Money Worksheets for Ages 6-8

18 filtered results

-

From - To

Introduce young learners to the concept of money with our engaging money worksheets designed specifically for ages 6-8. These printable activities foster essential math skills through fun and interactive exercises like counting coins, making change, and understanding currency value. Tailored to capture kids' interests, our worksheets blend education with enjoyment, reinforcing everyday math usage. Ideal for both classroom and home learning, these exercises support national math standards and help develop a practical understanding of money management. Start your child's financial literacy journey today with our expertly crafted money worksheets, designed to build confidence and competence in young minds.

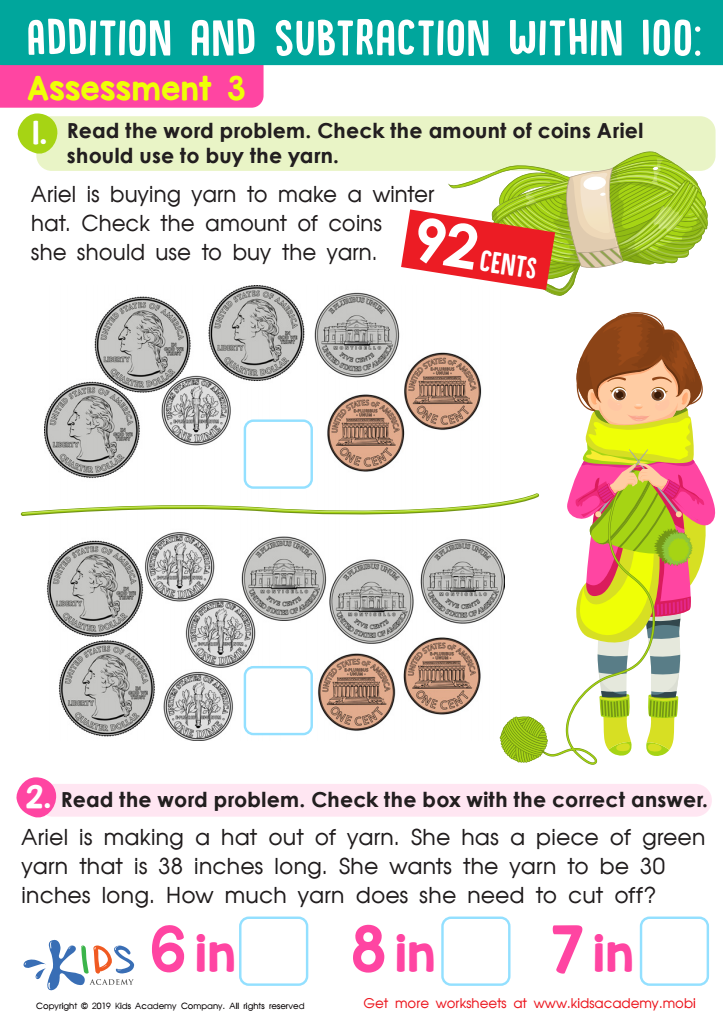

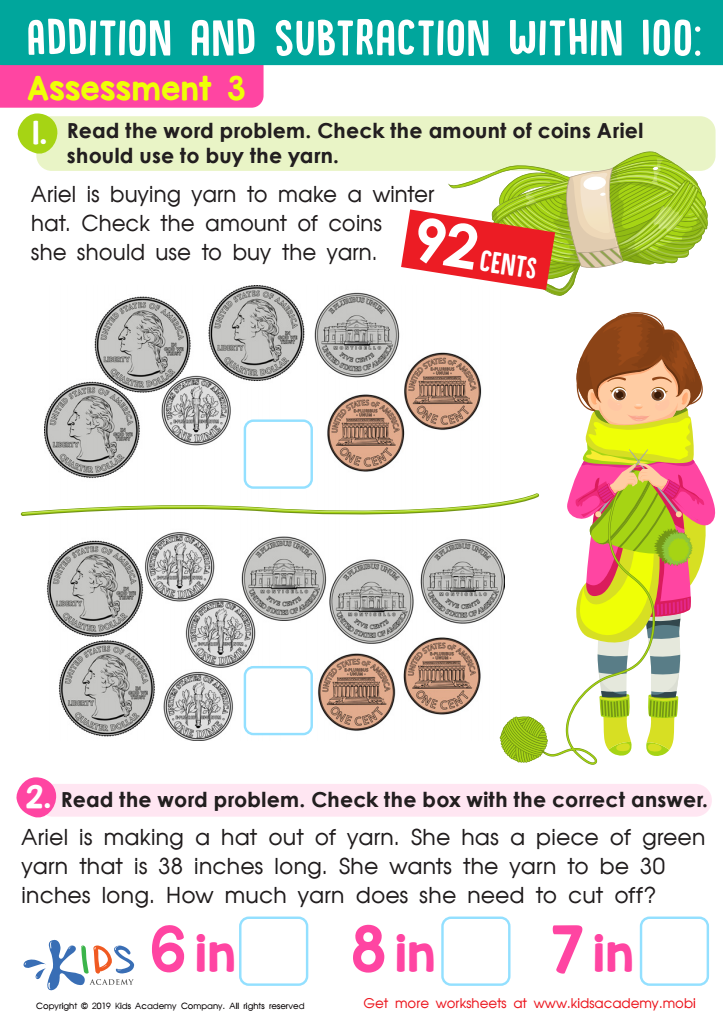

Assessment 3 Math Worksheet

