Money identification Worksheets for 8-Year-Olds

4 filtered results

-

From - To

Discover a vibrant collection of Money Identification Worksheets designed specifically for 8-year-olds! Our engaging worksheets help young learners master essential money skills, including recognizing coins and bills, understanding values, and solving real-life money scenarios. Each worksheet is thoughtfully crafted to make learning fun and interactive, encouraging kids to explore concepts like making change and counting money with confidence. Ideal for home or classroom use, these resources promote financial literacy from an early age. Download our printable worksheets today to empower your child with the skills they need for smart money management in the future! Start their learning journey now!

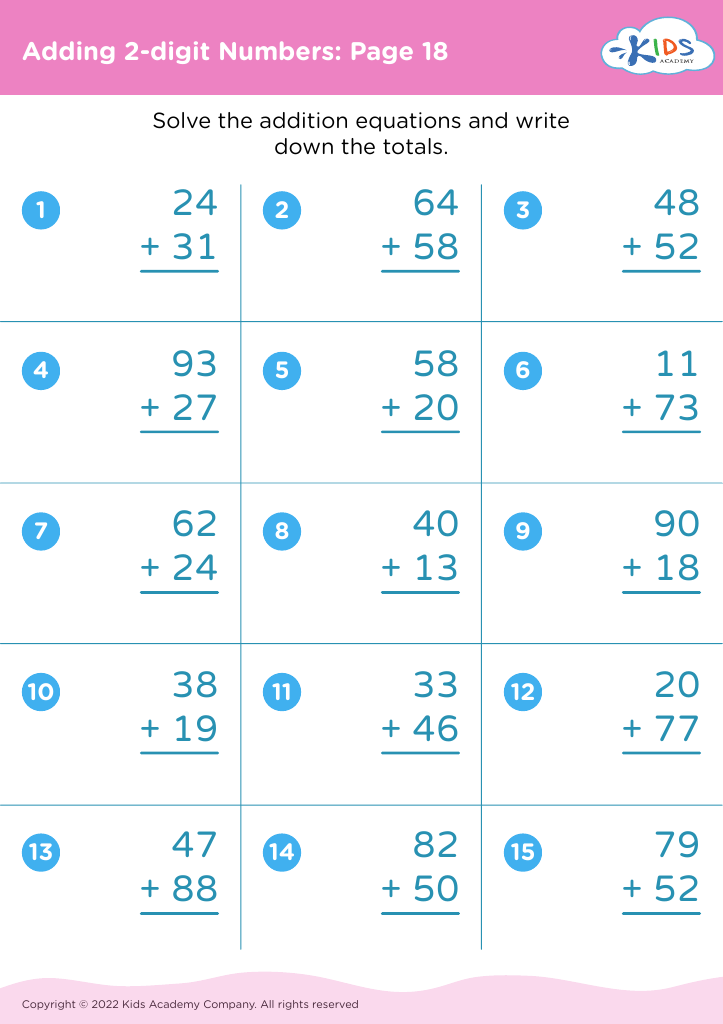

Money: Coins Dollars Printable

Picking the Coins You Need Money Worksheet

Money identification is a crucial skill for 8-year-olds as it lays the foundation for financial literacy and responsible money management later in life. Understanding different denominations of coins and bills enables children to make sense of the world around them, where money plays a central role in everyday transactions.

To begin with, recognizing money fosters independence. As children learn to identify different values, they become equipped to handle small purchases, saving them from confusion and anxiety in real-life situations such as shopping or making trades. This self-confidence builds a sense of achievement and responsibility.

Additionally, money identification contributes to essential math skills, such as addition, subtraction, and even basic multiplication, enhancing the child’s overall cognitive development. Engaging in real-life scenarios with money allows for practical application of these concepts, making math fun and relevant.

Moreover, fostering an understanding of money at a young age paves the way for responsible financial behavior. Teaching children about spending, saving, and making change can instill important values that prevent overspending and encourage smart saving practices. Therefore, emphasizing money identification in educational settings is important for equipping children with the skills they need to become financially savvy individuals.

Assign to My Students

Assign to My Students