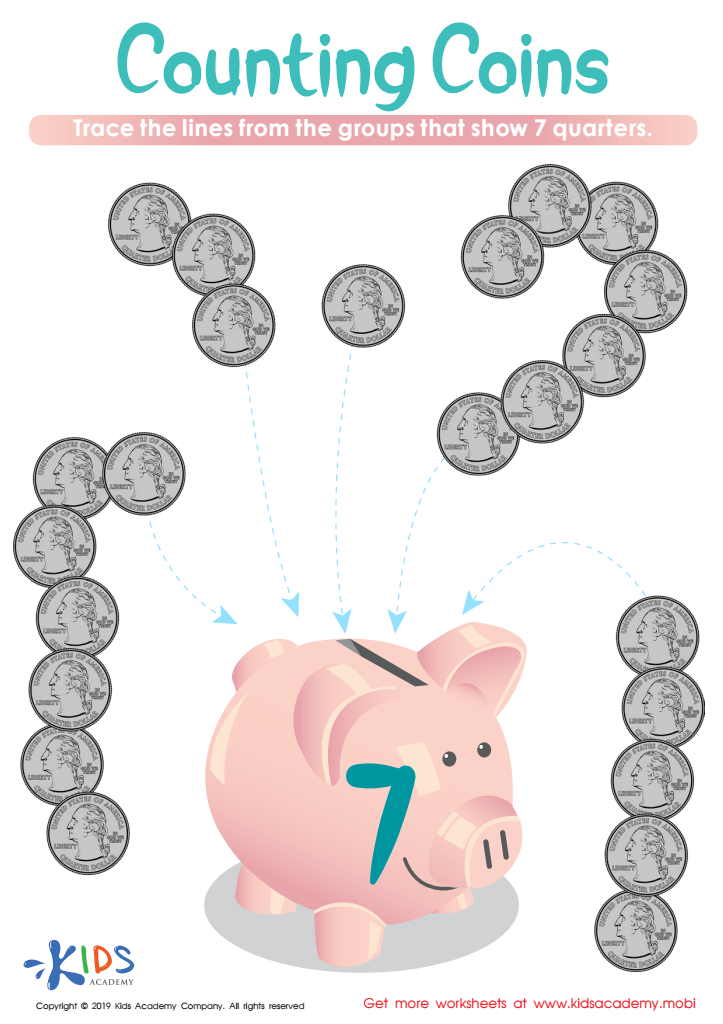

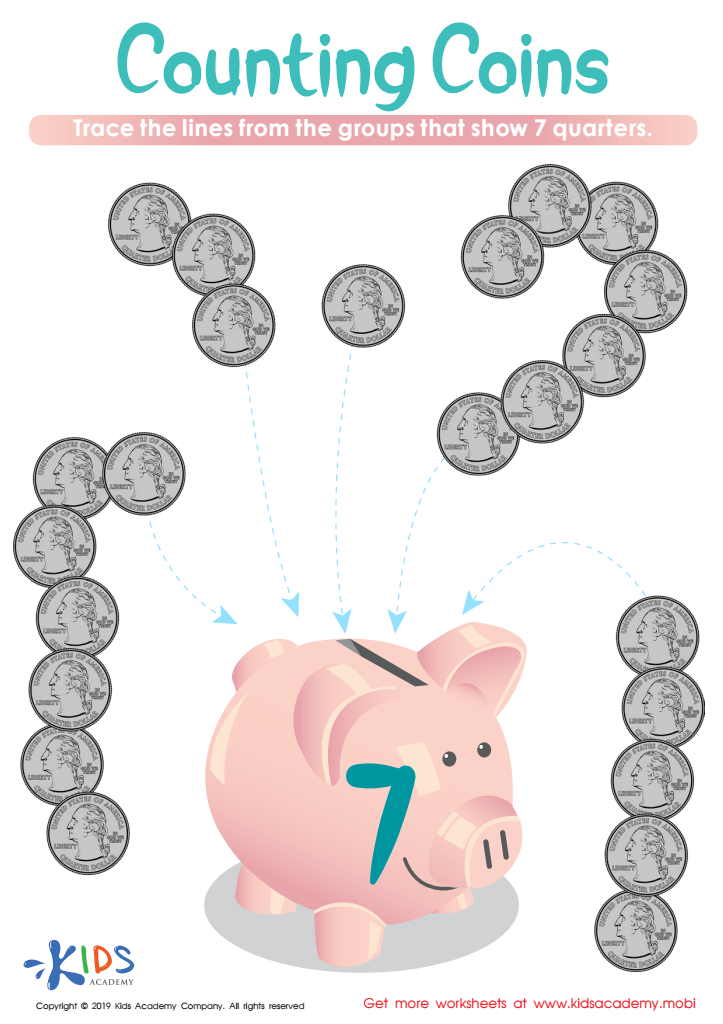

Counting Coins Worksheet

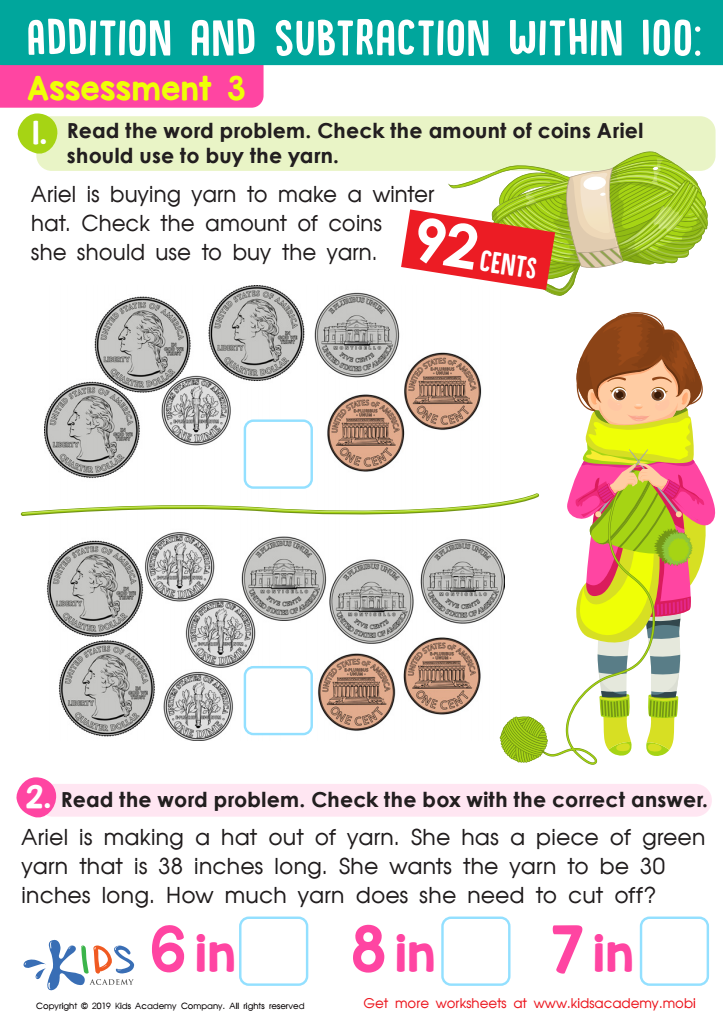

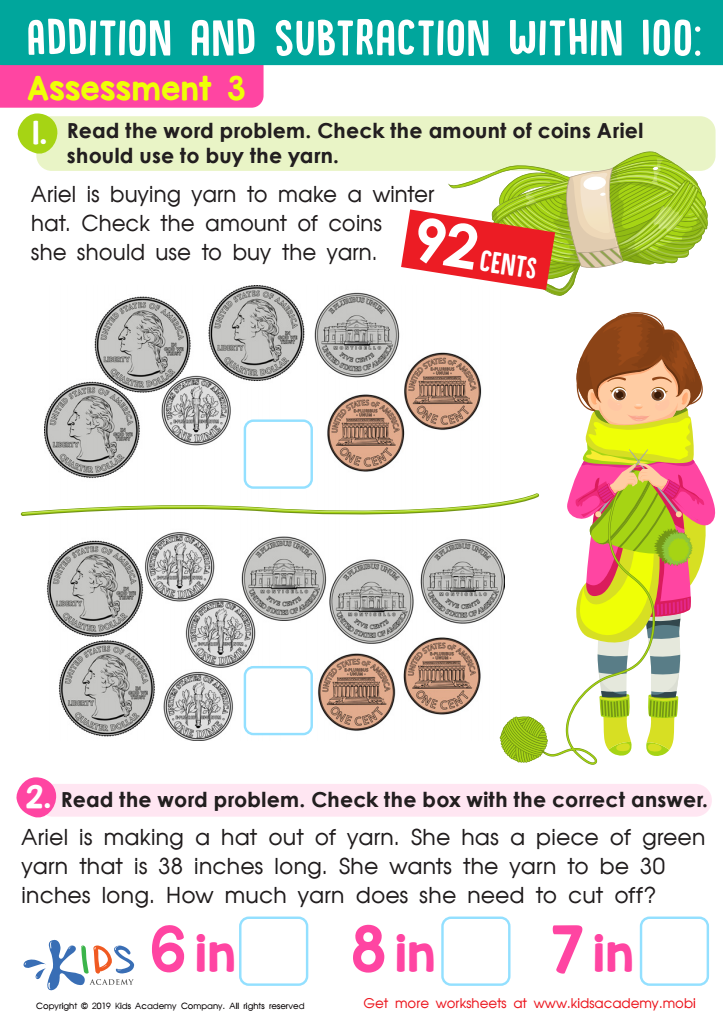

Assessment 3 Math Worksheet

Sweet Shop – Counting Coins Worksheet

Counting Coins Worksheet

Picking the Coins You Need Money Worksheet

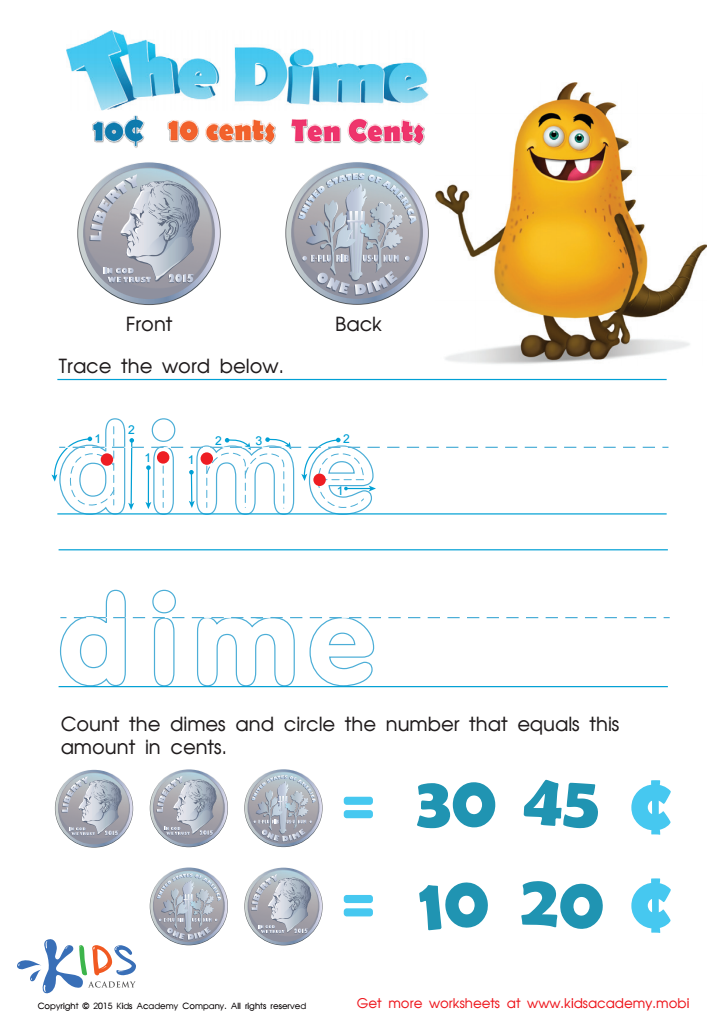

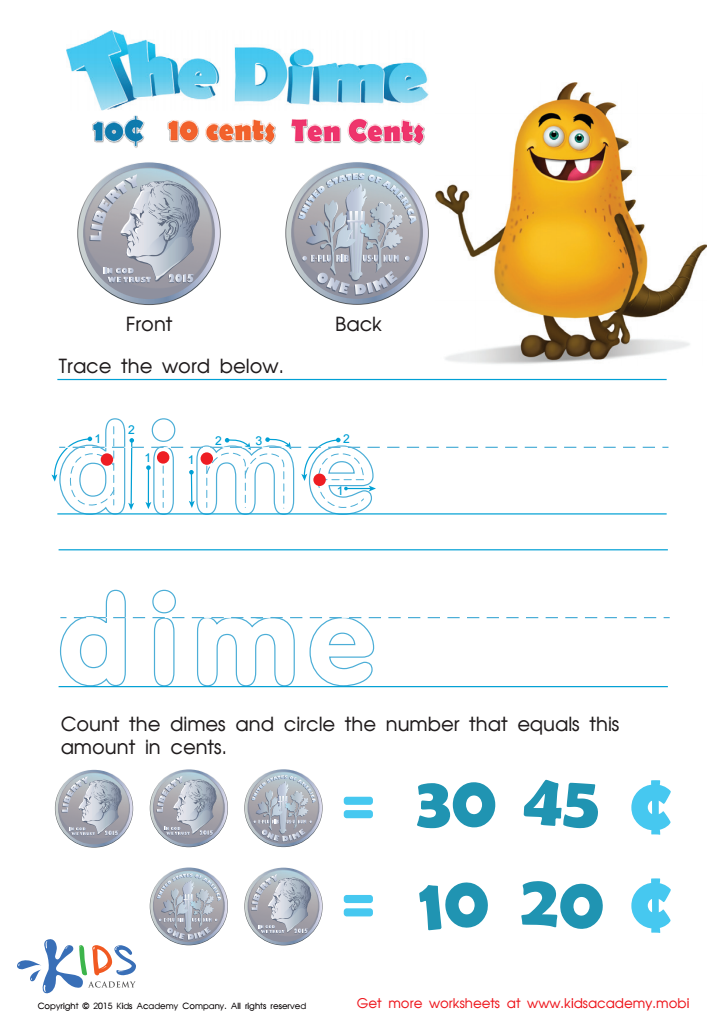

Ten Cents or the Dime Money Worksheet

Coin Names and Values Money Worksheet

One Cent or the Penny Money Worksheet

Five Cents or the Nickel Money Worksheet

Twenty Five Cents or the Quarter Money Worksheet

How Many Coins Money Worksheet

Counting the Coins Money Worksheet

Understanding coins is crucial for children aged 6-9, as it lays the foundation for essential life skills. Learning about coins helps develop mathematical understanding, particularly in addition, subtraction, and counting skills. At this age, children begin to explore financial literacy, and comprehension of money is a vital part of that learning journey.

Familiarity with coins also enhances cognitive development. It requires mental processing, memory, and problem-solving skills when identifying values and making transactions. Furthermore, using coins in practical scenarios—such as making purchases—teaches children how to budget, save, and make decisions based on their financial resources.

From a social perspective, understanding coins fosters independence and confidence in children. They become empowered to make their own small purchases, enhancing their social skills as they interact with peers and adults in various settings.

For parents and teachers, nurturing this understanding of money in young children promotes responsibility and prepares them for the complexities of adult life. By engaging children with coins, they not only cultivate educational skills but also equip them with the necessary tools to navigate today’s economic landscape effectively. Encouraging this learning early can lead to more financially savvy individuals in the future.

Assign to My Students

Assign to My Students