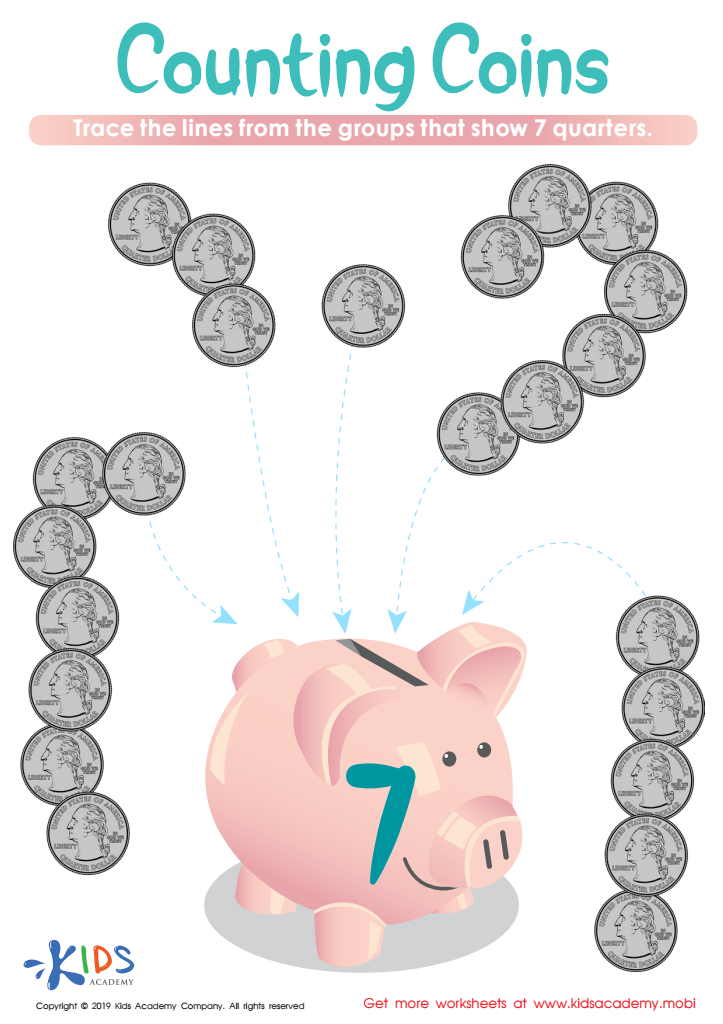

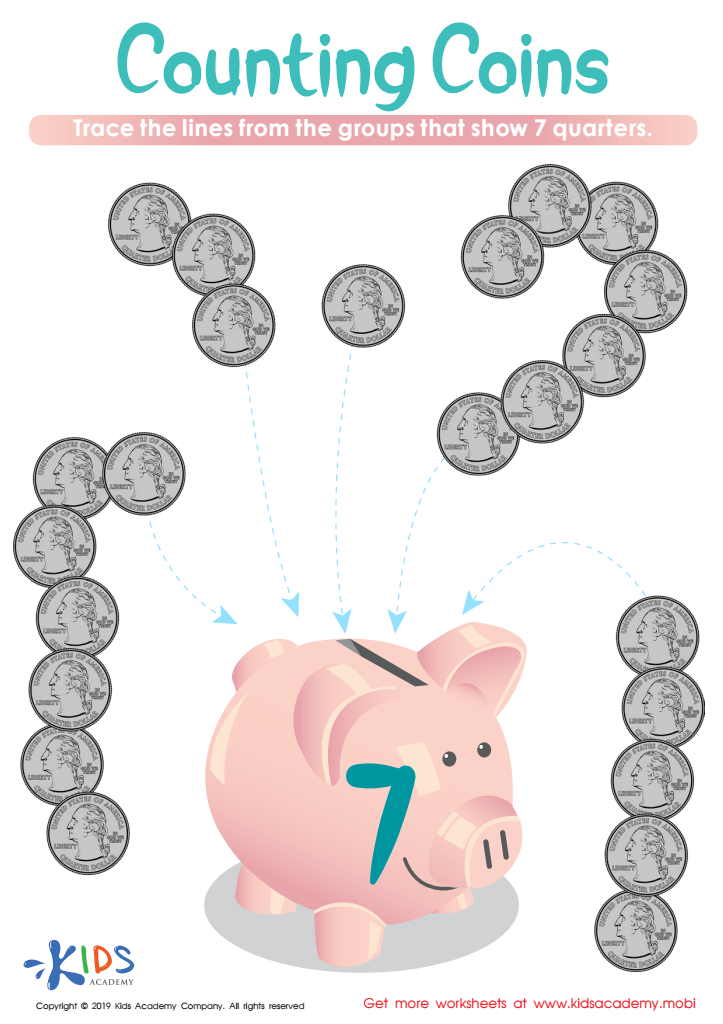

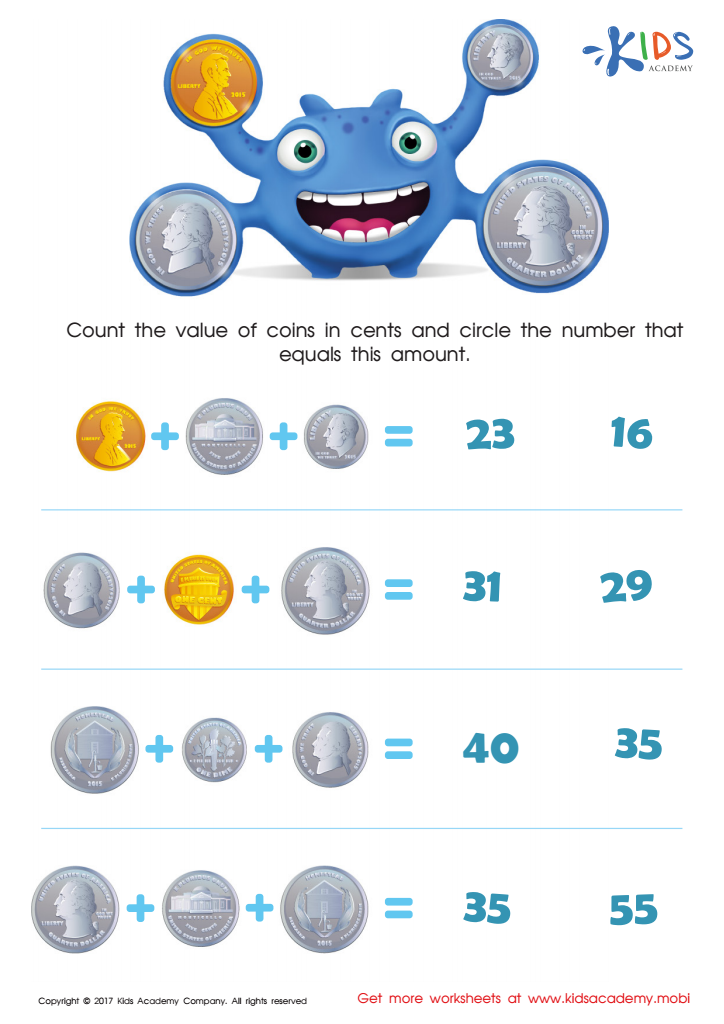

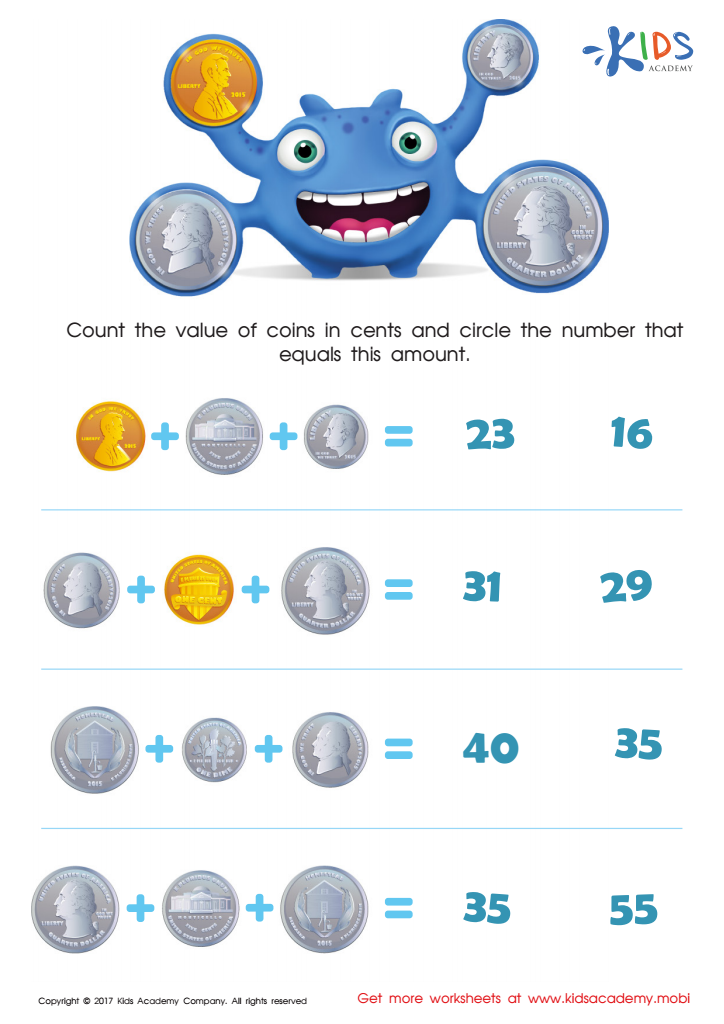

Counting Coins Worksheet

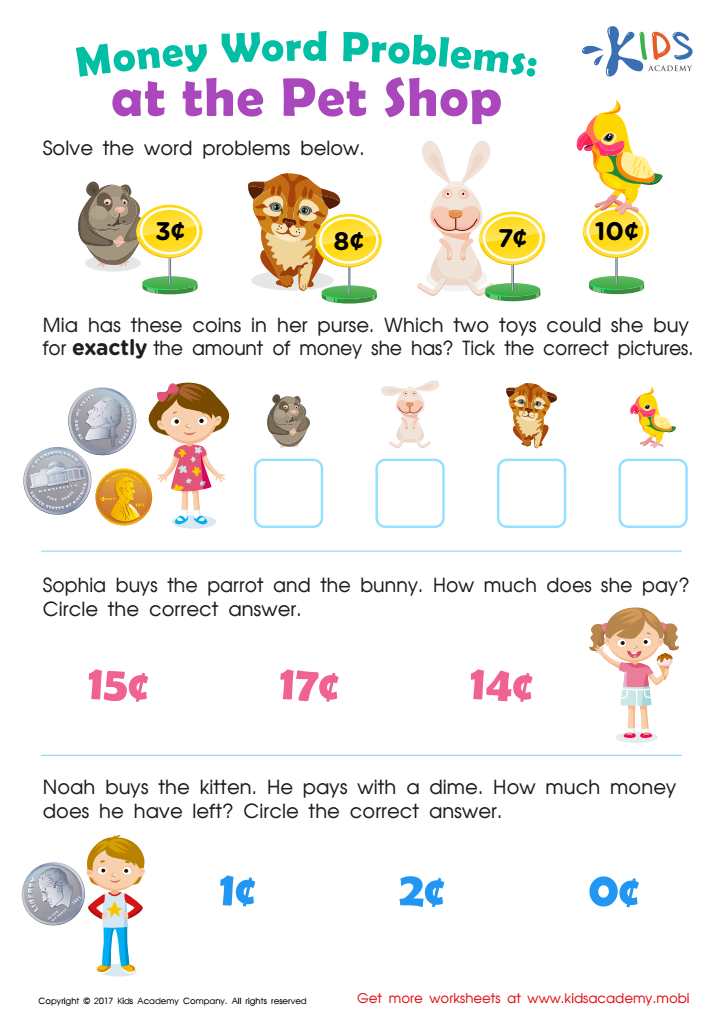

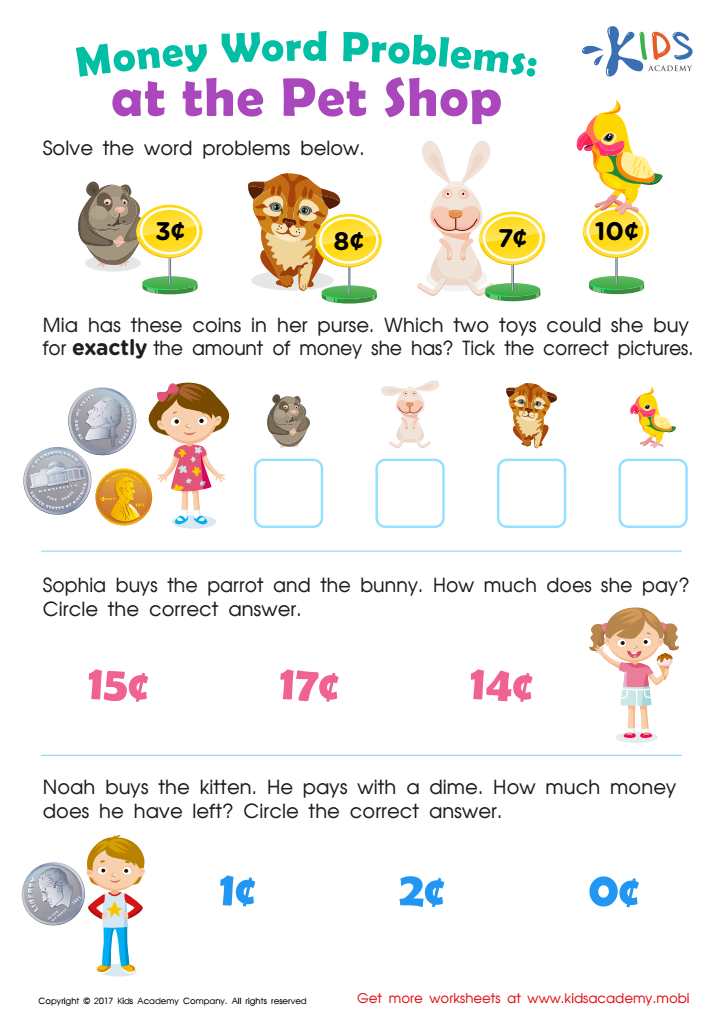

Pet Shop Worksheet

Counting Coins Worksheet

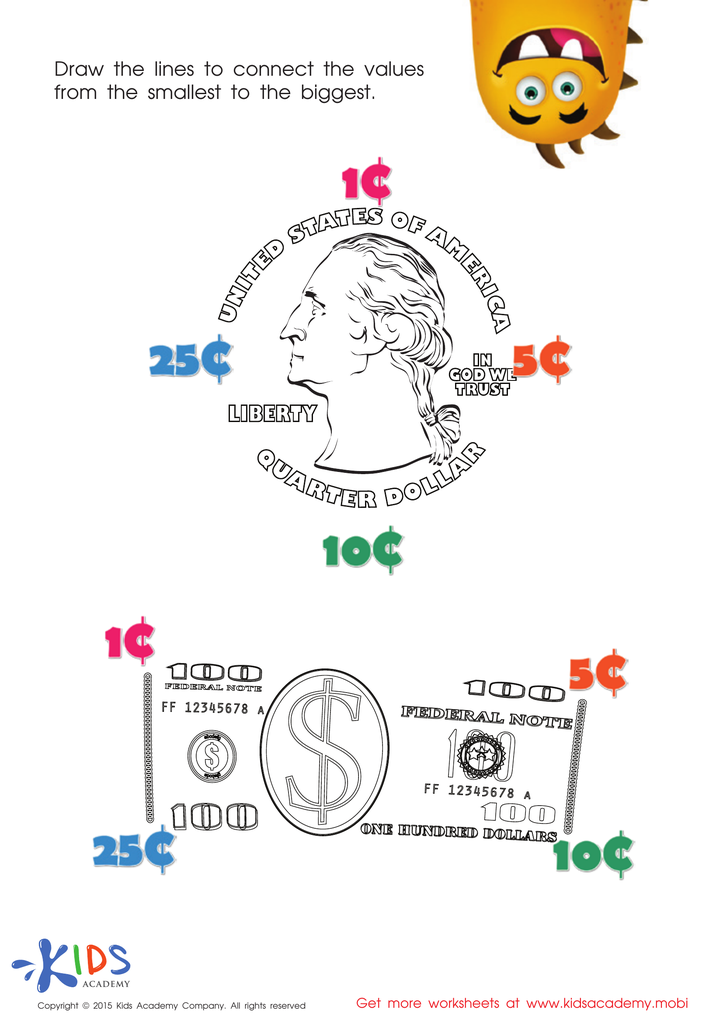

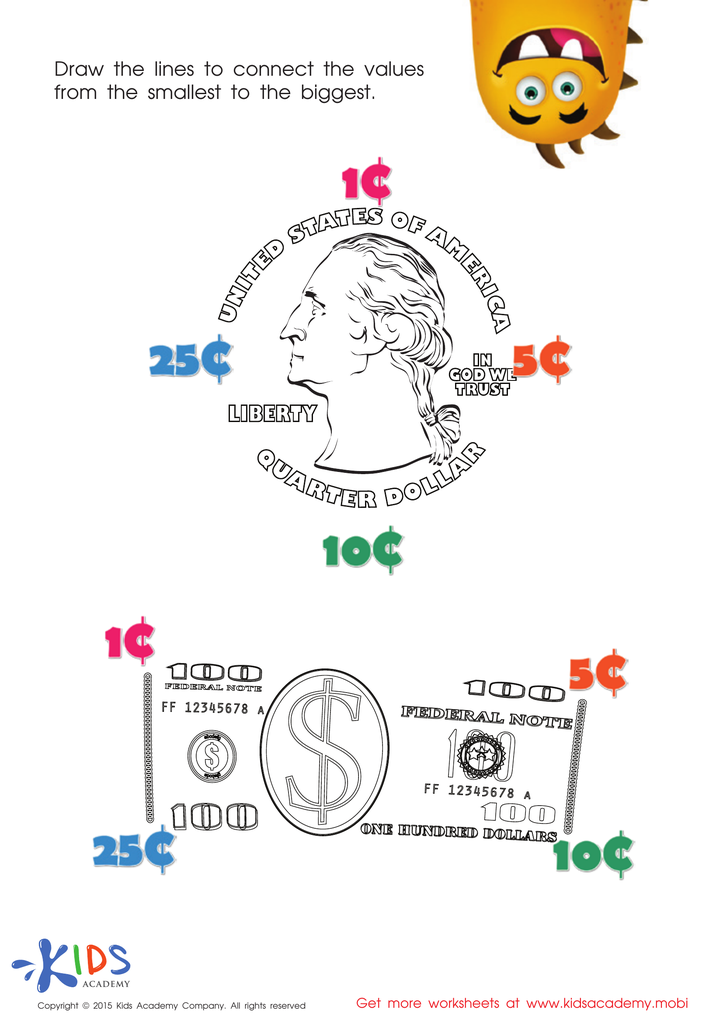

Connecting the Values Money Worksheet

How Many Coins Money Worksheet

Recognizing Money Money Worksheet

One Cent or the Penny Money Worksheet

Five Cents or the Nickel Money Worksheet

Coin Names and Values Money Worksheet

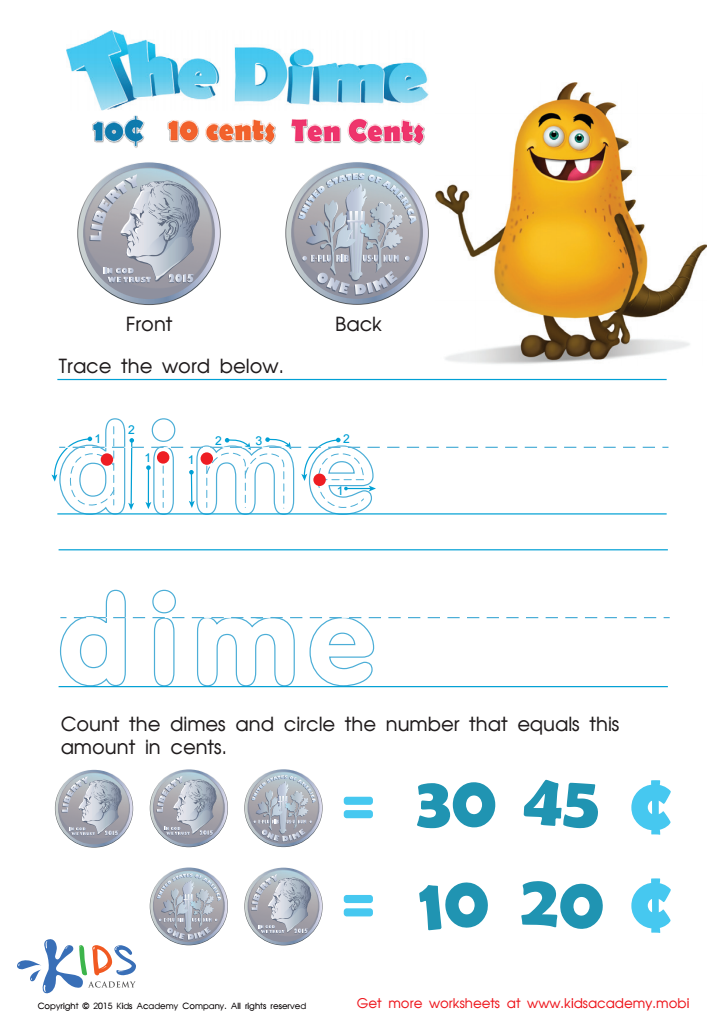

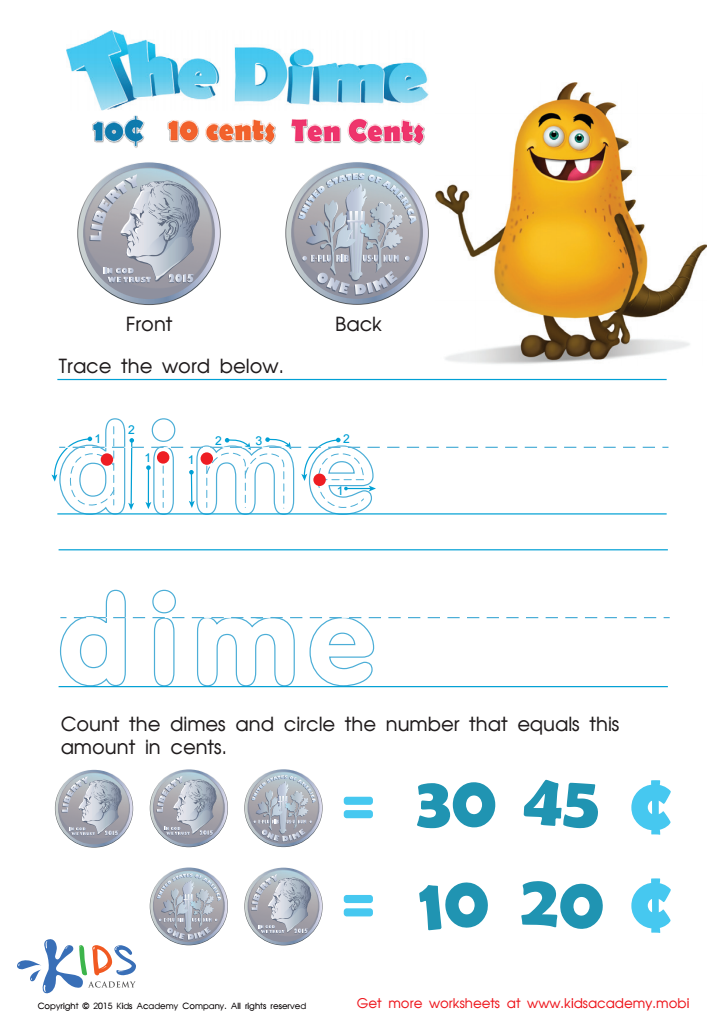

Ten Cents or the Dime Money Worksheet

Counting the Coins Money Worksheet

Money: Coins Dollars Printable

Picking the Coins You Need Money Worksheet

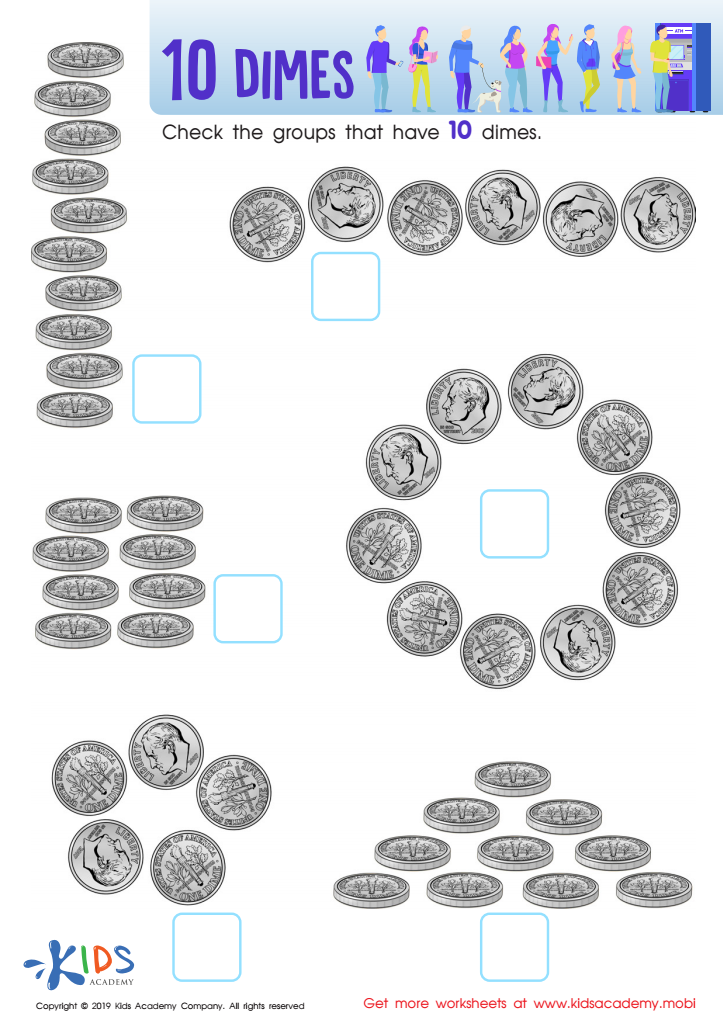

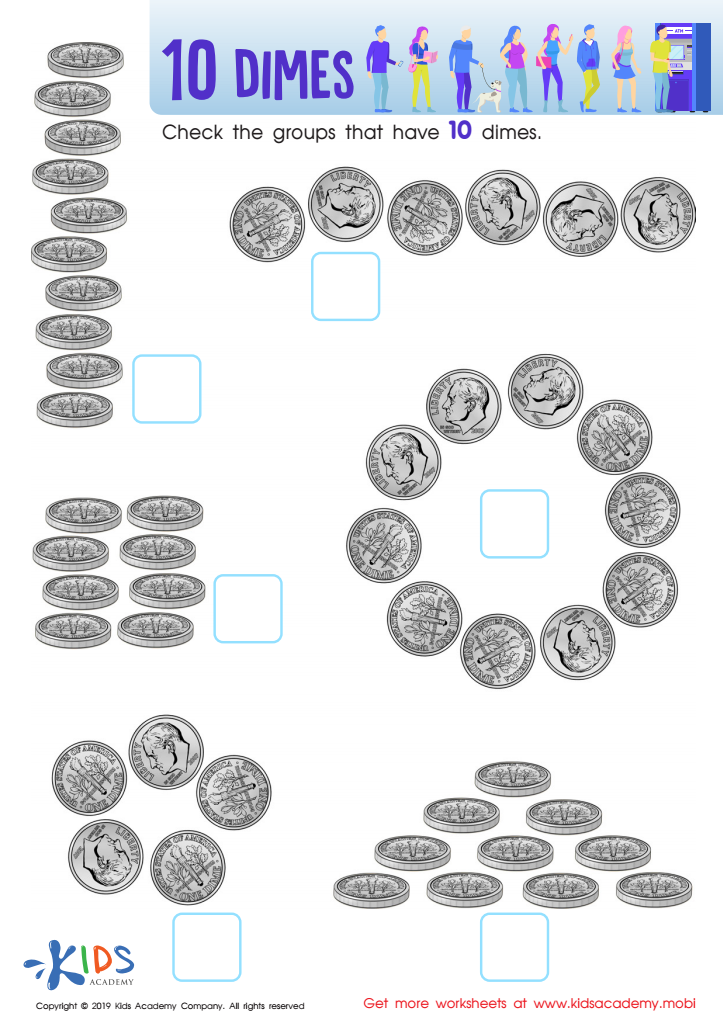

10 Dimes Worksheet

Sweet Shop – Counting Coins Worksheet

Twenty Five Cents or the Quarter Money Worksheet

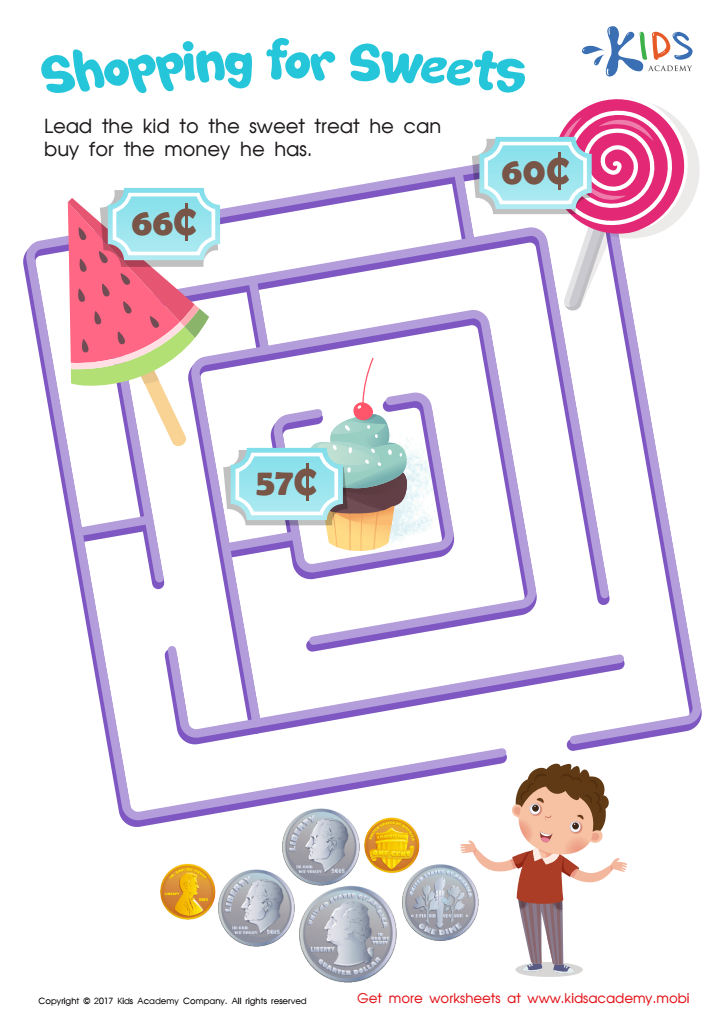

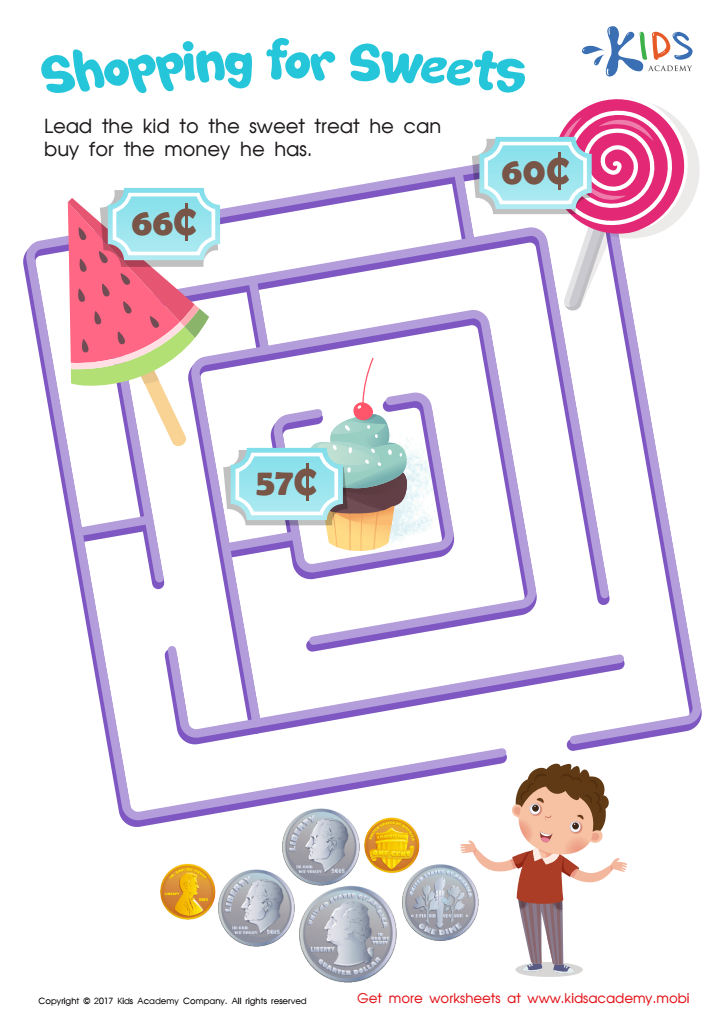

Shopping for Sweets Worksheet

Introducing concepts about money to children between the ages of 6 and 8 is crucial for several reasons. At this formative age, children are developing their basic understanding of the world, and money management skills are an important part of everyday life. By understanding the value of money, children can begin to appreciate the cost of goods and services that they often take for granted, such as toys, food, and other household items.

Teaching young children about money helps lay a strong foundation for financial literacy. Through simple practices like saving, spending wisely, and even basic budgeting, children can develop good habits early on. These skills can promote a sense of responsibility and independence, as kids learn that money is earned through effort and that it can be strategically managed rather than spent impulsively.

Moreover, understanding money can boost mathematical skills. Concepts like counting, addition, and subtraction are reinforced when children handle money. For parents and teachers, integrating money lessons into real-life scenarios makes learning relevant and practical, thereby enhancing engagement and retention.

Ultimately, fostering a healthy attitude towards money can significantly influence a child's future decisions and stability. In a world where financial literacy is increasingly important, these early lessons are essential for empowering the next generation to become financially savvy and responsible citizens.

Assign to My Students

Assign to My Students